- United States

- /

- Software

- /

- NasdaqGS:PANW

Palo Alto Networks (PANW): Revisiting Valuation After a Modest Share Price Rebound

Reviewed by Simply Wall St

Palo Alto Networks (PANW) has been quietly grinding higher again after a choppy past 3 months, with the stock now modestly up over the past month. That rebound has investors rechecking the longer term story.

See our latest analysis for Palo Alto Networks.

Zooming out, that 30 day share price recovery sits against a modest year to date share price gain. At the same time, a powerful three year total shareholder return north of 160 percent shows longer term momentum is still very much intact.

If Palo Alto Networks has you thinking more broadly about cybersecurity and digital infrastructure, it could be worth exploring other high growth tech and AI names via high growth tech and AI stocks.

With earnings still growing at double digits and the share price trading at a meaningful discount to analyst targets and intrinsic value estimates, is Palo Alto Networks quietly undervalued right now, or is the market already discounting years of future growth?

Most Popular Narrative: 16.8% Undervalued

With Palo Alto Networks last closing at $186.88 against a narrative fair value near $224.53, the story leans toward a meaningful valuation gap shaped by ambitious growth and profitability assumptions.

Strategic investments in AI driven security, automation, and differentiated product innovation (e.g., AI firewalls, SASE, secure browser, Cortex Cloud, XSIAM) are driving rapid ARR growth in high value segments (>32% NGS ARR growth and over 2.5x AI ARR YoY), supporting a move towards higher margin, recurring revenue streams, and improved long term net margins.

Want to see what kind of revenue runway and margin expansion are embedded in that view, and what future earnings multiple it quietly assumes? The full narrative lays out a detailed roadmap of growth expectations, profitability shifts, and the exact valuation framework used to claim this discount.

Result: Fair Value of $224.53 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, execution missteps around large acquisitions and intensifying competition in AI driven security could pressure margins and undermine the long term undervaluation case.

Find out about the key risks to this Palo Alto Networks narrative.

Another Take On Valuation

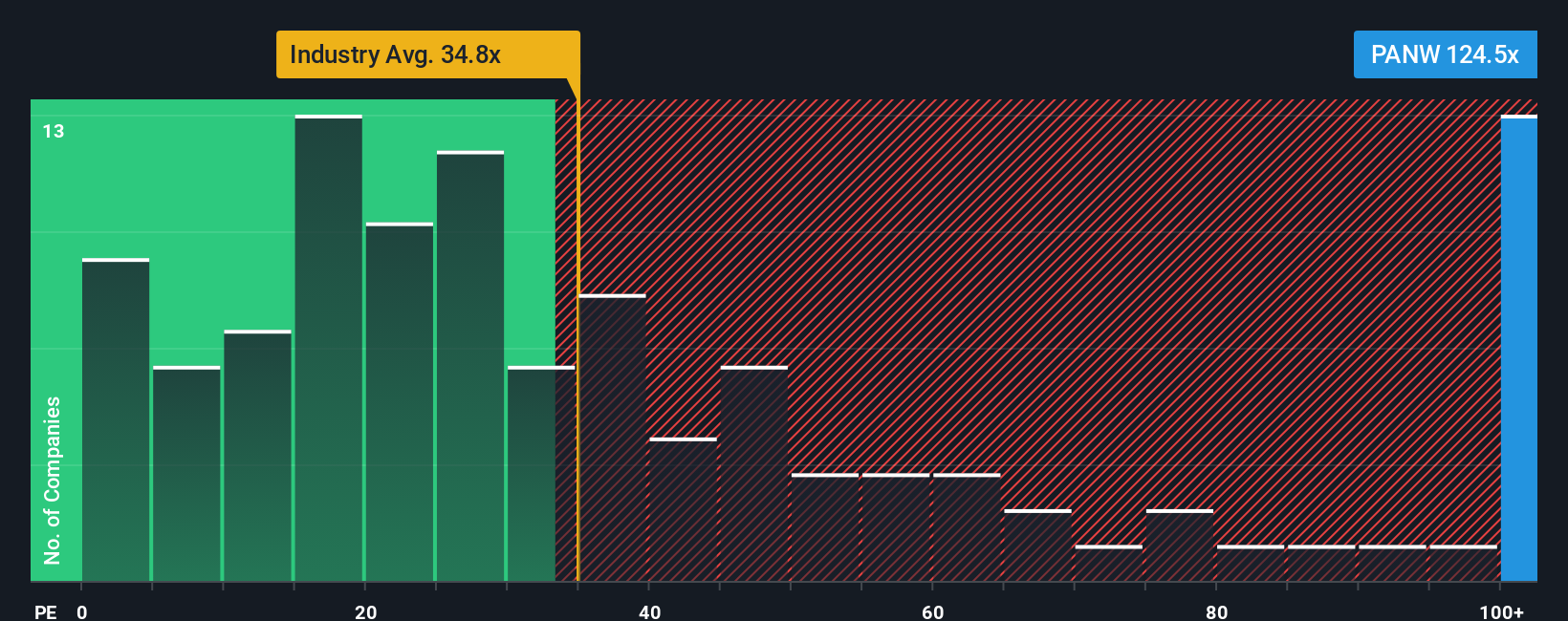

While narratives and intrinsic estimates suggest Palo Alto Networks is roughly 16.8 percent undervalued, the current price to earnings ratio of 116.6 times tells a different story. That is far above the US software industry at 32.4 times, peers at 45.2 times, and even a fair ratio of 43.2 times. This implies meaningful de rating risk if expectations wobble.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Palo Alto Networks Narrative

If you see the story differently or want to dig into the numbers yourself, you can build a personalized view in just a few minutes: Do it your way.

A great starting point for your Palo Alto Networks research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Before you move on, make sure you scan a few high conviction opportunities from our screeners, so you are not leaving potential winners off your radar.

- Capture powerful turnaround potential by targeting quality small caps using these 3633 penny stocks with strong financials that already show robust balance sheets and improving momentum.

- Ride the structural shift toward intelligent automation by focusing on companies at the forefront of AI innovation through these 24 AI penny stocks.

- Position yourself for asymmetric upside by zeroing in on companies trading below their estimated cash flow value with these 913 undervalued stocks based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:PANW

Palo Alto Networks

Provides cybersecurity solutions in the Americas, Europe, the Middle East, Africa, the Asia Pacific, and Japan.

Reasonable growth potential with adequate balance sheet.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion