- United States

- /

- Software

- /

- NasdaqCM:OSPN

OneSpan (OSPN) Margin Surge Reinforces Bull Case Despite Warnings of Looming Earnings Decline

Reviewed by Simply Wall St

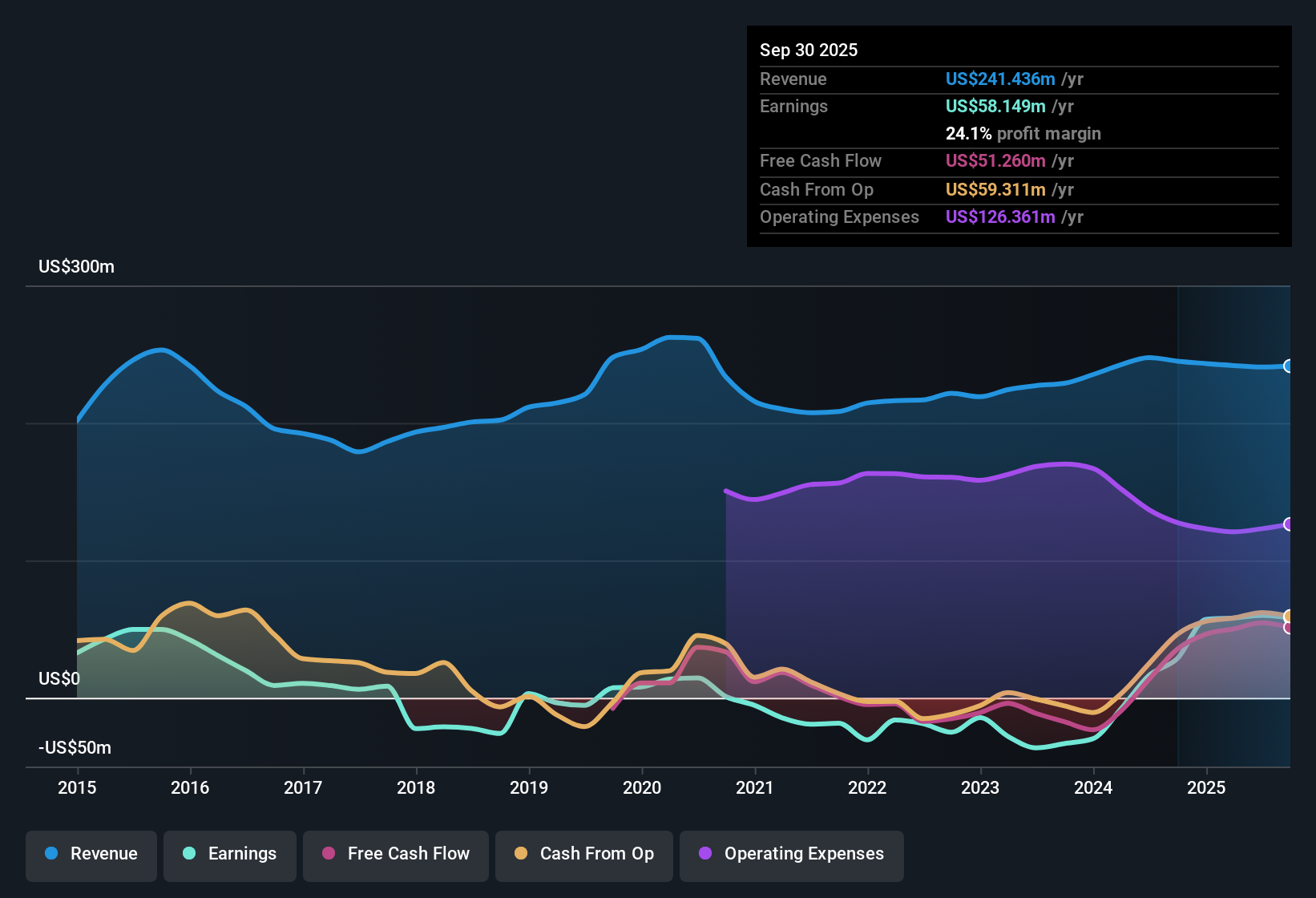

OneSpan (OSPN) posted a net profit margin of 24.1%, up from 11.7% a year ago, signaling a sharp boost in profitability. Earnings surged 102.4% over the past year, well above the five-year average annual growth rate of 52.1%. The company’s price-to-earnings ratio sits at just 7.5x, notably lower than both the peer average of 39x and the industry average of 34.1x. With the current share price of $11.4 trading well below a discounted cash flow estimated fair value of $23.66, investors may see the combination of robust historical earnings and undemanding valuation as an opportunity, even as forecasts point to a 9.5% annual earnings decline in the coming years.

See our full analysis for OneSpan.The next section will put these headline numbers into context by comparing them to the main narratives investors are watching, highlighting areas of agreement as well as potential surprises.

See what the community is saying about OneSpan

Profit Margins Expand to 24.1%, Dwarfing Industry Levels

- OneSpan’s net profit margin has climbed to 24.1%, substantially higher than the US Software industry average, as gross margins expanded from 66% to 73% year-over-year.

- Analysts' consensus view heavily supports the thesis that this margin strength stems from the company's shift to subscription-based offerings and focused acquisitions. This approach

- drives recurring software revenues with more predictable streams, and

- contributes to higher EBITDA margins and operational leverage as lower-margin legacy products are phased out.

- After these latest numbers, see if the consensus narrative is evolving and whether margin pressure or upside surprises could change the outlook. 📊 Read the full OneSpan Consensus Narrative.

Future Earnings Projected to Decline Sharply by 2028

- Analyst estimates call for annual earnings to drop from $59.9 million now to $26.1 million by September 2028, as profit margins are forecast to shrink to 9.3% and annual revenue growth slows to 5.3%.

- The consensus narrative notes these forecasts highlight both execution risks and ongoing revenue pressure. It emphasizes that

- the shift away from hardware and legacy contracts is creating persistent topline headwinds, and

- reliance on acquisitions plus intense competition may limit organic innovation, challenging the durability of recent gains.

PE Ratio and DCF Valuation Suggest Potential Upside

- At a price-to-earnings ratio of 7.5x and a share price of $11.4, OneSpan trades far below its DCF fair value of $23.66 and the US Software industry average P/E of 34.1x.

- In the analysts' consensus view, this deep discount reflects skepticism about sustaining profitability. However, it leaves the door open for re-rating if execution improves or recurring revenues stabilize faster than expected, because

- the consensus price target of $18.50 implies roughly 62% upside from here, even as forecasts anticipate a shrinking bottom line, and

- positive catalysts like cross-selling and new product innovation could drive a reassessment if current headwinds are overcome.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for OneSpan on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Have your own interpretation of the latest figures? In just minutes, you can craft and share a fresh perspective. Do it your way

A great starting point for your OneSpan research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

See What Else Is Out There

Despite strong margins, OneSpan faces steep projected earnings declines and top-line headwinds as revenue growth slows and profit margins are forecast to shrink.

If predictable results matter to you, start your search with stable growth stocks screener (2102 results) to uncover companies delivering steadier expansions in revenue and earnings year after year.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:OSPN

OneSpan

Provides digital solutions for security, authentication, identity, electronic signature, and digital workflow products in the Americas, Europe, the Middle East, Africa, and the Asia Pacific regions.

Outstanding track record with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives