- United States

- /

- Software

- /

- NasdaqGS:NBIS

Nebius Group's $2 Billion AI Infrastructure Bet Could Be a Game Changer for NBIS

Reviewed by Simply Wall St

- In recent days, Nebius Group announced amendments to its Articles of Association and raised its 2025 capital expenditure plan to US$2 billion, alongside updated financial projections showing a return to positive adjusted EBITDA in the year’s second half due to global expansion and revenue growth.

- These actions highlight Nebius Group’s aggressive commitment to building out advanced AI infrastructure worldwide, signaling a sharpened focus on innovation and service reliability for its customers.

- We’ll explore what Nebius Group’s increased AI infrastructure spending means for its investment narrative and anticipated global growth.

These 15 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

What Is Nebius Group's Investment Narrative?

For anyone considering Nebius Group as an investment, the big picture centers on a belief in the company’s ability to rapidly scale high-demand AI infrastructure, capture share in a fiercely competitive market, and eventually turn strong revenue growth into sustainable profitability. The recent amendments to Nebius Group’s Articles of Association, reducing authorized shares and clarifying how capital reductions can be implemented, are best viewed as corporate housekeeping, but paired with the jump in 2025 capital expenditure plans, they may have more immediate influence on investor expectations. This shift signals confidence from management to accelerate global expansion and pursue a quicker return to positive adjusted EBITDA, which had already been highlighted as a catalyst for the stock. However, with a volatile share price, heavy ongoing losses, and an inexperienced management and board, the risk profile remains elevated. While the company’s latest moves highlight a bold vision, much still hinges on execution and the ability to deliver on ambitious growth and innovation targets.

But one thing stands out: board experience is still a concern that investors should be aware of.

Exploring Other Perspectives

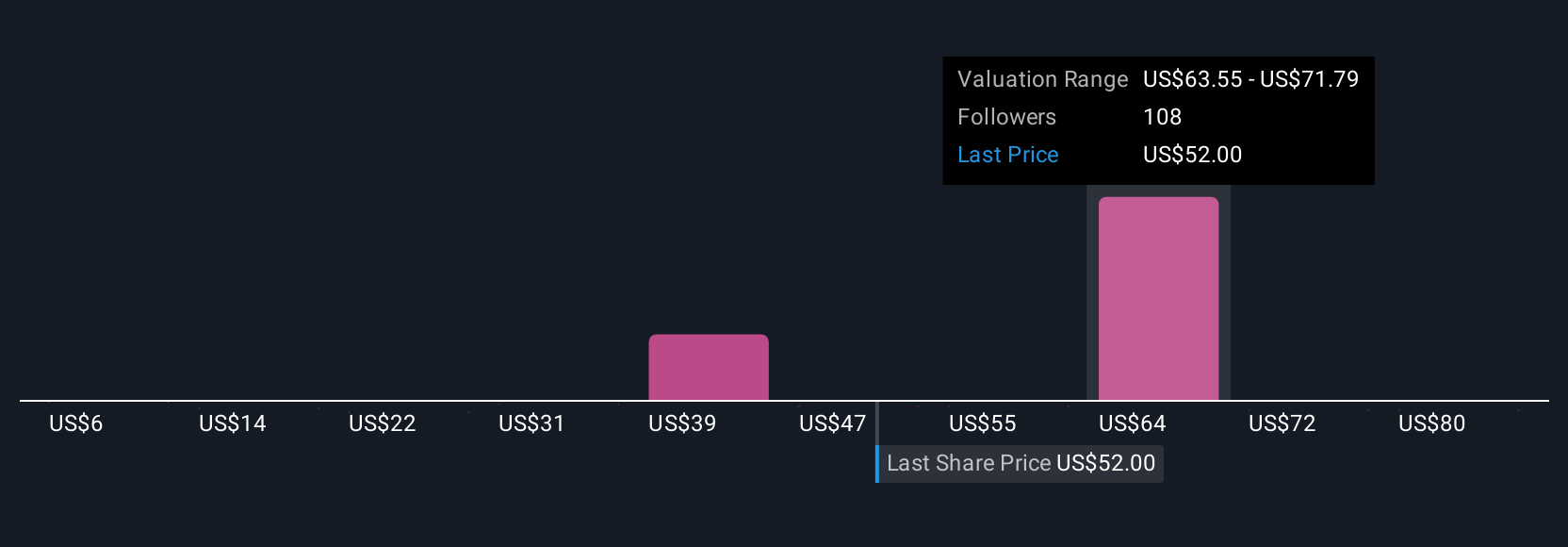

Explore 25 other fair value estimates on Nebius Group - why the stock might be worth as much as 67% more than the current price!

Build Your Own Nebius Group Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Nebius Group research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

- Our free Nebius Group research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Nebius Group's overall financial health at a glance.

Contemplating Other Strategies?

Our top stock finds are flying under the radar-for now. Get in early:

- Explore 27 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- The latest GPUs need a type of rare earth metal called Dysprosium and there are only 25 companies in the world exploring or producing it. Find the list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Nebius Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:NBIS

Nebius Group

A technology company, engages in building full-stack infrastructure to service the global AI industry in the Netherlands, Europe, North America, and Israel.

Excellent balance sheet with limited growth.

Similar Companies

Market Insights

Community Narratives