- United States

- /

- Software

- /

- NasdaqGS:OS

Could OneStream’s (OS) Microsoft Alliance Reveal Its True Competitive Moat in Enterprise Finance AI?

Reviewed by Sasha Jovanovic

- At Microsoft Ignite 2025, OneStream announced it has entered a strategic alliance with Microsoft to deeply integrate its SensibleAI Agents across Microsoft 365, Teams, Excel, Copilot, and Azure, aiming to deliver advanced real-time analysis, forecasting, and automation capabilities for enterprise finance teams within familiar Microsoft applications.

- This collaboration both expands OneStream's access to Microsoft's global platform and ecosystem and positions its AI-powered finance solutions directly within widely adopted enterprise tools.

- We'll explore how the deep integration of SensibleAI Agents into Microsoft 365 could influence OneStream's growth and competitive positioning.

These 11 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

OneStream Investment Narrative Recap

To own OneStream stock is to trust in its ability to capture growing demand for unified, AI-powered finance platforms as CFOs overhaul legacy systems. The newly announced integration with Microsoft 365 could strengthen OneStream’s competitive position and accelerate customer adoption, potentially serving as a short-term catalyst. However, the alliance does not directly address the key risk of heavy investments outpacing revenue growth, which continues to pressure operating margins as the company scales.

Among recent company developments, OneStream’s May 2025 release of new SensibleAI capabilities for finance leaders stands out as highly relevant to this Microsoft partnership. These product innovations, which focus on workflow automation and advanced analytics, directly contribute to the platform’s attractiveness in large-scale digital transformation projects, the very catalyst that underpins the growth narrative behind the Microsoft alliance.

In contrast, investors should remain aware of the risk that ongoing investment requirements could...

Read the full narrative on OneStream (it's free!)

OneStream's outlook forecasts $937.1 million in revenue and $122.7 million in earnings by 2028. Achieving this would require 19.8% annual revenue growth and a $353.9 million increase in earnings from the current $-231.2 million loss.

Uncover how OneStream's forecasts yield a $28.79 fair value, a 44% upside to its current price.

Exploring Other Perspectives

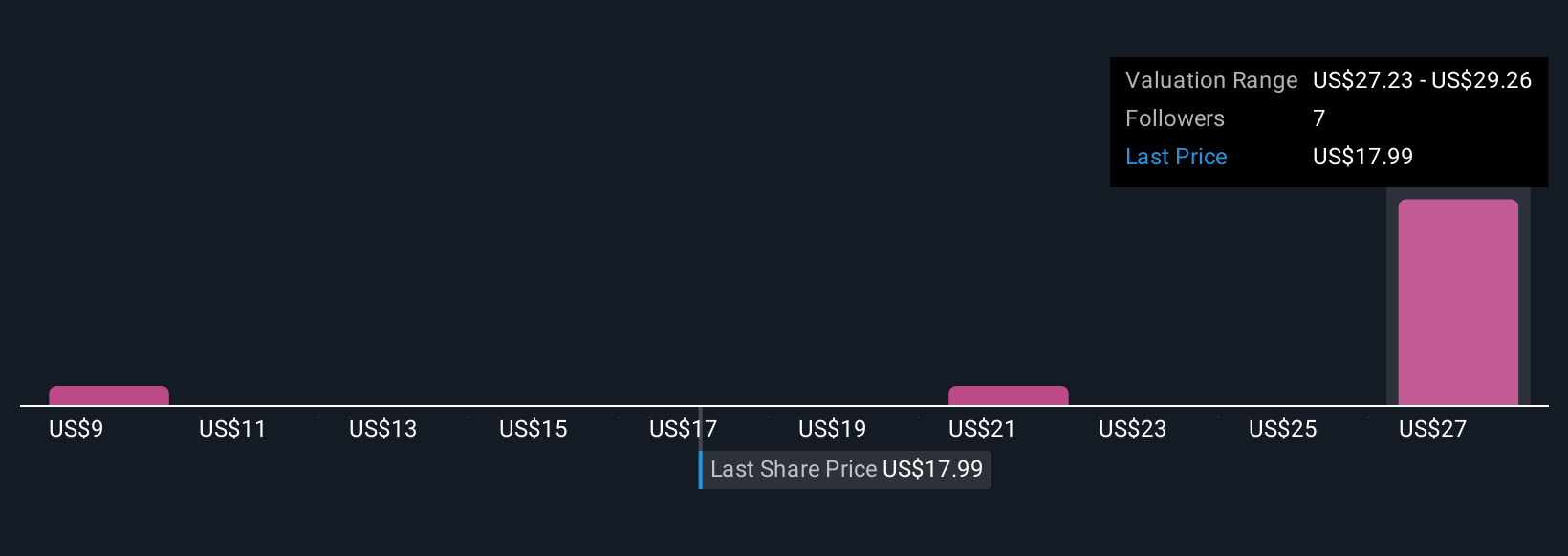

Simply Wall St Community members set fair value estimates for OneStream from US$8.97 to US$29.54 based on four projections. While some anticipate strong cloud and AI-driven catalysts, escalating investment costs could shape future profitability and should be considered when weighing these varied opinions.

Explore 4 other fair value estimates on OneStream - why the stock might be worth as much as 47% more than the current price!

Build Your Own OneStream Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your OneStream research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free OneStream research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate OneStream's overall financial health at a glance.

Contemplating Other Strategies?

Our top stock finds are flying under the radar-for now. Get in early:

- Outshine the giants: these 26 early-stage AI stocks could fund your retirement.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:OS

OneStream

OneStream, Inc. delivers a unified, AI-enabled, and extensible software platform in the United States and internationally.

Flawless balance sheet and good value.

Similar Companies

Market Insights

Community Narratives