- United States

- /

- Software

- /

- NasdaqCM:NXTT

Next Technology Holding (NXTT): Valuation in Focus After Nasdaq Delisting Threat and Major Equity Offerings

Reviewed by Simply Wall St

If you are following Next Technology Holding (NasdaqCM:NXTT), you have not missed the back-to-back corporate drama. The company is now facing a Nasdaq delisting process, following Nasdaq’s view that it operates as a public shell without an ongoing business. With a hearing scheduled for October, Next Technology Holding has appealed the decision and is pushing back against being removed from the exchange. In addition, within days the company completed a large equity offering and filed for another, raising millions in the process. For investors, this is more than just headline noise; it is a make-or-break saga where access to capital, regulatory scrutiny, and the future of the listing all collide at once.

This series of developments comes against a backdrop of severe long-term share price declines. Over the past year, the stock has fallen sharply and is now down nearly 95% year-to-date, creating a challenging environment for anyone holding on. Momentum has not reversed, with price action trending lower for months, and recent events highlight that questions around business viability and dilution risks are front and center. Still, the surge in trading activity signals that investors are closely watching what happens next with these crucial decisions looming.

The key question remains: Is the market already pricing in a bleak future for Next Technology Holding, or could the uncertainty and low valuation present a potential opportunity if the company survives delisting?

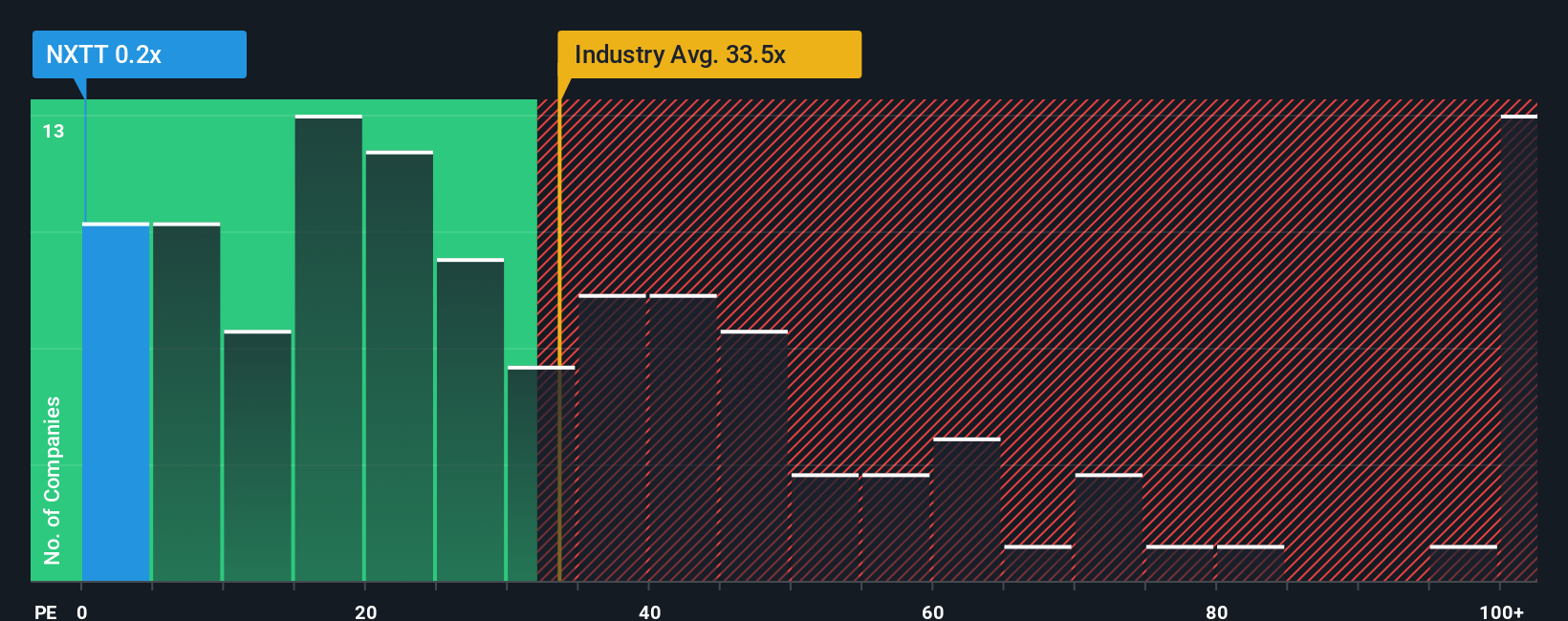

Price-to-Earnings of 0.3x: Is it justified?

Next Technology Holding is currently trading at a strikingly low price-to-earnings (P/E) ratio of 0.3x. This reflects deep undervaluation compared to both the US software industry average of 35.2x and its peer group average of 28.2x.

The P/E ratio measures a company’s current share price relative to its earnings per share. In the context of software stocks, this metric often reflects growth expectations and perceived quality of earnings. A much lower P/E can imply skepticism about the company’s ability to sustain profits or doubts about the quality of those profits.

Given that Next Technology Holding's P/E multiple is drastically below the broader market and sector norms, investors appear to be discounting the business’s long-term potential. This is the case even though recent profit growth rates were exceptionally high. The ultra-low ratio suggests the market questions whether these earnings are sustainable or representative of the true earnings power of the business.

Result: Fair Value of $0.15 (UNDERVALUED)

See our latest analysis for Next Technology Holding.However, ongoing regulatory uncertainty and the company’s lack of clear revenue growth could quickly undermine any bullish case for a turnaround.

Find out about the key risks to this Next Technology Holding narrative.Another View: Multiples in Focus

Taking a step back from the first valuation, another common method compares Next Technology Holding to the broader industry on a single ratio basis. This approach also indicates the stock is undervalued compared to sector norms. Yet, does this view cut through the noise of recent turmoil, or simply reflect the risks that have driven the low price?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Next Technology Holding Narrative

If you have a different perspective or want to investigate further, you can quickly put together your own take and see where the numbers lead. Do it your way

A great starting point for your Next Technology Holding research is our analysis highlighting 2 key rewards and 4 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Stay ahead of the market and find opportunities others might overlook. These stock ideas can put you in front of tomorrow’s winners. Check them out today.

- Spark your portfolio with companies transforming medicine by tapping into the world of healthcare AI stocks.

- Unlock the potential of fast-growing, under-the-radar companies by starting your search with penny stocks with strong financials.

- Maximize value with stocks trading below their true worth. See the full lineup on undervalued stocks based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Next Technology Holding might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:NXTT

Next Technology Holding

Provides software development services in the United States, Hong Kong, and Singapore.

Solid track record with excellent balance sheet.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion