- United States

- /

- Software

- /

- NasdaqGS:PEGA

Assessing Pegasystems (PEGA) Valuation After Recent Share Price Pullback

Reviewed by Simply Wall St

Pegasystems (PEGA) has seen its stock price move modestly over the past week, with shares edging up roughly 1% even as they fell nearly 14% over the past month. The company continues developing its suite of enterprise software solutions, drawing ongoing attention from investors who are evaluating its longer-term growth profile.

See our latest analysis for Pegasystems.

Pegasystems’ share price has delivered a solid 17.8% return so far this year, but after a strong run, recent momentum has faded with a 13.95% pullback over the last month. The stock’s long-term picture still looks impressive, with a standout 198% total shareholder return over three years that highlights how much optimism investors have priced into its transformation story.

If Pegasystems’ growth journey has you rethinking your watchlist, why not use this moment to discover fast growing stocks with high insider ownership

With shares trading at a meaningful discount to analyst price targets while recent gains stall, investors are left to wonder if market skepticism has opened up a fresh buying opportunity, or if future growth is already reflected in the price.

Most Popular Narrative: 25.1% Undervalued

Market watchers are at attention as the most widely followed narrative pegs Pegasystems’ fair value at $73.09, a substantial premium to its last close at $54.77. This sharp disconnect sets the scene for a deeper look into just what is driving these expectations so far above current market pricing.

“Pega's focus on AI and the Pega Gen AI Blueprint is transforming client engagement by accelerating digital and legacy transformations, potentially driving revenue growth through faster and more effective solution implementation. The adoption of agentic workflows and integration with AI models in Pega Blueprint, enabling predictable and streamlined processes, could enhance client satisfaction and retention, thereby improving net margins.”

What is the secret behind such bullish projections? The real game changers are embedded deep in the narrative’s numbers, from ambitious profit margin targets to standout revenue growth and a bold future earnings multiple. Wondering how these assumptions hold up under scrutiny? Uncover the financial drivers that support this valuation leap by reading the full story to see what the experts believe will fuel Pegasystems' next major surge.

Result: Fair Value of $73.09 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, volatile license revenue and macroeconomic uncertainty could still challenge the narrative and affect both Pegasystems’ growth momentum and financial stability.

Find out about the key risks to this Pegasystems narrative.

Another View: What Do Earnings Ratios Say?

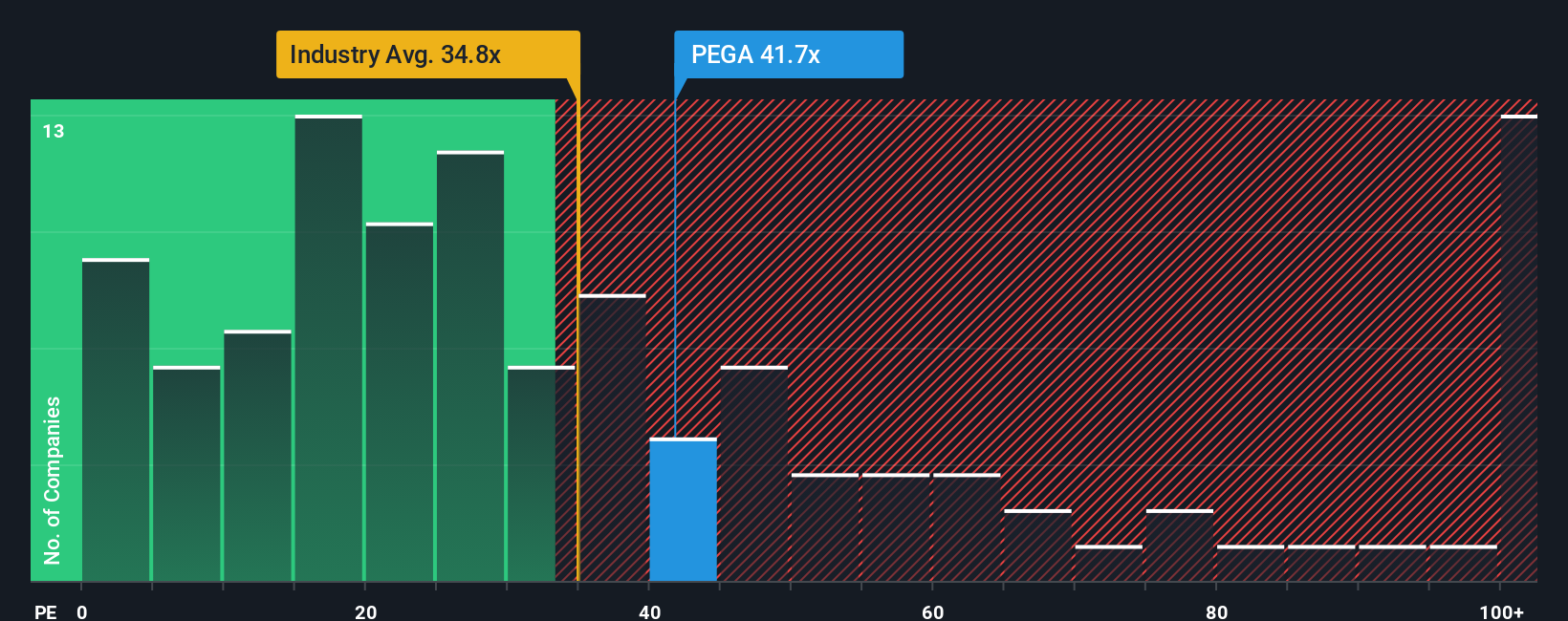

Taking a step back from fair value estimates, the current price-to-earnings ratio for Pegasystems is 33.4x. That is higher than both the US Software industry average of 31.8x and the peer group average of 25x, and it is also above the fair ratio of 29.4x. This means investors are paying a premium, which could signal added valuation risk if market expectations shift.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Pegasystems Narrative

If you have a different perspective or want to use your own insights, explore the data and craft a unique view of Pegasystems’ future in just a few minutes. Do it your way

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Pegasystems.

Looking for More Smart Investment Ideas?

Smart investors do not settle for just one opportunity. Use the Simply Wall Street Screener to uncover stocks with strong potential and broaden your investment approach today.

- Maximize your search for high yields and financial stability by checking out these 15 dividend stocks with yields > 3% which offers attractive returns beyond the market average.

- Tap into the explosive power of next-generation tech by targeting these 28 quantum computing stocks as it makes headlines in groundbreaking computing and innovation.

- Accelerate your growth ambitions and see which companies stand out with these 25 AI penny stocks that harness the latest advancements in artificial intelligence.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:PEGA

Pegasystems

Develops, markets, licenses, hosts, and supports enterprise software in the United States, rest of the Americas, the United Kingdom, rest of Europe, the Middle East, Africa, and the Asia-Pacific.

Outstanding track record with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Constellation Energy Dividends and Growth

CoreWeave's Revenue Expected to Rocket 77.88% in 5-Year Forecast

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026