- United States

- /

- Software

- /

- NasdaqGS:PANW

Palo Alto Networks (PANW): Evaluating Valuation After Leadership Change and Strong Revenue Growth

Reviewed by Simply Wall St

If you hold Palo Alto Networks (PANW) or are considering a position, you’re likely aware of the buzz around the company lately. Just this month, Palo Alto Networks posted strong fourth-quarter and full-year revenue growth, increased its outlook for fiscal 2026, and signaled a new era by announcing founder and CTO Nir Zuk’s retirement, passing the torch to Lee Klarich. Taken together, these moves suggest the company is not just riding the cybersecurity wave but is also trying to position itself at the forefront of innovation with AI-powered solutions.

All this action has attracted attention. After rebounding sharply from a July dip, the stock has gained nearly 7% over the past year despite some recent volatility, while maintaining significant momentum compared to historical returns. Leadership updates, new product launches, and positive commentary within the sector have helped shift sentiment, framing Palo Alto Networks as a leading name to watch as digital security demands continue to evolve.

But with the stock already moving upward again, the main question for investors is whether this represents a genuine buying opportunity or if market expectations already incorporate Palo Alto Networks’ future growth story.

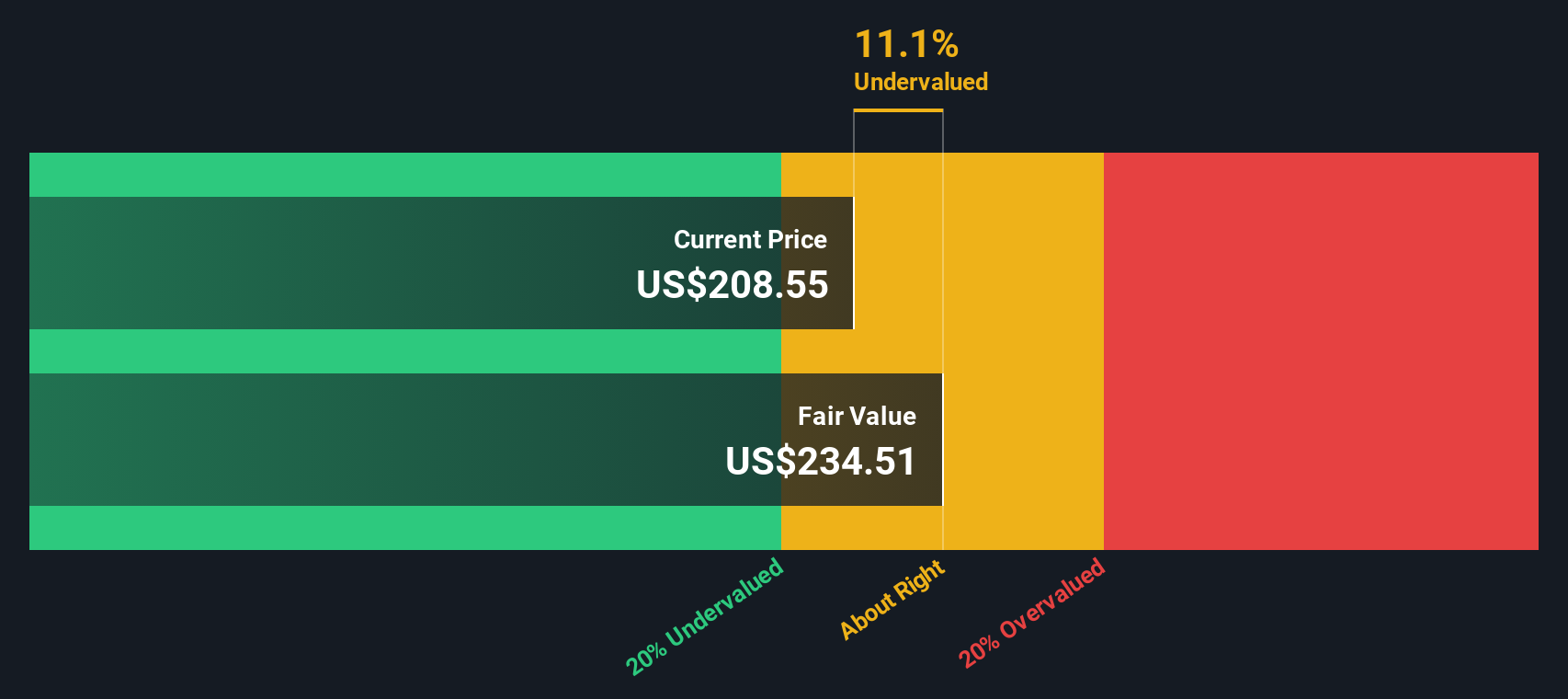

Most Popular Narrative: 10.7% Undervalued

According to community narrative, Palo Alto Networks is seen as undervalued by 10.7%. This suggests that analysts believe current market pricing does not fully reflect the company's future earnings potential and growth catalysts.

Ongoing industry consolidation, as enterprises seek to simplify and maximize the effectiveness of their security stack, has strengthened the trend towards platformization. This is resulting in larger multi-platform deal sizes, improved cross-sell, higher net retention rates (120%), and near zero churn among platformized clients. All of these factors support future margin expansion and earnings growth.

What is the secret behind this bullish view on Palo Alto Networks? The narrative points to a promising future, driven by consistent revenue growth and margin expansion built on aggressive enterprise platform deals, powerful recurring software streams, and industry-leading client retention. Curious which assumptions set this price target above the rest? Uncover the full financial story and see what numbers are fueling the optimistic outlook.

Result: Fair Value of $213.86 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, persistent integration challenges and rising R&D expenses could impact profitability. These factors may put Palo Alto Networks’ growth assumptions to the test.

Find out about the key risks to this Palo Alto Networks narrative.Another View: What About Cash Flows?

While many investors focus on the company's current market valuation compared to its earnings, our DCF model looks at future cash flows to estimate true value. This method suggests a different perspective. Could the market be missing something?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Palo Alto Networks Narrative

If you see things differently or want to dive into the details on your own terms, crafting a personalized financial narrative takes just a few minutes. So why not Do it your way

A great starting point for your Palo Alto Networks research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Level up your investment strategy with fresh opportunities you might not have considered. Don’t wait for the crowd. Set yourself apart by using powerful tools designed to surface hidden gems, income leaders, and tomorrow’s tech giants. Take action today and seize opportunities before everyone else catches on:

- Uncover high-yield opportunities by checking out dividend stocks with yields > 3% and secure steady returns from companies offering standout dividend payouts above 3%.

- Spot emerging breakthroughs in medicine and technology by tapping into healthcare AI stocks. Innovative healthcare AI businesses are transforming patient care and diagnostics.

- Catch the next wave of undervalued winners when you use undervalued stocks based on cash flows to find companies poised for growth but overlooked by the broader market.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Kshitija Bhandaru

Kshitija (or Keisha) Bhandaru is an Equity Analyst at Simply Wall St and has over 6 years of experience in the finance industry and describes herself as a lifelong learner driven by her intellectual curiosity. She previously worked with Market Realist for 5 years as an Equity Analyst.

About NasdaqGS:PANW

Palo Alto Networks

Provides cybersecurity solutions in the Americas, Europe, the Middle East, Africa, the Asia Pacific, and Japan.

Reasonable growth potential with adequate balance sheet.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Q3 Outlook modestly optimistic

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

MicroVision will explode future revenue by 380.37% with a vision towards success

Trending Discussion