- United States

- /

- Software

- /

- NasdaqGS:PANW

Palo Alto Networks (PANW) Announces US$20 Billion Acquisition Of CyberArk

Reviewed by Simply Wall St

Palo Alto Networks (PANW) has announced its agreement to acquire CyberArk, strengthening its position in the cybersecurity sector. The company's stock price moved 4% over the last quarter. This movement aligns with the broader market trends that have seen significant tech sector activities, including interest rate decisions and large technology firms' earnings. Palo Alto's merger and acquisition activity and strategic client collaborations, such as the partnerships with Okta and the UK's Ministry of Justice, likely contributed to the company's ability to support this trend, adding weight to the overall positive market sentiments in tech.

We've spotted 1 possible red flag for Palo Alto Networks you should be aware of.

The recent acquisition of CyberArk by Palo Alto Networks underscores a significant commitment to enhancing its cybersecurity offerings. This move could further solidify its AI-driven platformization strategy, potentially increasing revenue through expanded integrated security solutions. Over the last five years, Palo Alto Networks achieved an impressive total return of 356.26%, reflecting its strong long-term growth trajectory. However, in the more immediate past, the company underperformed the US Software industry, growing less over the last year.

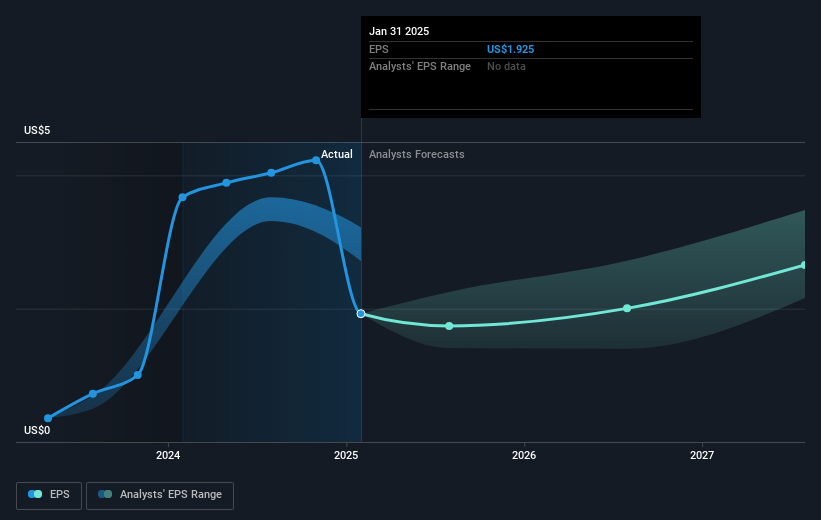

Palo Alto's revenue and earnings forecasts are likely to be positively influenced by the acquisition, with expected synergies boosting profit margins. Analysts predict revenue growth of 14.5% annually and earnings to reach US$2.3 billion by mid-2028. The current share price of US$193.84 remains just below the consensus price target of US$212.15, reflecting a 7.3% potential upside. This suggests analysts see room for valuation improvement, partly depending on successful integration and realization of acquisition benefits.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:PANW

Reasonable growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives