- United States

- /

- Diversified Financial

- /

- NasdaqCM:OLB

Does OLB Group (NASDAQ:OLB) Have A Healthy Balance Sheet?

Howard Marks put it nicely when he said that, rather than worrying about share price volatility, 'The possibility of permanent loss is the risk I worry about... and every practical investor I know worries about.' When we think about how risky a company is, we always like to look at its use of debt, since debt overload can lead to ruin. As with many other companies The OLB Group, Inc. (NASDAQ:OLB) makes use of debt. But the real question is whether this debt is making the company risky.

What Risk Does Debt Bring?

Debt is a tool to help businesses grow, but if a business is incapable of paying off its lenders, then it exists at their mercy. In the worst case scenario, a company can go bankrupt if it cannot pay its creditors. However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price simply to get debt under control. Having said that, the most common situation is where a company manages its debt reasonably well - and to its own advantage. When we examine debt levels, we first consider both cash and debt levels, together.

View our latest analysis for OLB Group

What Is OLB Group's Net Debt?

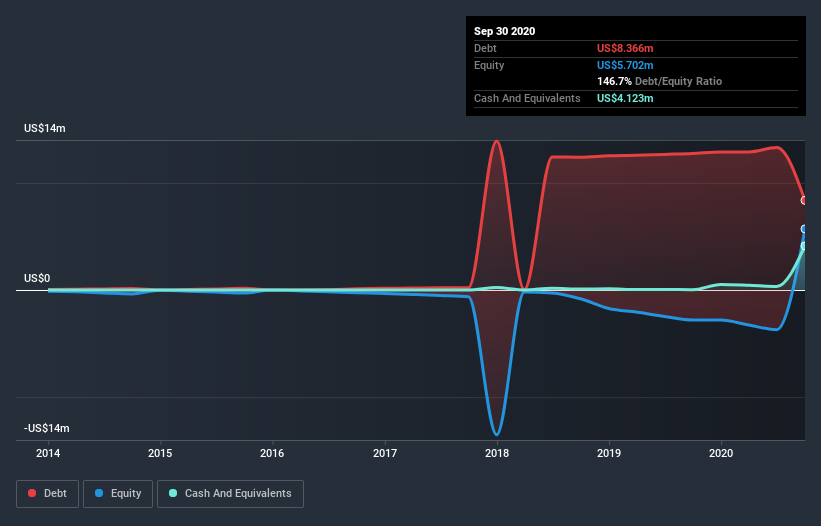

The image below, which you can click on for greater detail, shows that OLB Group had debt of US$8.37m at the end of September 2020, a reduction from US$12.7m over a year. However, it does have US$4.12m in cash offsetting this, leading to net debt of about US$4.24m.

How Healthy Is OLB Group's Balance Sheet?

Zooming in on the latest balance sheet data, we can see that OLB Group had liabilities of US$1.16m due within 12 months and liabilities of US$8.12m due beyond that. Offsetting this, it had US$4.12m in cash and US$420.1k in receivables that were due within 12 months. So it has liabilities totalling US$4.74m more than its cash and near-term receivables, combined.

Since publicly traded OLB Group shares are worth a total of US$29.0m, it seems unlikely that this level of liabilities would be a major threat. But there are sufficient liabilities that we would certainly recommend shareholders continue to monitor the balance sheet, going forward. There's no doubt that we learn most about debt from the balance sheet. But ultimately the future profitability of the business will decide if OLB Group can strengthen its balance sheet over time. So if you're focused on the future you can check out this free report showing analyst profit forecasts.

Over 12 months, OLB Group made a loss at the EBIT level, and saw its revenue drop to US$9.6m, which is a fall of 29%. To be frank that doesn't bode well.

Caveat Emptor

While OLB Group's falling revenue is about as heartwarming as a wet blanket, arguably its earnings before interest and tax (EBIT) loss is even less appealing. To be specific the EBIT loss came in at US$762k. Considering that alongside the liabilities mentioned above does not give us much confidence that company should be using so much debt. So we think its balance sheet is a little strained, though not beyond repair. However, it doesn't help that it burned through US$107k of cash over the last year. So suffice it to say we do consider the stock to be risky. There's no doubt that we learn most about debt from the balance sheet. But ultimately, every company can contain risks that exist outside of the balance sheet. For example, we've discovered 3 warning signs for OLB Group that you should be aware of before investing here.

Of course, if you're the type of investor who prefers buying stocks without the burden of debt, then don't hesitate to discover our exclusive list of net cash growth stocks, today.

If you decide to trade OLB Group, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NasdaqCM:OLB

OLB Group

Provides integrated financial and transaction processing services for small and mid-sized merchants in the United States.

Slight risk with mediocre balance sheet.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion