- United States

- /

- Software

- /

- NasdaqGS:NBIS

Will Microsoft’s $17 Billion AI Partnership Rewrite Nebius Group’s (NBIS) Investment Narrative?

Reviewed by Sasha Jovanovic

- Microsoft recently announced a landmark multi-year AI cloud infrastructure partnership with Nebius Group, involving an agreement valued at over US$17 billion and focused on delivering advanced GPU capacity from a new data center in New Jersey.

- This collaboration not only secures significant long-term revenue for Nebius Group but also highlights the shifting landscape as leading hyperscalers deepen ties with specialized AI infrastructure providers to meet soaring compute demand.

- We'll explore how Nebius Group's high-profile Microsoft contract could reshape its investment outlook and address previous concerns around growth sustainability.

Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

Nebius Group Investment Narrative Recap

To be a shareholder in Nebius Group, you need confidence in robust, sustained demand for AI cloud infrastructure and the company's ability to convert major contracts into recurring revenue growth. The widely publicized US$17 billion Microsoft partnership meaningfully accelerates scale and de-risks short-term revenue visibility, but it also intensifies the pressure on execution, particularly as Nebius ramps up capital spending to expand capacity, a key catalyst and risk in tandem.

Among recent announcements, the Microsoft contract stands out as the most relevant. Securing this five-year, multi-billion dollar deal not only anchors Nebius’s revenue base but directly addresses concerns about growth durability and its competitive positioning within the AI infrastructure industry.

However, investors should also weigh the contrast between rapid expansion and the costs tied to delivering next-gen GPU infrastructure at scale, particularly as...

Read the full narrative on Nebius Group (it's free!)

Nebius Group's outlook anticipates $3.2 billion in revenue and $428.7 million in earnings by 2028. This is based on an annual revenue growth rate of 133.9% and an increase of $238.5 million in earnings from the current $190.2 million.

Uncover how Nebius Group's forecasts yield a $153.00 fair value, a 18% upside to its current price.

Exploring Other Perspectives

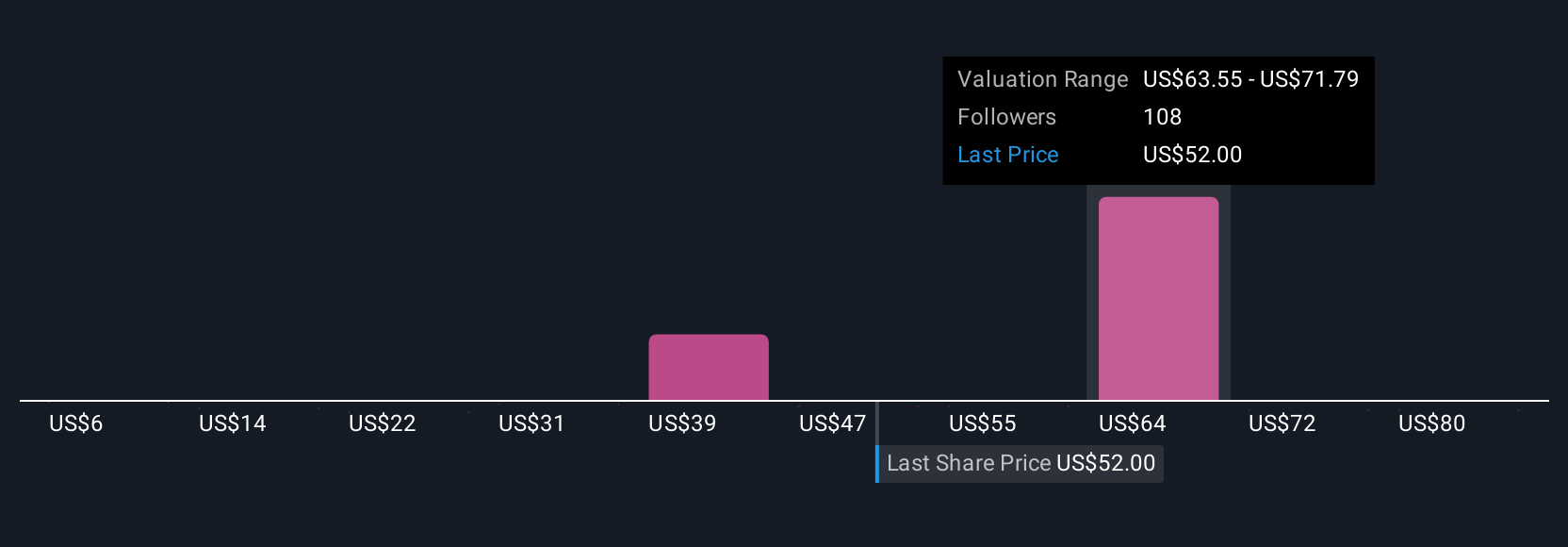

Fair value estimates from 37 Simply Wall St Community members span from US$9.17 to US$333.76 per share. While many see room for further gains tied to Nebius’s growth in AI compute infrastructure, the wide dispersion of views reflects how differently investors assess the company’s revenue trajectory and execution risks.

Explore 37 other fair value estimates on Nebius Group - why the stock might be worth over 2x more than the current price!

Build Your Own Nebius Group Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Nebius Group research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Nebius Group research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Nebius Group's overall financial health at a glance.

Looking For Alternative Opportunities?

Our top stock finds are flying under the radar-for now. Get in early:

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 24 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if Nebius Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:NBIS

Nebius Group

A technology company, engages in building full-stack infrastructure to service the global AI industry in the Netherlands, Europe, North America, and Israel.

Mediocre balance sheet with low risk.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Clarivate Stock: When Data Becomes the Backbone of Innovation and Law

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

MicroVision will explode future revenue by 380.37% with a vision towards success

Trending Discussion