- United States

- /

- Software

- /

- NasdaqGS:MSTR

Will Strategy (MSTR)’s Bold Bitcoin Bet Redefine Its Risk Profile or Test Investor Patience?

Reviewed by Sasha Jovanovic

- In the past week, Strategy Inc disclosed a major purchase of 8,178 bitcoin valued at approximately $835.6 million, financed by a recent €620 million preferred stock issuance.

- This substantial addition raised Strategy's bitcoin holdings to nearly 650,000 BTC, highlighting both the company's considerable exposure to digital assets and the market scrutiny over its leveraged approach.

- We'll examine how Strategy’s commitment to expanding its bitcoin reserves shapes the company’s overall investment narrative and risk profile.

Find companies with promising cash flow potential yet trading below their fair value.

What Is Strategy's Investment Narrative?

For anyone considering Strategy Inc as an investment, the crux is confidence in both bitcoin's long-term upside and the company's leveraged approach to accumulating digital assets. The recent purchase of over 8,000 bitcoin, largely funded through a €620 million preferred stock issue, reinforces the company's thesis: bitcoin is its core treasury asset, and management is willing to take on more leverage to increase exposure. This move comes as the company faces criticism for its reliance on bitcoin and debt financing, especially with its market value now sitting below the net asset value of its bitcoin holdings. While the headline bitcoin purchase hasn't fundamentally changed the short-term catalysts, bitcoin price movements and leveraged balance sheet risks, the scale and timing signal that volatility could intensify. If bitcoin rebounds, Strategy’s positioning may pay off, but downside risks are magnified if market pressure persists. Shareholder dilution and servicing preferred stock obligations are front of mind now more than ever. If there's an impact from this news, it’s mainly an acceleration of both the potential rewards and the key risks tied to bitcoin’s next moves.

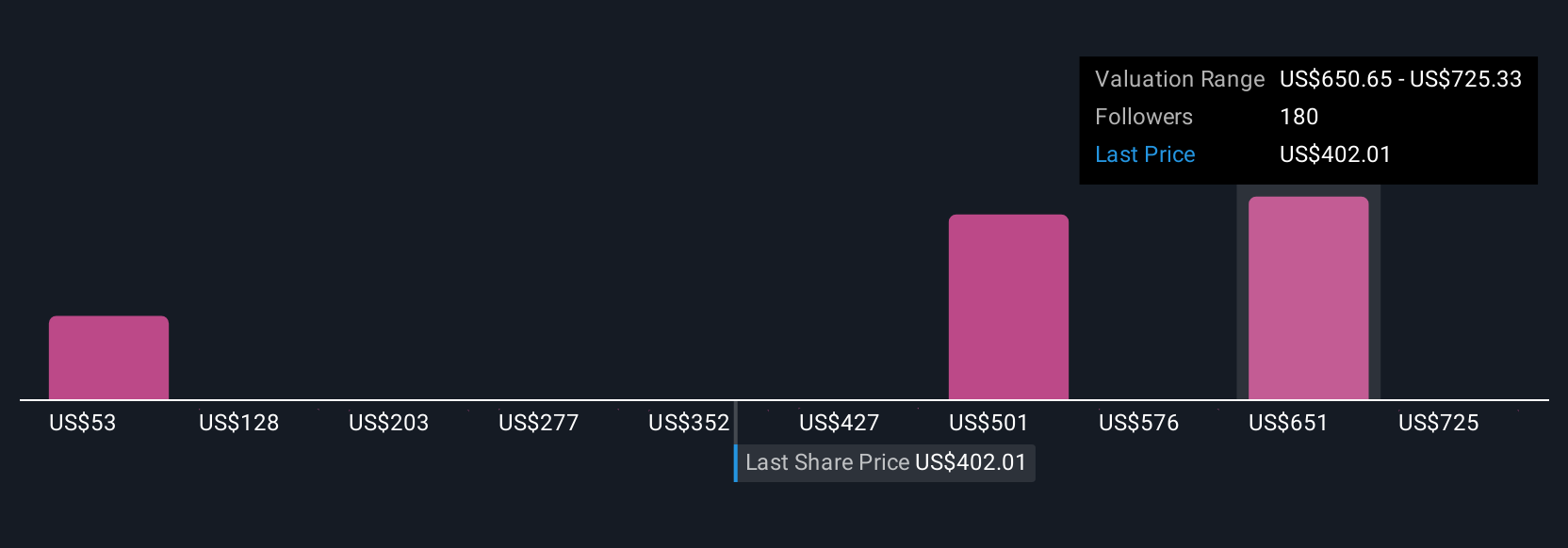

But with market value below bitcoin assets, capital and debt risks are an issue investors need to watch. The valuation report we've compiled suggests that Strategy's current price could be quite moderate.Exploring Other Perspectives

Explore 5 other fair value estimates on Strategy - why the stock might be worth just $505.78!

Build Your Own Strategy Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Strategy research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Strategy research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Strategy's overall financial health at a glance.

No Opportunity In Strategy?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 37 best rare earth metal stocks of the very few that mine this essential strategic resource.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:MSTR

Strategy

Operates as a bitcoin treasury company in the United States, Europe, the Middle East, Africa, and internationally.

Fair value with questionable track record.

Similar Companies

Market Insights

Community Narratives