- United States

- /

- Software

- /

- NasdaqGS:OS

Does the 5% Rally Signal a Turnaround for OneStream in 2025?

Reviewed by Bailey Pemberton

- If you have ever looked at OneStream and wondered whether it is set for a turnaround or just another high flyer at a discount, you are not alone.

- In just the last week, the stock has climbed 5.0%, hinting at renewed interest after a tough year, with the share price still down 37.0% over the last 12 months.

- Recent news from the software sector has fueled speculation about potential tech rebound stories and highlighted increased competition, which could be driving some of the volatility we are seeing in OneStream's price.

- When we put the company through our valuation checklist, OneStream scores a 4 out of 6, showing it looks undervalued by several key measures. This is a starting point, but we will dive into multiple valuation approaches next and reveal what really matters for long-term value by the end of this article.

Find out why OneStream's -37.0% return over the last year is lagging behind its peers.

Approach 1: OneStream Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow (DCF) valuation projects a company’s future cash flows and discounts them back to today’s dollars. This process provides an estimate of what the business is really worth right now. For OneStream, this approach uses recent and forecasted Free Cash Flow (FCF) numbers to inform the valuation.

Currently, OneStream’s Free Cash Flow stands at $89.98 million. Analyst estimates predict a steady climb in the next five years, with FCF projected to reach $288.45 million by 2029. After those analyst-based projections, the DCF model extrapolates further into the future, with growth tapering based on reasonable assumptions for the software sector. All these future figures are discounted back to the present to account for risks and the time value of money.

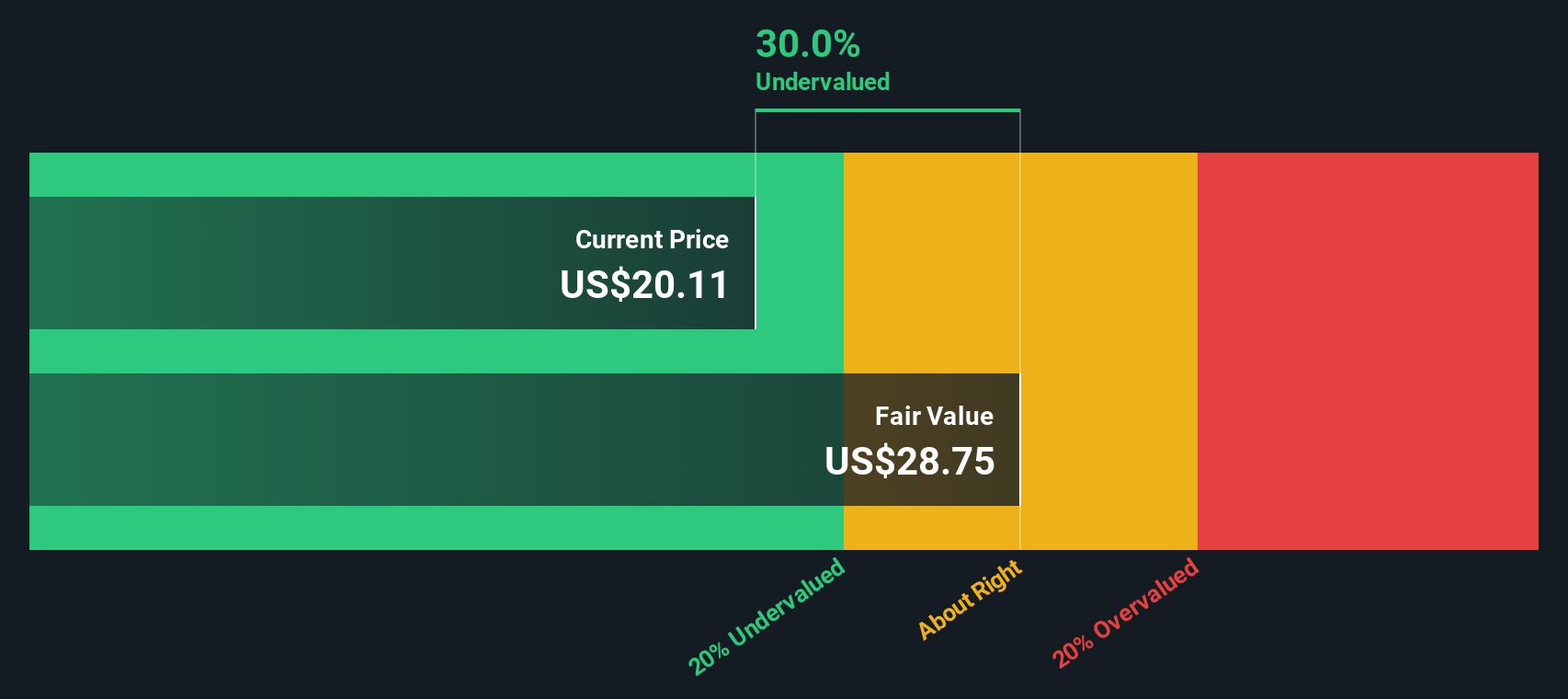

Based on these projections and the 2 Stage Free Cash Flow to Equity model, OneStream’s intrinsic value per share is calculated at $27.90. Compared to the current share price, this means the stock is trading at a substantial 32.3% discount, suggesting it may be undervalued by the market.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests OneStream is undervalued by 32.3%. Track this in your watchlist or portfolio, or discover 833 more undervalued stocks based on cash flows.

Approach 2: OneStream Price vs Sales

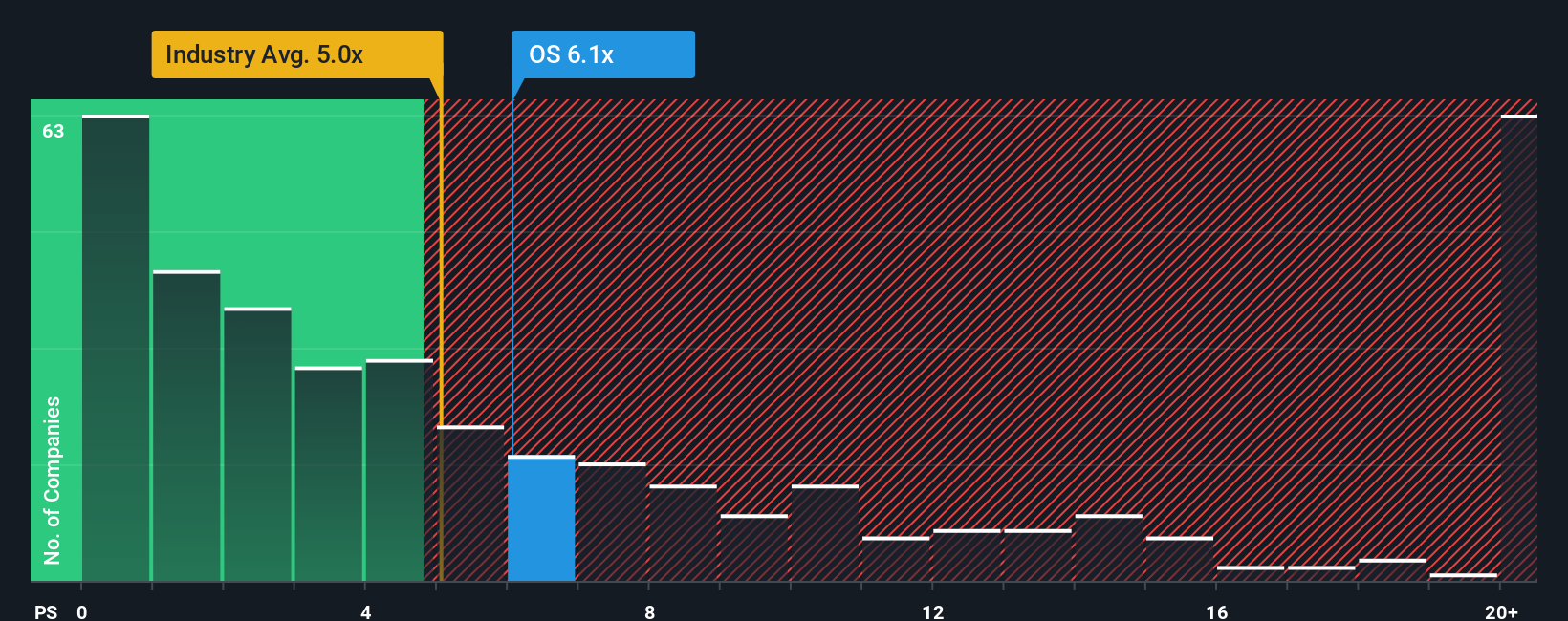

For software companies like OneStream, the Price-to-Sales (PS) ratio is a widely accepted valuation gauge, especially when profitability is inconsistent or still developing. The PS ratio provides insight into how much investors are willing to pay for every dollar of the company's sales, making it helpful for high-growth sectors where net earnings can be volatile.

Growth expectations and business risk both influence what counts as a “fair” PS ratio. Companies growing faster or operating with less risk are generally valued at higher multiples, while those with slower growth or more uncertainty command lower ratios.

Currently, OneStream trades at a PS ratio of 6.45x. This compares to an industry average of 5.21x and a peer group average of 7.21x. This positions OneStream between these two key benchmarks.

To refine this assessment, Simply Wall St's proprietary “Fair Ratio” for OneStream stands at 5.87x. This approach is more customized than a simple peer or industry comparison because it accounts for the company’s expected earnings growth, risk profile, profit margin, industry dynamics, and market capitalization. These are factors that are often overlooked in broad averages.

Comparing the actual PS ratio of 6.45x with the Fair Ratio of 5.87x indicates the stock may be slightly overvalued on this metric. While the numbers are reasonably close, the difference suggests a mild premium is priced in by the market.

Result: OVERVALUED

PS ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1411 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your OneStream Narrative

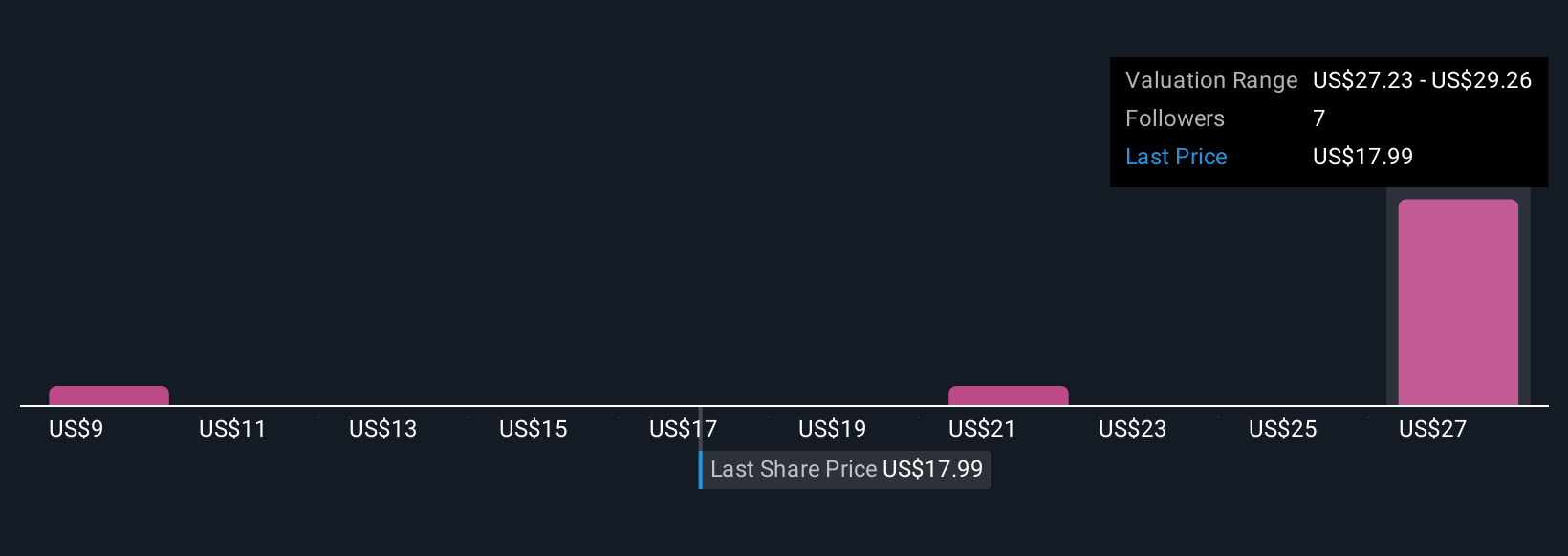

Earlier we mentioned that there's an even better way to understand valuation, so let's introduce you to Narratives. A Narrative makes investing more personal and dynamic by letting you describe your perspective on a company. In other words, it’s your story behind the numbers, including your own estimate of fair value and assumptions for future revenue, profits, and margins.

Simply put, a Narrative links a company's story to a financial forecast and then to a fair value, so you can see in one place why you believe a stock is undervalued, overvalued, or fairly priced. Narratives are easy and accessible tools available right now on Simply Wall St's Community page, where millions of investors use them to improve and explain their decisions.

Narratives help you decide when to buy or sell by letting you compare your Fair Value with the current market price, and they stay up-to-date as soon as new news or results emerge. For example, with OneStream, one investor might see digital transformation and global SaaS trends justifying a fair value as high as $38.00, while another, factoring in competition or spending risks, may land closer to $23.00, and both can track and adjust their view as reality unfolds.

Do you think there's more to the story for OneStream? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:OS

OneStream

OneStream, Inc. delivers a unified, AI-enabled, and extensible software platform in the United States and internationally.

Flawless balance sheet and good value.

Similar Companies

Market Insights

Community Narratives