- United States

- /

- IT

- /

- NasdaqGS:OKTA

How Okta’s (OKTA) AI-Focused Security Upgrades and Partnerships Have Changed Its Investment Story

Reviewed by Sasha Jovanovic

- In late September, Okta announced new platform capabilities and integrations focused on securing AI agents and enhancing identity fabric, while MIND revealed a technology integration with Okta to unite data security and identity for context-aware protection. These updates, alongside increasing investor optimism in the AI sector, have reinforced Okta’s role in addressing emerging security threats linked to AI adoption and digital transformation.

- We'll now examine how Okta’s focus on secure AI agent governance and digital credentials could shape its investment outlook going forward.

Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

Okta Investment Narrative Recap

To be optimistic about Okta as an investment, you need to believe that identity security will remain central to digital transformation, and that Okta’s innovations, particularly around AI agent governance and digital credentials, will help defend its position even as competition intensifies. The latest announcement on securing AI agents and issuing tamper-proof digital credentials reinforces Okta’s alignment with industry tailwinds, though it doesn’t directly alter near-term catalysts such as adoption rates or address the primary risk of larger platform competitors consolidating market share.

Among Okta’s recent announcements, the introduction of tamper-proof Verifiable Digital Credentials stands out. This move addresses the growing challenge of AI-enabled fraud while aligning with customer needs for seamless, secure onboarding, a potential catalyst for new adoption and increased cross-sell to large enterprises.

Yet, in contrast, investors also need to be aware of intensifying competition from platform security providers, which could impact Okta’s long-term pricing power and...

Read the full narrative on Okta (it's free!)

Okta's outlook projects $3.6 billion in revenue and $414.2 million in earnings by 2028. This implies a 9.5% annual revenue growth rate and a $246.2 million increase in earnings from the current $168.0 million.

Uncover how Okta's forecasts yield a $120.37 fair value, a 28% upside to its current price.

Exploring Other Perspectives

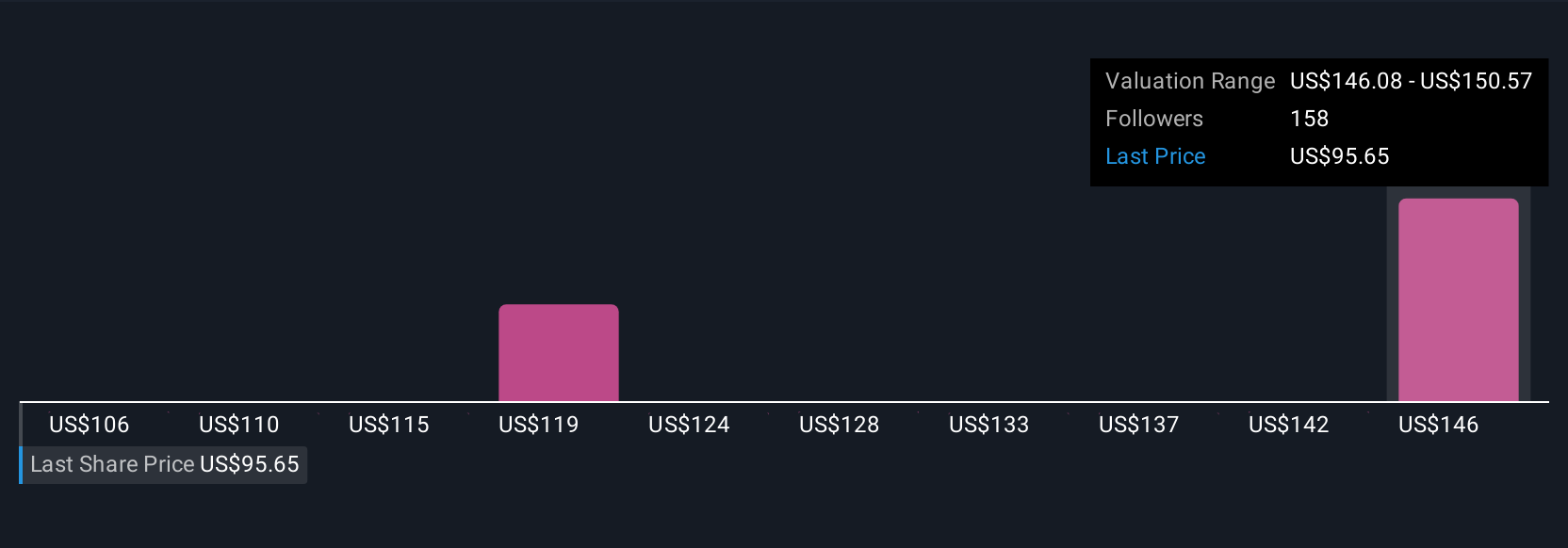

Eight independent fair value estimates from the Simply Wall St Community range from US$94.96 to US$147.87 per share. While some see upside, the ongoing risk of integration and execution challenges for Okta’s expanding product suite remains a factor worth weighing as you consider these viewpoints.

Explore 8 other fair value estimates on Okta - why the stock might be worth just $94.96!

Build Your Own Okta Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Okta research is our analysis highlighting 4 key rewards that could impact your investment decision.

- Our free Okta research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Okta's overall financial health at a glance.

Interested In Other Possibilities?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 25 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 34 best rare earth metal stocks of the very few that mine this essential strategic resource.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:OKTA

Okta

Operates as an identity partner in the United States and internationally.

Flawless balance sheet with acceptable track record.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Meta’s Bold Bet on AI Pays Off

ADP Stock: Solid Fundamentals, But AI Investments Test Its Margin Resilience

Visa Stock: The Toll Booth at the Center of Global Commerce

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion