- United States

- /

- Software

- /

- NasdaqGS:NBIS

How Nebius Group's (NBIS) US$2 Billion Capex Hike and EBITDA Outlook Will Impact Investors

Reviewed by Simply Wall St

- Nebius Group announced plans to amend its Articles of Association and notified shareholders of its upcoming Annual General Meeting, alongside raising its 2025 capital expenditure guidance to US$2 billion and forecasting a return to positive adjusted EBITDA in the second half of the year.

- This move comes as Nebius Group responds to very large revenue growth and expanding global demand for AI and cloud infrastructure services.

- With Nebius Group increasing its capital expenditure plan to accelerate infrastructure expansion, we'll examine the impact on its investment narrative.

AI is about to change healthcare. These 26 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

What Is Nebius Group's Investment Narrative?

For anyone considering Nebius Group, it’s all about conviction in the ongoing shift toward AI and cloud infrastructure. Being a shareholder means believing Nebius can capture significant value from very large growth in global demand, all while scaling at breakneck speed. The company’s fresh capital expenditure upgrade to US$2 billion for 2025, paired with projections for a return to positive adjusted EBITDA in the second half, is a direct play on massive AI infrastructure buildout. These latest announcements mark a bold step, underscoring Nebius’s intent to seize the current demand wave. In the short term, sentiment will likely be driven by whether Nebius hits its aggressive growth and profitability milestones, especially with major financial disclosures on the horizon. However, the sharp increase in capex also elevates execution risk for a young management team and fast-changing board. Share price gains following these updates suggest the market sees the move as supportive, but it also raises the stakes if delivery falls short. On the other hand, the rapid scaling of costs may test Nebius's ability to reach profitability as planned.

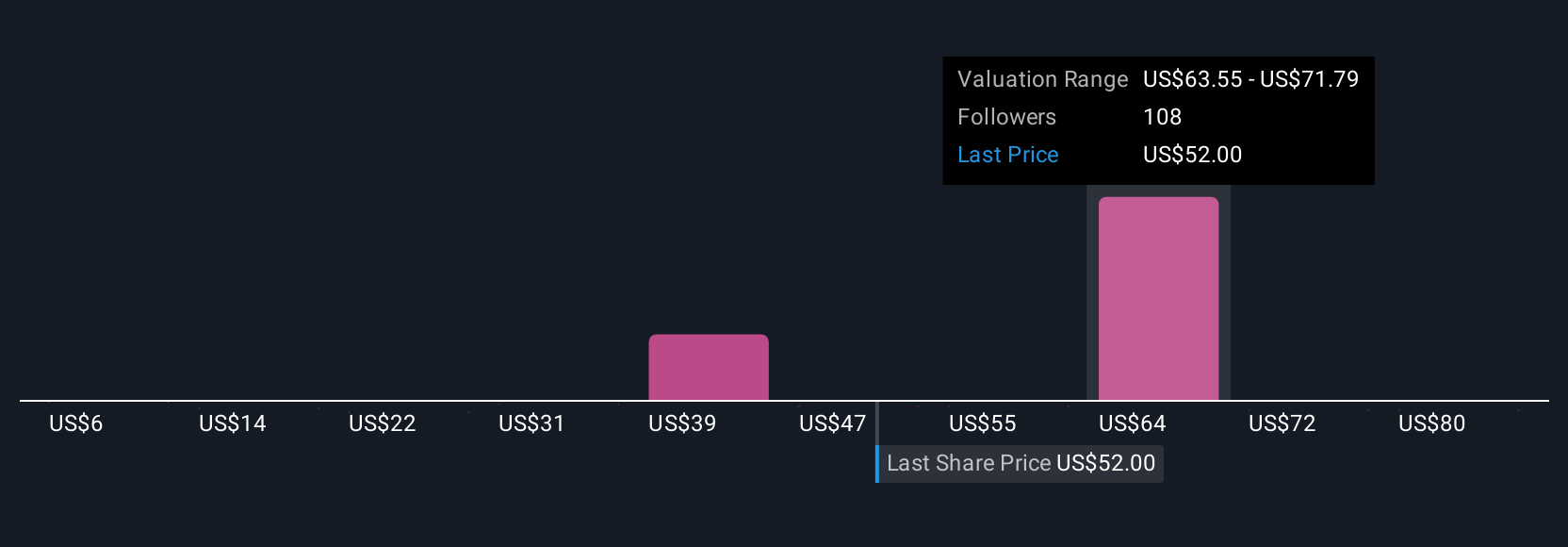

Our valuation report unveils the possibility Nebius Group's shares may be trading at a premium.Exploring Other Perspectives

Explore 26 other fair value estimates on Nebius Group - why the stock might be worth as much as 62% more than the current price!

Build Your Own Nebius Group Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Nebius Group research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

- Our free Nebius Group research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Nebius Group's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- The end of cancer? These 25 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Nebius Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:NBIS

Nebius Group

A technology company, engages in building full-stack infrastructure to service the global AI industry in the Netherlands, Europe, North America, and Israel.

Excellent balance sheet with limited growth.

Similar Companies

Market Insights

Community Narratives