- United States

- /

- Software

- /

- NasdaqGS:PANW

Is Palo Alto Networks Stock Pricing In Its AI Security Growth Potential?

Reviewed by Bailey Pemberton

- If you are wondering whether Palo Alto Networks is still worth buying at today's price, you are not alone. This stock sits at the crossroads of cybersecurity hype and long term fundamentals.

- Despite short term moves like a 2.5% dip over the last week and a 6.5% slide over the past month, longer horizons look much stronger, with the stock up 164.6% over 3 years and 205.4% over 5 years.

- Those swings have come as Palo Alto Networks continues to consolidate its platform and push deeper into AI driven security, while customers keep shifting spend toward integrated cloud based solutions. At the same time, rising competition and changing enterprise IT budgets have added more uncertainty to how fast that growth can continue.

- On our framework the stock scores a 3 out of 6 valuation score, which means it looks undervalued on some metrics but not all. Next we will unpack those traditional valuation approaches, before finishing with a more holistic way of thinking about what Palo Alto Networks is really worth.

Find out why Palo Alto Networks's 0.1% return over the last year is lagging behind its peers.

Approach 1: Palo Alto Networks Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow model estimates what a business is worth by projecting all the cash it could generate in the future and then discounting those cash flows back to today in dollar terms.

For Palo Alto Networks, the 2 Stage Free Cash Flow to Equity model starts from last twelve months free cash flow of about $3.8 billion and assumes this continues to grow as the business scales. Analyst forecasts and Simply Wall St extrapolations suggest free cash flow could rise to roughly $13.4 billion by 2035, with specific projections stepping up through the late 2020s and early 2030s as the platform expands.

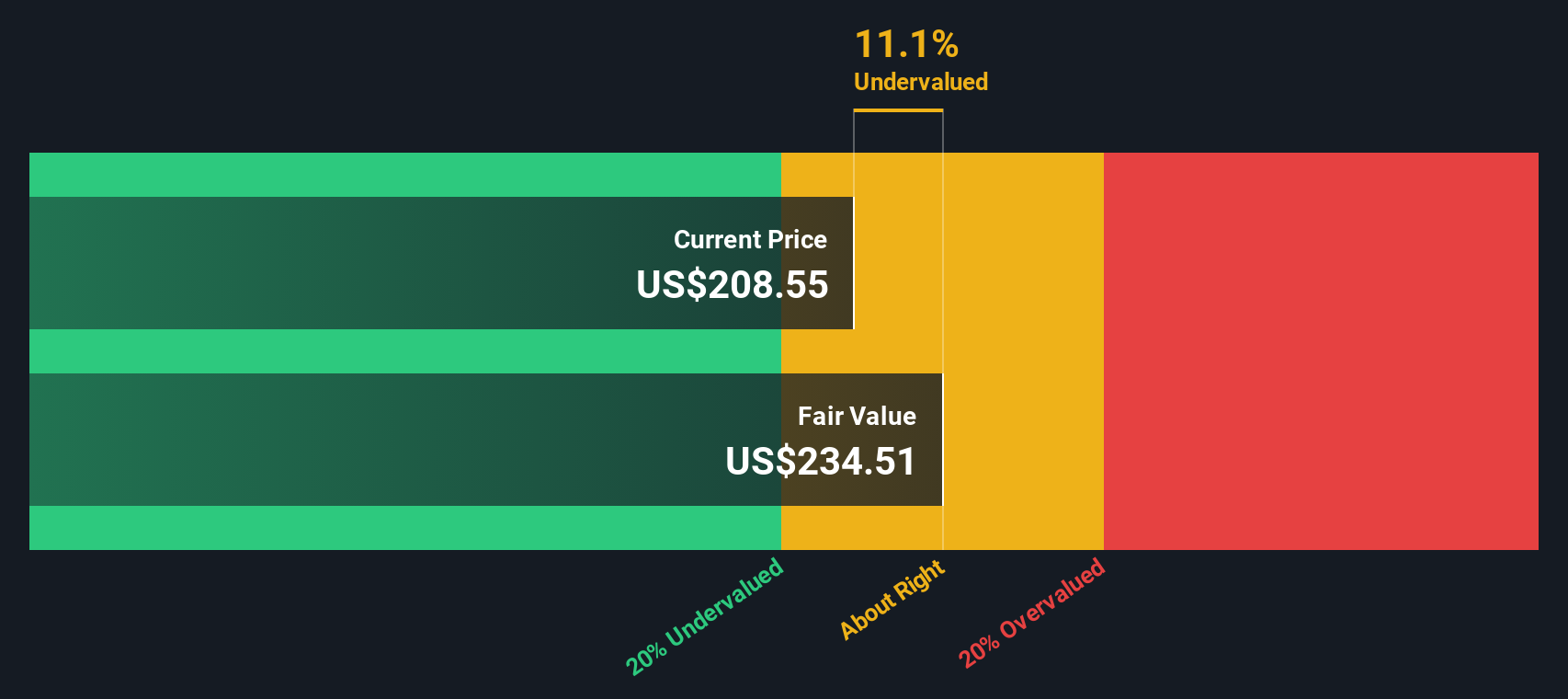

When all of those future cash flows are discounted back, the model arrives at an intrinsic value of about $246.21 per share. Compared to the current share price, this implies Palo Alto Networks is trading at roughly a 24.1% discount. This indicates that, based on these assumptions and projections, the market price may be lower than the model’s estimate of the company’s long term cash generation potential.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Palo Alto Networks is undervalued by 24.1%. Track this in your watchlist or portfolio, or discover 914 more undervalued stocks based on cash flows.

Approach 2: Palo Alto Networks Price vs Earnings

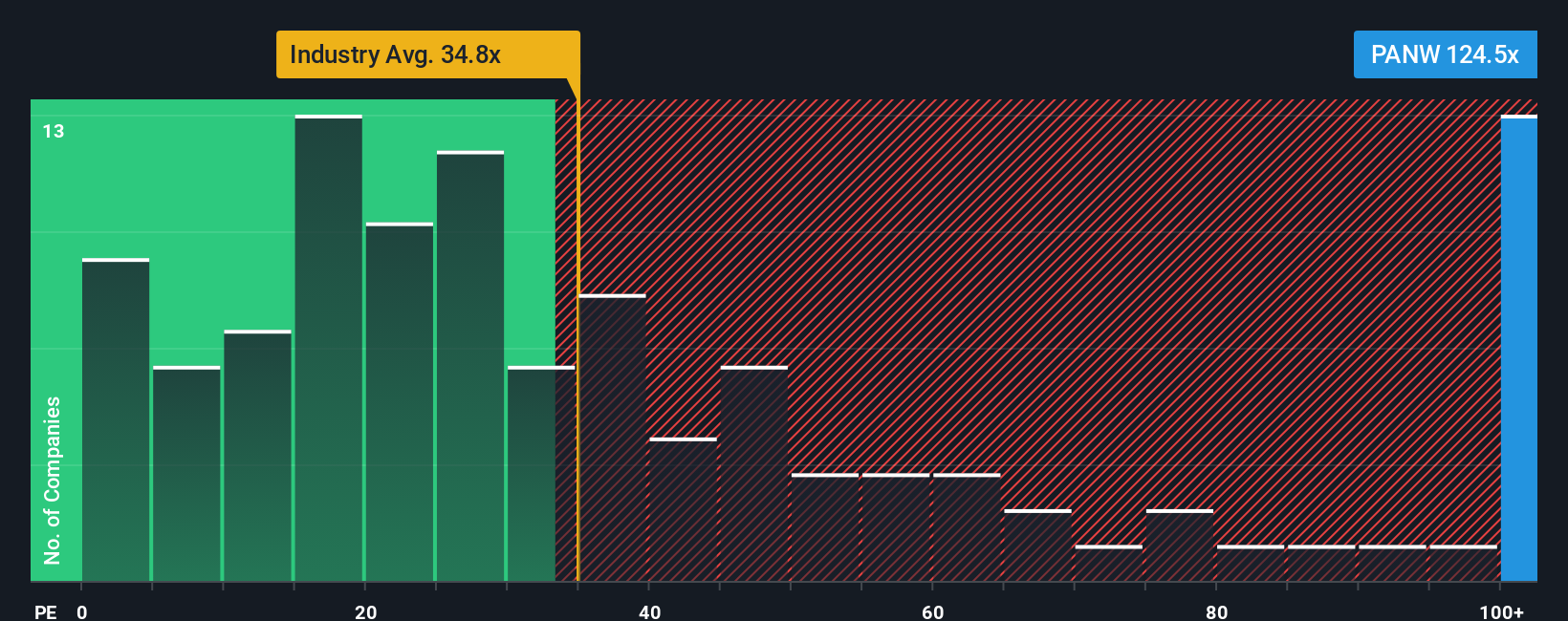

For profitable, established software businesses like Palo Alto Networks, the price to earnings, or PE, ratio is a useful valuation tool because it connects what investors pay today with the actual profits the company is generating. In general, higher growth and lower risk justify a higher PE, while slower growth or more uncertainty usually calls for a lower, more conservative multiple.

Today, Palo Alto Networks trades on a PE of about 116.6x, which is far above the broader software industry average of around 32.4x and also well ahead of its cybersecurity peers at roughly 45.2x. To get a more tailored view, Simply Wall St calculates a proprietary Fair Ratio of 43.1x. This is the PE that might be expected given Palo Alto Networks earnings growth profile, margins, industry, market cap and risk characteristics. This Fair Ratio can be more informative than a simple peer or industry comparison because it explicitly incorporates those company specific drivers rather than assuming all software or security names deserve the same multiple.

Comparing the current 116.6x PE to the 43.1x Fair Ratio suggests the shares are trading materially above what fundamentals alone would justify.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1465 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Palo Alto Networks Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives. This is an easy tool on Simply Wall St’s Community page that lets you attach a clear story about Palo Alto Networks future to your own numbers for revenue, earnings and margins. You can then link that story to a financial forecast and fair value estimate, and compare that fair value to the current price to decide whether to buy, hold, or sell. The platform keeps updating your Narrative as fresh news, earnings and guidance come in. For example, a bullish investor might build a Narrative where accelerating AI driven platform adoption, successful acquisitions and rising margins justify a fair value toward the higher end of analyst targets around the mid to high $200s. In contrast, a more cautious investor could create a Narrative where integration risks, slower growth and margin pressure lead to a fair value closer to the most bearish target near $131. Both perspectives are translated into concrete numbers and potential decisions in one place.

Do you think there's more to the story for Palo Alto Networks? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:PANW

Palo Alto Networks

Provides cybersecurity solutions in the Americas, Europe, the Middle East, Africa, the Asia Pacific, and Japan.

Reasonable growth potential with adequate balance sheet.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Clarivate Stock: When Data Becomes the Backbone of Innovation and Law

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

MicroVision will explode future revenue by 380.37% with a vision towards success

Trending Discussion