- United States

- /

- IT

- /

- NasdaqGS:OKTA

Is Okta (OKTA) Undervalued? Examining the Identity Leader’s Valuation After Recent Volatility

Reviewed by Simply Wall St

See our latest analysis for Okta.

Okta’s share price has delivered a 6.5% gain so far this year, reflecting a measured rebound after a choppy few months. However, the one-year total shareholder return stands at nearly 14%, highlighting that despite recent wobbles, longer-term holders have been rewarded with positive momentum building into 2024.

If volatility in the software sector has you curious, now is a good time to discover fast growing stocks with high insider ownership

But is Okta’s current price an attractive entry given ongoing volatility and growth, or has Wall Street already factored in all of the company’s potential upside?

Most Popular Narrative: 30.3% Undervalued

Okta's most closely watched narrative sets the stock’s fair value at $120.37, a hefty premium over the last closing price of $83.93. This gap shapes investor debate as the narrative leans heavily on robust projected growth and profitability expansion.

The proliferation of AI agents and nonhuman identities is creating new, urgent security use cases that require sophisticated identity governance, privileged access management, and policy controls. These are areas where Okta is innovating (Cross App Access, Auth0 for AI Agents, Axiom acquisition), opening incremental growth avenues and potential margin expansion through higher value and differentiated products.

What’s driving this aggressive price target? The narrative blends bullish revenue expectations, ambitious profit margin expansion, and bold assumptions about future earnings per share. Want to know exactly which financial forecast powers this valuation leap? Dive in to see what’s beneath the surface.

Result: Fair Value of $120.37 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing integration challenges or aggressive competition from large cybersecurity players could quickly undermine Okta’s forecasted growth and reshape its outlook.

Find out about the key risks to this Okta narrative.

Another View: Multiples Paint a Pricier Picture

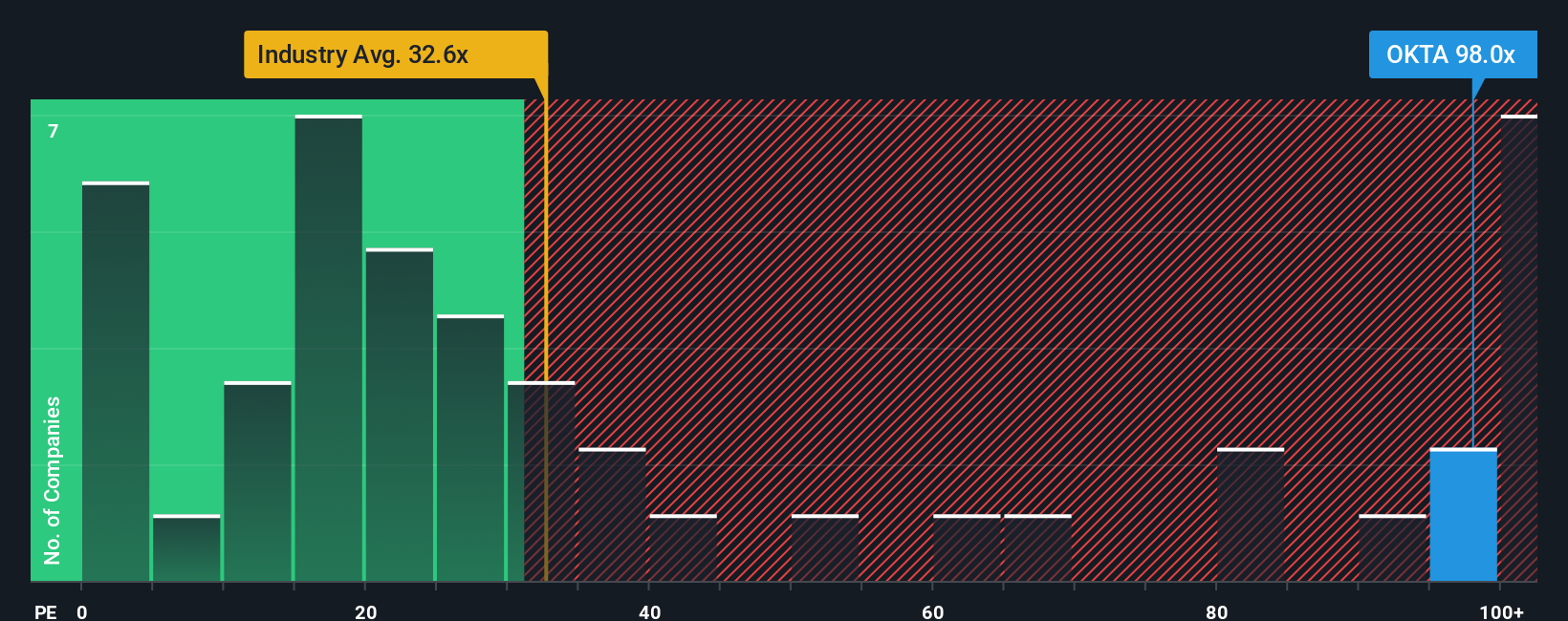

Looking at valuation through the lens of the price-to-earnings ratio tells a different story. Okta trades at 88.1 times earnings, which is well above the industry average of 31.3 times and nearly double the fair ratio of 40.7 times. This suggests the stock is expensive by this approach. Does the premium reflect real growth potential, or risk for late buyers?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Okta Narrative

If you see things differently or want to put your own analysis to the test, it takes just a few minutes to build your own view and Do it your way.

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding Okta.

Looking for more investment ideas?

Don't miss out on the next big opportunity. Make your money work harder by targeting stocks poised for momentum, growth, or rewarding yields. Start now to get ahead.

- Capitalize on high-yield opportunities by checking out these 17 dividend stocks with yields > 3% offering attractive income potential for your portfolio.

- Seize your edge in tomorrow’s tech by uncovering these 26 quantum computing stocks making waves with breakthroughs that could reshape entire industries.

- Ride the future of finance and pursue growth and innovation with these 82 cryptocurrency and blockchain stocks at the heart of blockchain and digital asset trends.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:OKTA

Okta

Operates as an identity partner in the United States and internationally.

Flawless balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives