- United States

- /

- Software

- /

- NasdaqGS:OTEX

The Bull Case for OpenText (OTEX) Could Change Following New UAE AI and Cloud Collaboration

Reviewed by Sasha Jovanovic

- OpenText recently announced a Memorandum of Understanding with Core42, a G42 company, to accelerate AI, cloud, and automation initiatives in the UAE public sector, and released Cloud Editions 25.4 with advanced industry-specific AI capabilities and expanded support services.

- This collaboration and product launch enhances OpenText's position in delivering secure, compliant, and AI-driven digital solutions for government and regulated industries, emphasizing data protection, local sovereignty, and AI readiness.

- We'll explore how OpenText's deepening focus on sovereign AI solutions could influence its investment narrative and future growth opportunities.

Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 37 best rare earth metal stocks of the very few that mine this essential strategic resource.

Open Text Investment Narrative Recap

To believe in OpenText as a shareholder, one needs confidence in its ability to lead digital transformation for regulated and government clients through secure, compliance-focused cloud and AI solutions. The new MOU with Core42 and launch of Cloud Editions 25.4 reinforce this direction by deepening OpenText’s sovereign AI offering, but they do not materially offset the company’s ongoing dependence on accelerating cloud growth to counterbalance the decline in legacy maintenance revenues, the most critical short-term catalyst and risk, respectively.

Among the recent announcements, the release of Cloud Editions 25.4 stands out, directly supporting OpenText’s efforts to drive cloud-based, AI-driven revenue. This strengthens its position with industry-specific tools and support services designed to advance customers’ AI readiness and cloud adoption, both of which are crucial for maintaining recurring revenue and improving operational margin as legacy business faces headwinds.

By contrast, investors should be particularly mindful that legacy maintenance revenue remains under pressure and, if cloud adoption does not accelerate as intended...

Read the full narrative on Open Text (it's free!)

Open Text's narrative projects $5.4 billion revenue and $862.6 million earnings by 2028. This requires 1.4% yearly revenue growth and an increase of $426.7 million in earnings from $435.9 million today.

Uncover how Open Text's forecasts yield a $37.66 fair value, a 4% downside to its current price.

Exploring Other Perspectives

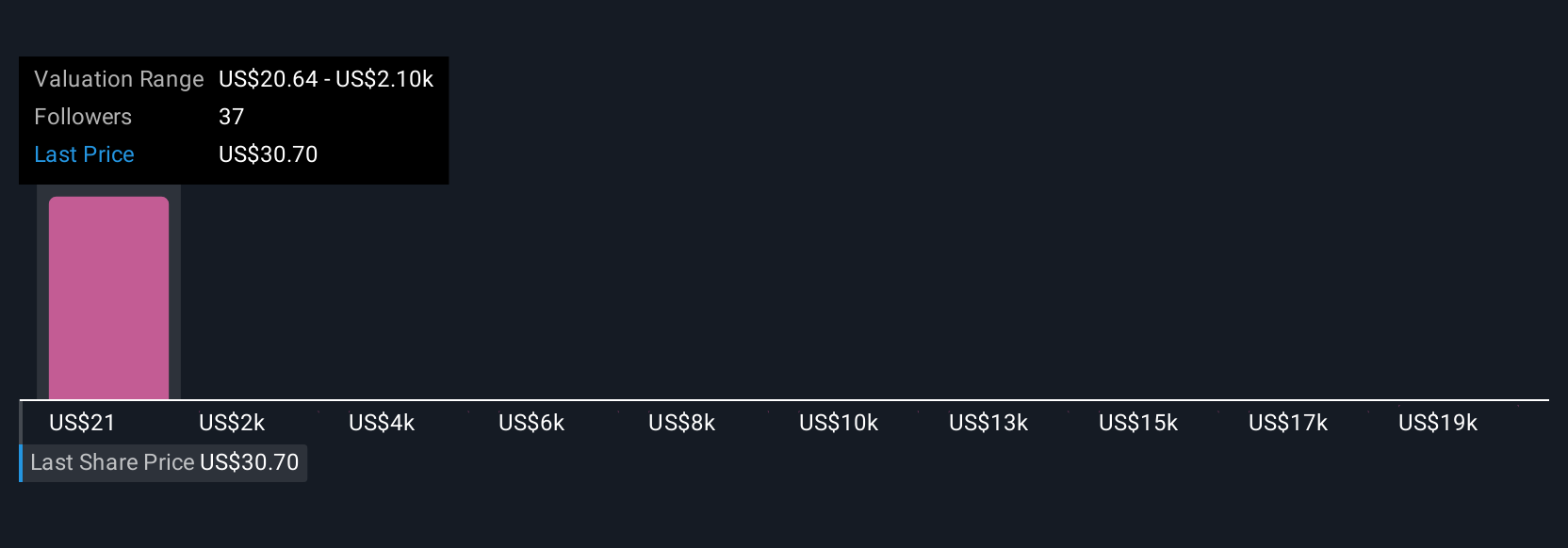

Six fair value opinions from the Simply Wall St Community put OpenText’s worth between US$21.43 and US$66.82 per share. While investors weigh this diversity, the key catalyst remains whether OpenText’s cloud and AI initiatives can deliver the revenue growth needed to offset core business declines, inviting you to consider these differing viewpoints and implications for future performance.

Explore 6 other fair value estimates on Open Text - why the stock might be worth as much as 70% more than the current price!

Build Your Own Open Text Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Open Text research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Open Text research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Open Text's overall financial health at a glance.

Searching For A Fresh Perspective?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- The end of cancer? These 27 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- We've found 17 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- These 15 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:OTEX

Open Text

Designs, develops, markets, and sells information management software and solutions in North, Central, and South America, Europe, the Middle East, Africa, Australia, Japan, Singapore, India, and China.

Undervalued established dividend payer.

Similar Companies

Market Insights

Community Narratives