- United States

- /

- Software

- /

- NasdaqGS:NTNX

Should Earnings Forecast Revisions Shape Investor Focus on Nutanix’s (NTNX) Near-Term Outlook?

Reviewed by Simply Wall St

- Nutanix is drawing attention ahead of its upcoming earnings release, with forecasts indicating year-over-year growth in both earnings per share and net sales, despite recent downward revisions from analysts.

- This mixed sentiment underscores the importance of the upcoming financial performance as a potential catalyst for future investor decisions.

- We'll explore how anticipation for Nutanix's latest earnings, amid updated analyst expectations, could influence its broader investment outlook.

Rare earth metals are the new gold rush. Find out which 25 stocks are leading the charge.

Nutanix Investment Narrative Recap

To be a Nutanix shareholder, you need to believe in the company’s role in driving enterprise cloud modernization, especially as customers seek robust, flexible IT platforms to meet evolving workload demands. While upcoming earnings are forecasted to improve year over year, recent downward estimate revisions from analysts keep the spotlight on the company’s financial performance as the central near-term catalyst, with continued sales variability still presenting the biggest risk; the most recent news does little to materially shift these priorities.

Recent quarterly results revealed Nutanix’s Q3 revenue grew to US$638.98 million, paired with improved net income of US$63.36 million. This context makes the current buzz around the Q4 earnings release especially relevant, as financial consistency and delivery versus expectations will remain key for both near-term sentiment and the larger story for new enterprise customer wins.

Yet, despite headline growth figures, investors should not overlook ongoing sales cycle unpredictability, which could mean...

Read the full narrative on Nutanix (it's free!)

Nutanix's outlook anticipates $4.1 billion in revenue and $609.3 million in earnings by 2028. This is based on a 19.4% annual revenue growth rate and an increase in earnings of $585.7 million from the current $23.6 million.

Uncover how Nutanix's forecasts yield a $91.58 fair value, a 24% upside to its current price.

Exploring Other Perspectives

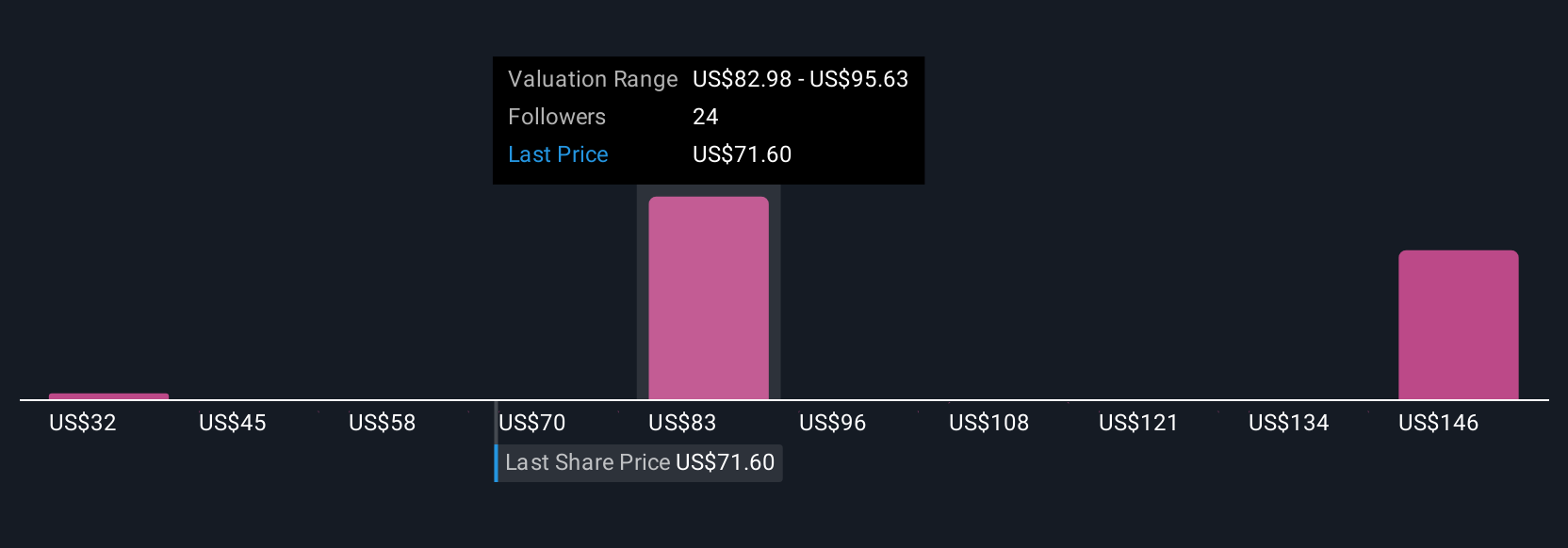

Six fair value views from the Simply Wall St Community range widely, from US$32.34 to US$175.20 per share. Current analyst attention on variable sales cycles highlights that perspectives can differ sharply on Nutanix’s underlying momentum, see what others think.

Explore 6 other fair value estimates on Nutanix - why the stock might be worth less than half the current price!

Build Your Own Nutanix Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Nutanix research is our analysis highlighting 4 key rewards and 4 important warning signs that could impact your investment decision.

- Our free Nutanix research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Nutanix's overall financial health at a glance.

Curious About Other Options?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- AI is about to change healthcare. These 26 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- The end of cancer? These 25 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Nutanix might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:NTNX

Nutanix

Provides an enterprise cloud platform in North America, Europe, the Asia Pacific, the Middle East, Latin America, and Africa.

Undervalued with high growth potential.

Similar Companies

Market Insights

Community Narratives