- United States

- /

- Software

- /

- NasdaqGS:NBIS

How Nebius Group's Major Data Center Expansion and New Revenue Targets Will Impact NBIS Investors

Reviewed by Simply Wall St

- Nebius Group recently increased its revenue guidance, forecasting an annualized run rate of US$900 million to US$1.1 billion by the end of 2025, while planning to quadruple global data center capacity and raising US$1 billion in convertible notes to fund its expansion.

- A key insight is Nebius Group's aggressive infrastructure investment signals confidence in sustained AI-driven demand and requires significant financial and operational execution to deliver on these ambitious growth plans.

- We'll explore how Nebius Group's upgraded revenue targets and capital expansion could shift the company's longer-term investment narrative.

Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 29 best rare earth metal stocks of the very few that mine this essential strategic resource.

Nebius Group Investment Narrative Recap

For shareholders, the key conviction centers on Nebius Group's ability to rapidly scale AI infrastructure in response to accelerating global demand, betting that its ambitious expansion and raised revenue targets can translate into durable long-term growth. The latest upgraded guidance and plans to quadruple data center capacity heighten the importance of execution, but do not materially change the immediate catalyst, which remains successful deployment and utilization of this new infrastructure. The main short-term risk is whether Nebius can deliver on both scaling and profitability without exposing itself to overextension.

Among recent announcements, the completion of a US$1 billion convertible note financing stands out as directly relevant to these expanded ambitions. Securing this funding provides Nebius with the capital necessary to accelerate data center expansion, addressing a key enabler for growth while underscoring that capital allocation and operational discipline will remain in sharp focus as the next phase unfolds.

In contrast, investors should also be aware of the risk that heavy capital expenditures for new GPU deployments and data centers...

Read the full narrative on Nebius Group (it's free!)

Nebius Group's narrative projects $3.2 billion in revenue and $428.7 million in earnings by 2028. This requires 133.9% yearly revenue growth and a $238.5 million increase in earnings from $190.2 million today.

Uncover how Nebius Group's forecasts yield a $89.40 fair value, a 37% upside to its current price.

Exploring Other Perspectives

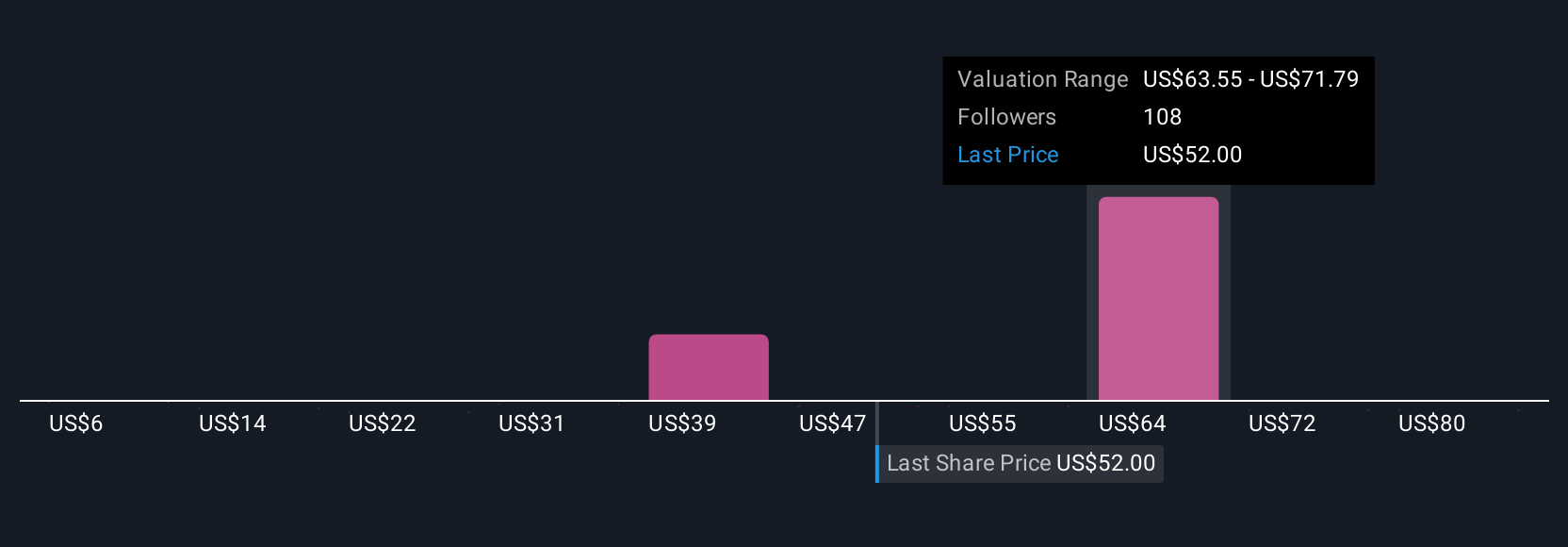

Fair value estimates from 33 Simply Wall St Community members range widely, from US$6.5 to US$128 per share. Investors are weighing these views alongside Nebius Group's aggressive expansion plans and the challenge of funding and utilizing new capacity for revenue growth, explore these perspectives to see how your own outlook compares.

Explore 33 other fair value estimates on Nebius Group - why the stock might be worth less than half the current price!

Build Your Own Nebius Group Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Nebius Group research is our analysis highlighting 1 key reward and 3 important warning signs that could impact your investment decision.

- Our free Nebius Group research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Nebius Group's overall financial health at a glance.

Searching For A Fresh Perspective?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- Find companies with promising cash flow potential yet trading below their fair value.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if Nebius Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:NBIS

Nebius Group

A technology company, engages in building full-stack infrastructure to service the global AI industry in the Netherlands, Europe, North America, and Israel.

Mediocre balance sheet with low risk.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion