- United States

- /

- Software

- /

- NasdaqCM:OSPN

Will OneSpan’s (OSPN) Shift to Software Unlock Growth Amid Lowered Guidance and Buybacks?

Reviewed by Sasha Jovanovic

- On October 30, 2025, OneSpan reported third quarter earnings, with revenue rising to US$57.06 million but net income falling to US$6.51 million, alongside a reduction in full-year 2025 guidance and the completion of a share buyback and dividend affirmation.

- An interesting development is the company's ongoing shift toward software and services, highlighted by recent acquisitions and investments intended to accelerate future growth despite current hardware headwinds.

- We'll explore how OneSpan's lowered full-year guidance and evolving business mix are shaping its current investment narrative and outlook.

These 16 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

OneSpan Investment Narrative Recap

To be a shareholder in OneSpan today, you need to believe in the company's ability to accelerate its software and services transition quickly enough to offset ongoing declines in hardware revenue and maintain earnings stability. The latest downward revision of full-year guidance underlines the biggest short-term risk: slowing hardware and maintenance sales, which currently outweigh the positive momentum in subscription and recurring software revenue. While this revised guidance was significant, it does not materially alter the importance of successful execution on cross-selling and ARR growth, which remains the most critical near-term catalyst.

Among the recent announcements, OneSpan’s acquisition of Knock Labs is especially relevant, as it enhances the company’s FIDO2 authentication capabilities and supports the push into higher-growth software sectors. This aligns with the company’s broader effort to offset revenue headwinds by leveraging a broader product portfolio and deepening its reach within the digital banking and cybersecurity space, reinforcing the focus on recurring revenue expansion.

However, in contrast, investors should be aware that persistent hardware declines and ongoing maintenance contraction could affect...

Read the full narrative on OneSpan (it's free!)

OneSpan's outlook anticipates $281.1 million in revenue and $26.1 million in earnings by 2028. This assumes an annual revenue growth rate of 5.3% and a decrease in earnings of $33.8 million from the current $59.9 million.

Uncover how OneSpan's forecasts yield a $19.50 fair value, a 71% upside to its current price.

Exploring Other Perspectives

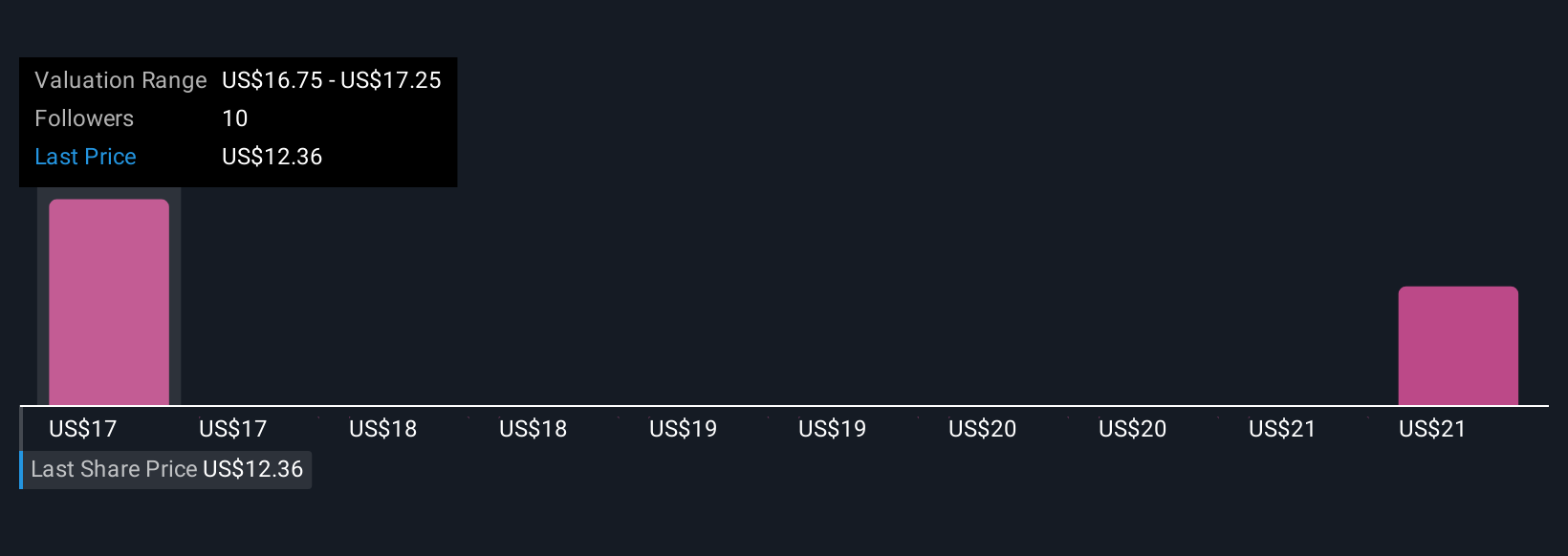

Two members of the Simply Wall St Community estimate OneSpan’s fair value between US$19.50 and US$23.62. As the stock’s subscriber transition faces hardware headwinds and net retention pressure, you can explore how your outlook compares to theirs.

Explore 2 other fair value estimates on OneSpan - why the stock might be worth just $19.50!

Build Your Own OneSpan Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your OneSpan research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free OneSpan research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate OneSpan's overall financial health at a glance.

Ready For A Different Approach?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Outshine the giants: these 27 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:OSPN

OneSpan

Provides digital solutions for security, authentication, identity, electronic signature, and digital workflow products in the Americas, Europe, the Middle East, Africa, and the Asia Pacific regions.

Outstanding track record with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives