- United States

- /

- IT

- /

- NasdaqGS:OKTA

Okta (NasdaqGS:OKTA) Board Reduces Size as Benjamin Horowitz Steps Down

Reviewed by Simply Wall St

Benjamin Horowitz has resigned from Okta's (NasdaqGS:OKTA) Board of Directors, reducing the Board's size from nine to eight members. This recent change could influence the company's strategic direction. Nevertheless, Okta's share price remained flat over the past week. During the same period, the company introduced Cross App Access, enhancing security and user experience amid rising AI integration. Despite these internal developments, the market rose by 2%, somewhat contrasting Okta's stagnant performance. These events may have tempered an otherwise favorable market trend, given their potential implications for Okta's governance and product innovation.

Buy, Hold or Sell Okta? View our complete analysis and fair value estimate and you decide.

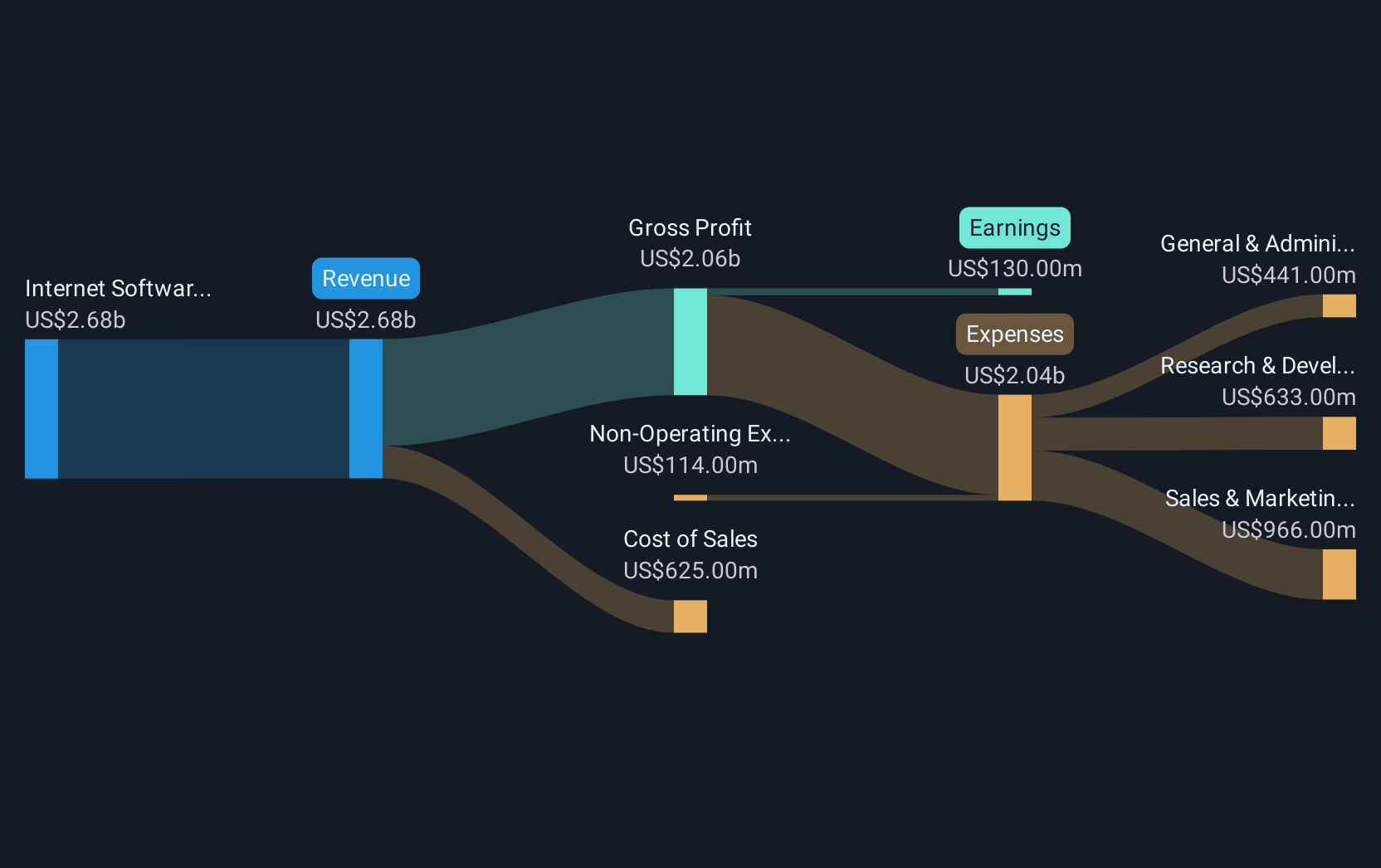

The resignation of Benjamin Horowitz from Okta's Board may have implications for its strategic direction, potentially influencing its innovation agenda as seen with the launch of Cross App Access. Despite these internal changes, Okta's shares experienced a modest 11.22% total return over the past year. This performance aligns with the broader market, which showed a 12% increase over the same period, yet it has underperformed the US IT industry, which posted a substantial 36.7% rise.

The company's share price remains 20% below the consensus price target of US$123.32, reflecting investor caution despite optimistic analyst forecasts. Analysts expect Okta's earnings to grow significantly, projecting them to more than double over the next few years. Horowitz's departure might introduce uncertainties that could affect Okta's ability to capitalize on its expanded product offerings and AI integration. This, coupled with internal shifts, may impact revenue and earnings forecasts, especially given potential challenges in customer integration and competition from major cloud providers.

Examine Okta's past performance report to understand how it has performed in prior years.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:OKTA

Okta

Operates as an identity partner in the United States and internationally.

Flawless balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives