- United States

- /

- Software

- /

- NasdaqGS:NCNO

Assessing nCino (NCNO) Valuation After Recent Share Price Rebound and Investor Sentiment Shift

Reviewed by Simply Wall St

See our latest analysis for nCino.

This month’s bump in nCino’s share price hints at renewed optimism, but keep in mind that momentum has been hard to sustain. The stock is still down 22% year-to-date and the total shareholder return over the past twelve months sits at -38.7%. Some investors see the recent price moves as a signal that confidence is building in its growth story, even while longer-term returns highlight the need for caution.

If you’re watching the shift in sentiment around nCino and want to spot more software names on the rise, check out our full list of high-growth tech and AI stocks: See the full list for free.

With the numbers in front of us, the big question remains: is nCino currently trading at a level below its true worth, or has the market already factored in all the company’s future growth prospects?

Most Popular Narrative: 26.7% Undervalued

With nCino’s narrative fair value sitting at $35.54, which is well above the recent close of $26.06, expectations for further upside are running high. Analysts seem to believe there is room for a re-rating, attributing their optimism to the company’s ongoing international expansion, product innovation, and improving margins as key factors driving long-term value.

Expanding the nCino platform's capabilities beyond core loan origination into onboarding, analytics, commercial pricing, and incentive compensation provides robust cross-sell and up-sell opportunities, increasing average contract value and driving both top line revenue and margin expansion over time.

Want to peek under the hood of this bullish price target? The most crucial forecast behind this optimism is a bold margin turnaround that underpins every future projection. See the full narrative to uncover how revenue growth, international momentum, and profit assumptions combine to justify such a premium valuation.

Result: Fair Value of $35.54 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, heightened competition from both large cloud providers and ongoing high investment requirements could limit nCino’s revenue growth and margin expansion if these challenges persist.

Find out about the key risks to this nCino narrative.

Another View: What Do the Ratios Say?

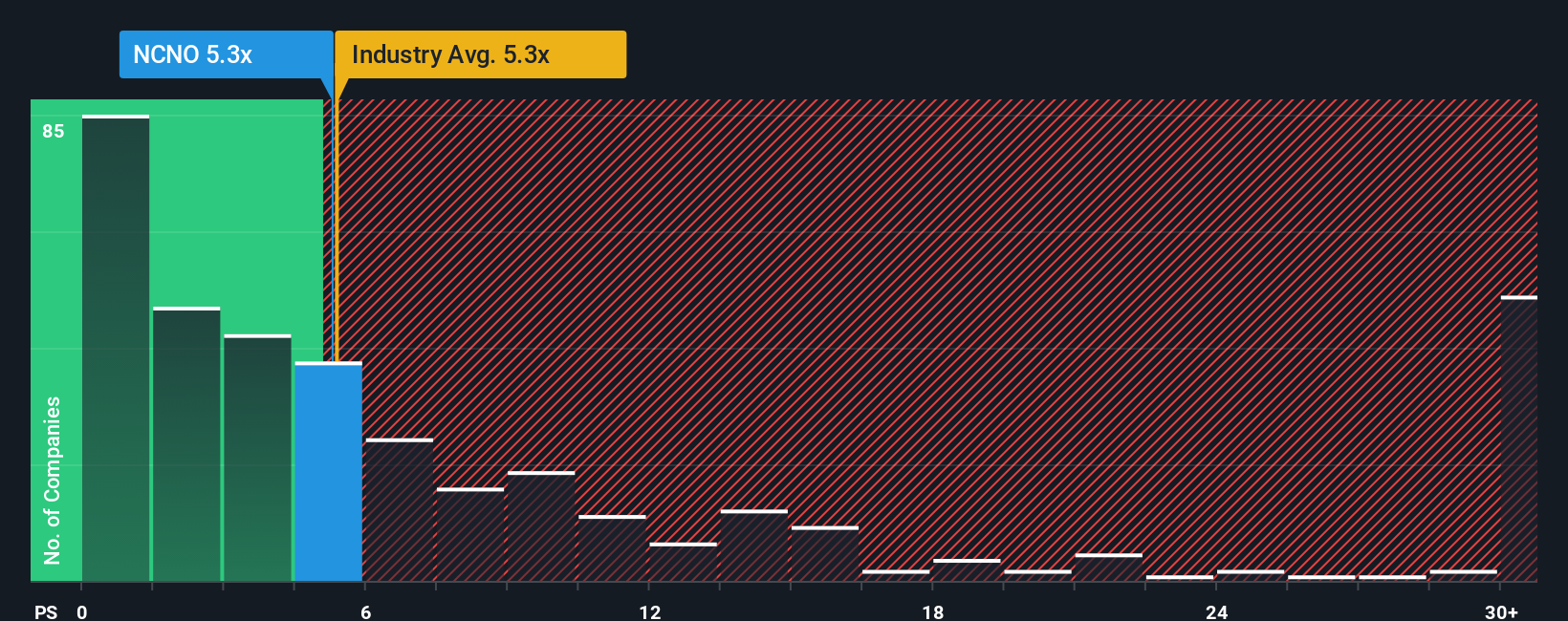

Looking through the lens of price-to-sales, nCino trades at 5.3x, which is noticeably higher than both the US Software industry average of 4.8x and the peer group. In fact, this is above the fair ratio of 3.4x, signaling investors are paying a premium. Does the market see something others are missing, or is caution needed?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own nCino Narrative

If you see things differently or want to dig into the details yourself, building your own view is quick and easy. Do it your way

A great starting point for your nCino research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Don't limit yourself to just one opportunity. Game-changing trends are reshaping the market every day. Unlock powerful growth potential and diversify your playbook by tapping into the most promising stocks right now.

- Uncover fresh value by targeting these 876 undervalued stocks based on cash flows that show strong upside based on solid fundamentals and future earnings potential.

- Supercharge your portfolio’s growth by harnessing the innovations of these 25 AI penny stocks, which are actively transforming industries with cutting-edge artificial intelligence.

- Grow your income stream through these 16 dividend stocks with yields > 3% offering yields above 3 percent, combining steady payouts with resilient business models.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:NCNO

nCino

A software-as-a-service company, provides software solutions to financial institutions in the United States, the United Kingdom, and internationally.

Adequate balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives