- United States

- /

- Software

- /

- NasdaqGS:PANW

Palo Alto Networks (PANW) Expands Cybersecurity Capabilities With Okta Partnership Integration

Reviewed by Simply Wall St

Palo Alto Networks (PANW) announced an expanded partnership with Okta to enhance customer security through new integrations, particularly focusing on a unified security architecture. This and other recent strategic collaborations, such as those with GTT Communications and Binary Defense, likely supported the company's share price increase of approximately 10% over the last quarter. Despite a mixed market setting, where major indexes were only marginally shifted, PANW's integrations and partnership expansions were significant enough to stand out, countering the broader market's flat movement and contributing positively to its quarterly performance.

Palo Alto Networks has 1 possible red flag we think you should know about.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

The recent announcement of expanded partnerships between Palo Alto Networks and key companies like Okta is expected to bolster its integrated security solutions offering. This aligns with the narrative of platformization and AI-driven growth, which has been identified as a catalyst for increasing deal sizes and boosting revenue. Although short-term share price movements reflect optimism about these partnerships, the long-term performance shows a very large total return of 354.82% over the past five years. This impressive growth marks a significant return for investors, highlighting the company's resilient business model and execution over longer periods.

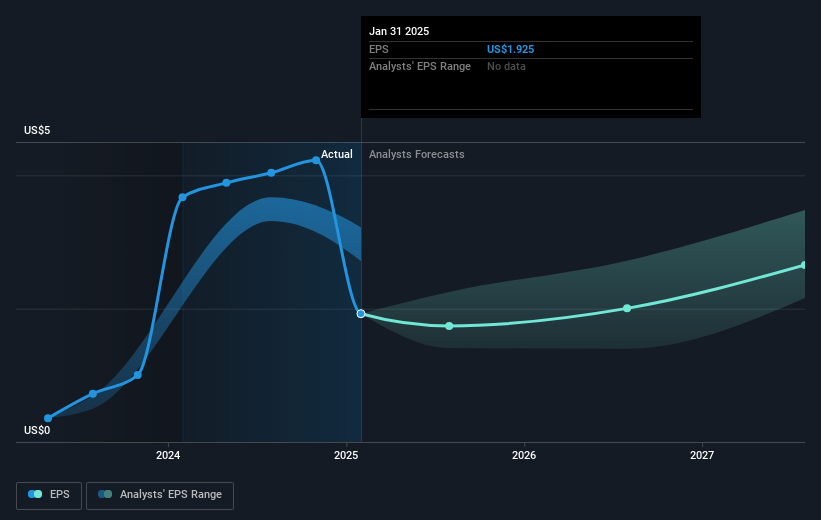

Over the past year, however, Palo Alto Networks has matched the US market's return of 11.4% but underperformed compared to the US Software industry, which grew by 19.2%. These partnerships could impact revenue and earnings forecasts positively by further supporting the company's international expansion and cloud security solutions. As analysts project revenue to grow 15.5% annually and earnings to potentially reach US$2.3 billion by 2028, the current share price of US$190.72 provides a context for evaluating analyst price targets set at US$211.20. Thus, Palo Alto Networks' recent price movements and partnership announcements align well with its strategic initiatives, potentially driving future value realization.

Our valuation report here indicates Palo Alto Networks may be overvalued.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:PANW

Reasonable growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives