- United States

- /

- IT

- /

- NasdaqGS:OKTA

Is Okta’s (OKTA) Canadian Data Residency Initiative Shaping Its Privacy-Driven Investment Narrative?

Reviewed by Sasha Jovanovic

- Earlier this month, Okta announced the opening of a new Canadian cell to keep customer data in-country and enhance privacy compliance, alongside expanding its local team and introducing French-language support for Quebec and Francophone users.

- This move addresses the increasing need for secure AI infrastructure in Canada, particularly as organizations manage the challenges of governing non-human identities and sensitive data access introduced by AI agents.

- We'll examine how Okta's commitment to Canadian data residency and privacy compliance could influence its broader investment narrative.

We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Okta Investment Narrative Recap

Okta’s long-term opportunity depends on organizations needing reliable identity management as digital transformation and AI adoption accelerate, and on its ability to remain essential despite competition from full-suite security vendors. The new Canadian data residency cell is an operational enhancement that supports compliance-focused growth but is unlikely to materially shift the core, near-term catalysts or the main risks around market consolidation and platform integration, though it could help mitigate regulatory risks for international expansion.

Among recent company updates, Okta’s September launch of new features for AI agent security stands out as especially relevant. Like the Canadian cell, it directly addresses the challenges of controlling non-human identities, reinforcing the company's push to capture emerging demand for AI security and governance solutions. Both initiatives align with core growth drivers, linking product innovation with privacy and compliance needs.

By contrast, investors should be aware that intensifying competition from integrated security platforms remains a key factor that could reshape Okta’s medium-term revenue profile if demand for standalone identity solutions weakens…

Read the full narrative on Okta (it's free!)

Okta's narrative projects $3.6 billion in revenue and $414.2 million in earnings by 2028. This requires 9.5% yearly revenue growth and a $246.2 million earnings increase from $168.0 million today.

Uncover how Okta's forecasts yield a $118.80 fair value, a 48% upside to its current price.

Exploring Other Perspectives

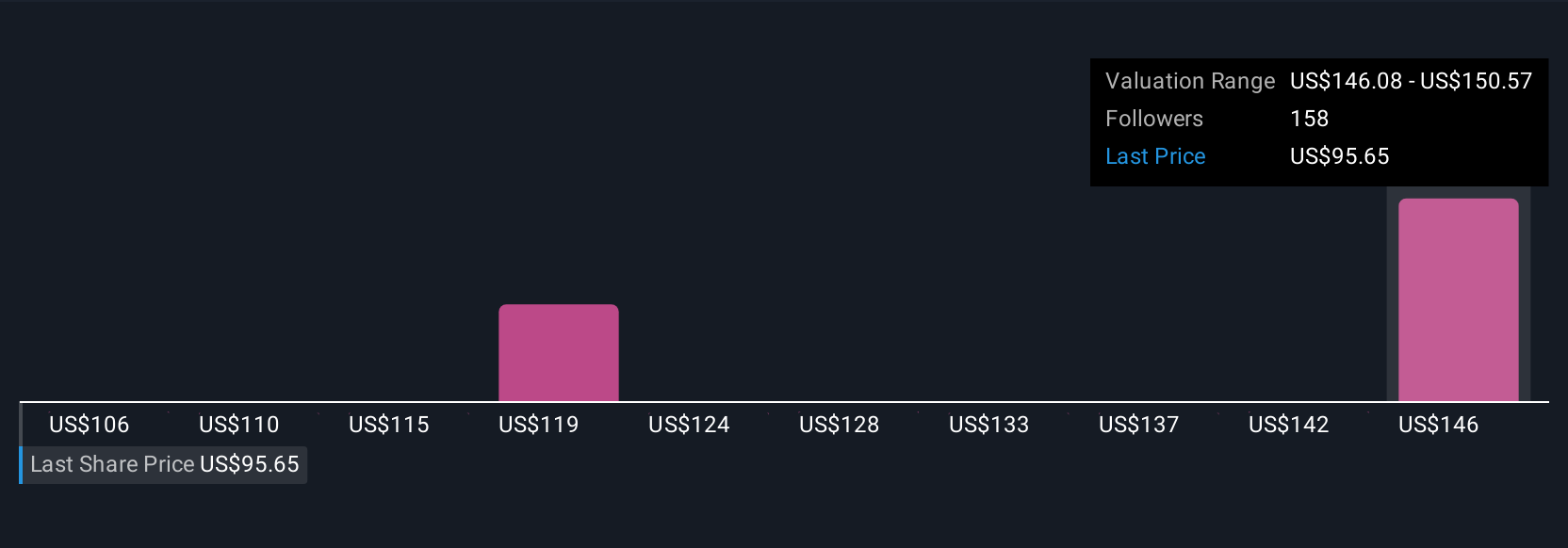

Seven members of the Simply Wall St Community estimate Okta’s fair value in a wide US$105.65 to US$147.87 range. While opinions differ, growing competition from larger security platforms could influence long-term value, so compare these varied viewpoints for a broader context.

Explore 7 other fair value estimates on Okta - why the stock might be worth just $105.65!

Build Your Own Okta Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Okta research is our analysis highlighting 4 key rewards that could impact your investment decision.

- Our free Okta research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Okta's overall financial health at a glance.

Looking For Alternative Opportunities?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- Find companies with promising cash flow potential yet trading below their fair value.

- Outshine the giants: these 25 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:OKTA

Okta

Operates as an identity partner in the United States and internationally.

Flawless balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Constellation Energy Dividends and Growth

CoreWeave's Revenue Expected to Rocket 77.88% in 5-Year Forecast

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026