- United States

- /

- Software

- /

- NasdaqGS:MSFT

Microsoft’s Sovereign Cloud Push And Copilot Expansion Set Against Valuation

- Capgemini and Microsoft announced an expanded partnership to deliver end to end sovereign cloud and AI solutions, targeting clients with strict data residency and compliance needs.

- Microsoft shared new adoption metrics for its Copilot AI platform and highlighted fresh integrations with partners including TeamDynamix, Dragos, and CAEVES.

- The company is also investing in data center innovation, including exploring superconducting power lines to improve energy efficiency for AI workloads.

For investors watching NasdaqGS:MSFT, these updates touch three key areas: regulated cloud, workplace AI, and physical infrastructure for large scale computing. Sovereign cloud and AI offerings with partners like Capgemini speak directly to governments and highly regulated sectors that need tight control over data location and access.

On the AI side, broader Copilot metrics and integrations indicate that Microsoft is trying to make its AI tools more embedded across enterprise workflows rather than a stand alone add on. At the same time, work on superconducting power lines reflects a focus on practical constraints of AI at scale, such as power usage and data center capacity, which remain important for large corporate users and long term investors.

Stay updated on the most important news stories for Microsoft by adding it to your watchlist or portfolio. Alternatively, explore our Community to discover new perspectives on Microsoft.

📰 Beyond the headline: 1 risk and 5 things going right for Microsoft that every investor should see.

Quick Assessment

- ✅ Price vs Analyst Target: At US$413.27, Microsoft trades about 31% below the consensus analyst target of roughly US$596.

- ⚖️ Simply Wall St Valuation: The shares are described as trading close to estimated fair value, so no clear valuation gap either way.

- ❌ Recent Momentum: The 30 day return of about 13.8% decline shows recent weakness despite the positive news flow.

There is only one way to know the right time to buy, sell or hold Microsoft. Head to Simply Wall St's company report for the latest analysis of Microsoft's Fair Value.

Key Considerations

- 📊 The deeper sovereign cloud partnership and wider Copilot ecosystem keep Microsoft closely connected to regulated clients and everyday enterprise workflows.

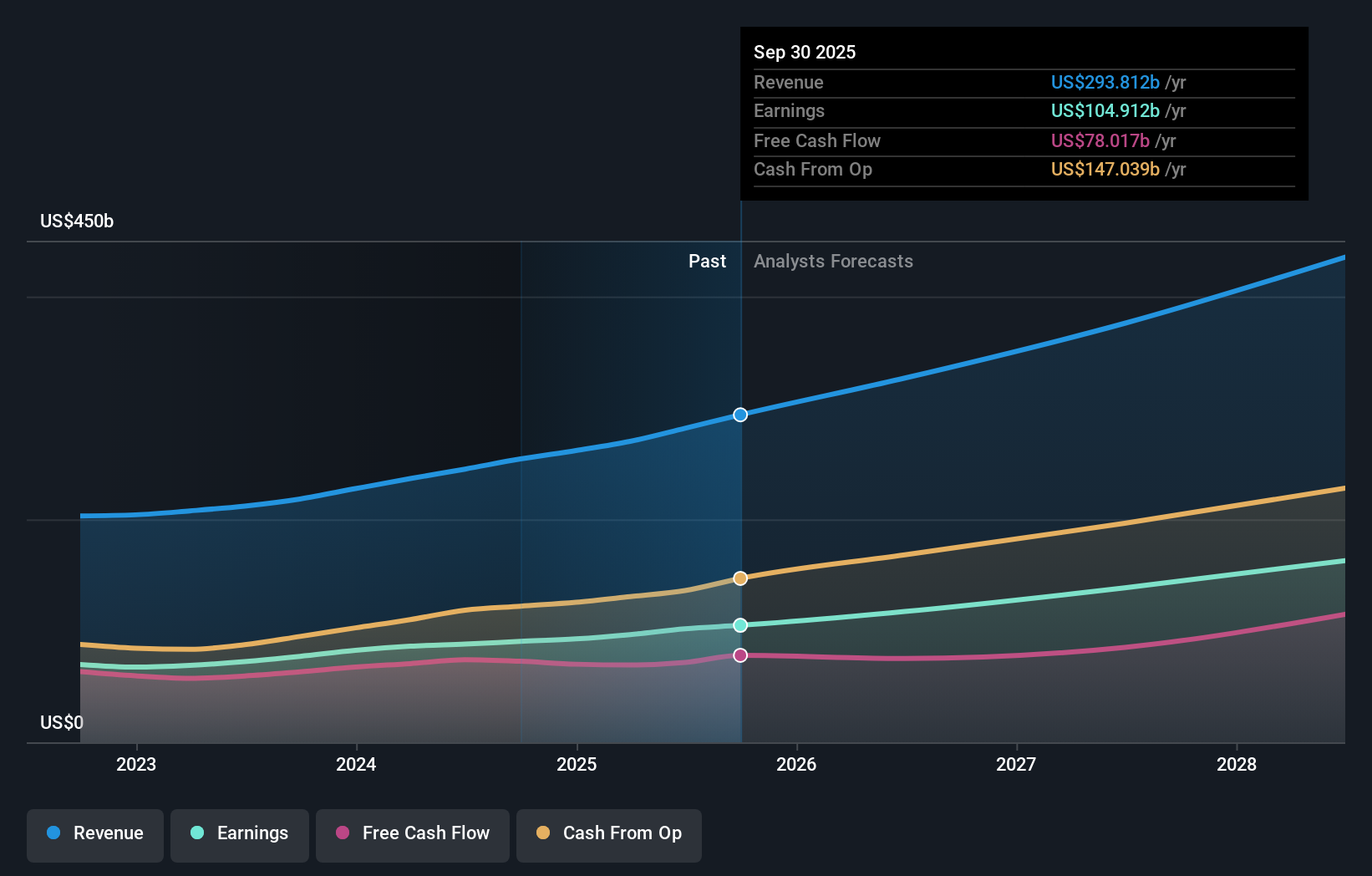

- 📊 It may be useful to watch how Copilot adoption trends, sovereign cloud contract activity, and data center spending develop relative to the current P/E of about 25.7x and the analyst target of US$596.

- ⚠️ The reported insider selling over the past 3 months is worth monitoring alongside further AI and infrastructure announcements.

Dig Deeper

For the full picture including more risks and potential rewards, check out the complete Microsoft analysis. Alternatively, you can visit the community page for Microsoft to see how other investors believe this latest news may affect the company's narrative.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:MSFT

Microsoft

Develops and supports software, services, devices, and solutions worldwide.

Outstanding track record with flawless balance sheet and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

The "Physical AI" Monopoly – A New Industrial Revolution

Czechoslovak Group - is it really so hot?

The Compound Effect: From Acquisition to Integration

Recently Updated Narratives

Inotiv NAMs Test Center

Delta loses shine after warning of falling travel demand, but still industry leader

Project Ixian Accelerated Rollout will Drive Valuation Expansion to £0.0150.

Popular Narratives

Undervalued Key Player in Magnets/Rare Earth

Is Ubisoft the Market’s Biggest Pricing Error? Why Forensic Value Points to €33 Per Share

The Strategic Revaluation of Adobe: A Critical Analysis of Market Sentiment

Trending Discussion

When was the last time that Tesla delivered on its promises? Lets go through the list! The last successful would be the Tesla Model 3 which was 2019 with first deliveries 2017. Roadster not shipped. Tesla Cybertruck global roll out failed. They might have a bunch of prototypes (that are being controlled remotely) And you think they'll be able to ship something as complicated as a robot? It's a pure speculation buy.