- United States

- /

- Software

- /

- NasdaqGS:MSFT

Microsoft’s New Dragon Copilot AI for Nurses Might Change The Case For Investing In MSFT

Reviewed by Sasha Jovanovic

- On October 16, 2025, Microsoft announced a major expansion to its Dragon Copilot AI clinical assistant, introducing the first commercially available ambient AI solution tailored for nursing workflows and new extensibility features enabling partner AI integration.

- This development highlights Microsoft's increasing focus on integrating AI-driven efficiency directly into healthcare operations, while positioning its platform as a foundation for a growing ecosystem of specialized clinical tools.

- We’ll consider how the launch of Dragon Copilot’s ambient AI capabilities for nursing may strengthen Microsoft’s investment case around AI-driven healthcare adoption.

The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

Microsoft Investment Narrative Recap

To be a Microsoft shareholder today, you need to believe that AI-led transformation across cloud, productivity, and industry verticals will drive sustained revenue growth, offsetting rising capital expenditures and risks from concentration among large enterprise customers. The recent expansion of Dragon Copilot in healthcare highlights Microsoft's AI integration, but it does not materially impact the most immediate stock catalyst: broad-based Azure and Copilot adoption. The biggest risk remains execution in scaling AI infrastructure profitably if enterprise demand slows.

Among the recent announcements, Microsoft's partnership with Learning Tree International to boost federal agency AI adoption stands out. This move showcases how Microsoft is building its AI ecosystem not just through product innovation, but also by equipping large organization clients to realize value across workflows, an approach aligned with the core catalysts of intensifying AI deployment and entrenched cloud relationships.

Yet, on the other hand, investors should be alert to the mounting pressure on margins as Microsoft commits substantial capital to...

Read the full narrative on Microsoft (it's free!)

Microsoft's outlook projects $425.0 billion in revenue and $158.4 billion in earnings by 2028. This is based on a 14.7% annual revenue growth rate and a $56.6 billion increase in earnings from the current $101.8 billion.

Uncover how Microsoft's forecasts yield a $621.03 fair value, a 19% upside to its current price.

Exploring Other Perspectives

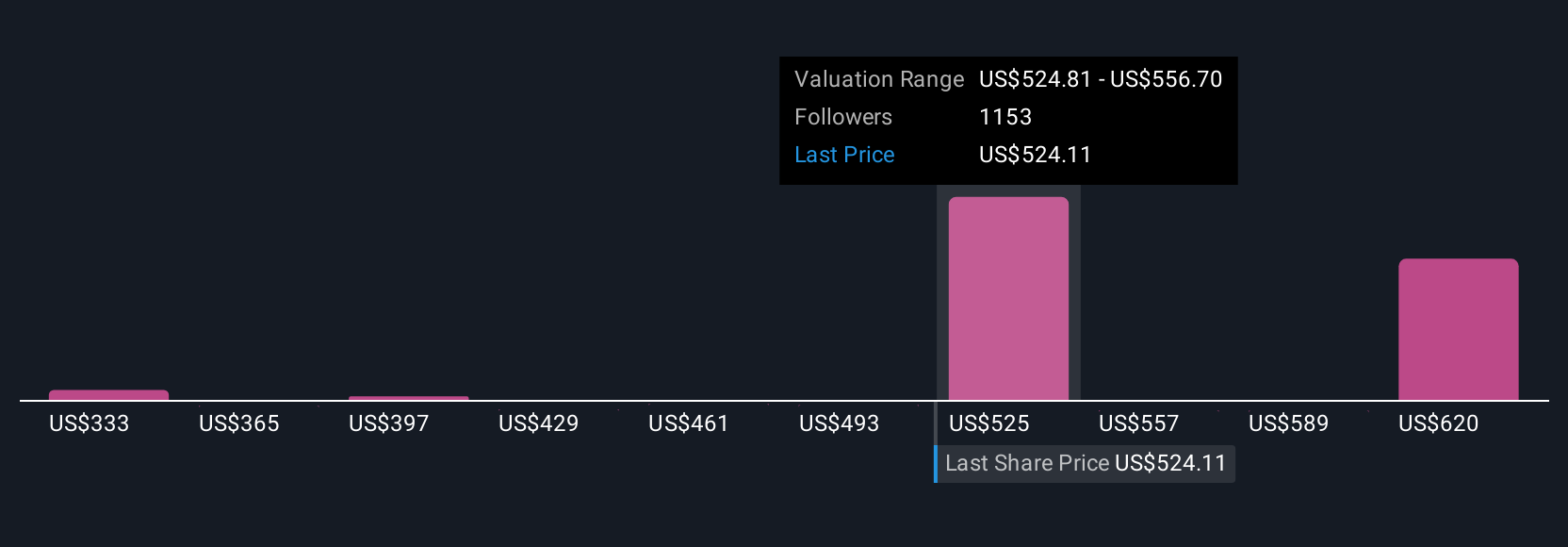

Simply Wall St Community members set Microsoft’s fair value anywhere from US$360 to US$621, based on 127 independent forecasts. With CapEx accelerating around AI and data centers, many see wide-ranging outcomes for profitability and growth ahead, explore how these perspectives might inform your own view.

Explore 127 other fair value estimates on Microsoft - why the stock might be worth 31% less than the current price!

Build Your Own Microsoft Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Microsoft research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Microsoft research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Microsoft's overall financial health at a glance.

Looking For Alternative Opportunities?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- Explore 27 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Outshine the giants: these 26 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:MSFT

Microsoft

Develops and supports software, services, devices, and solutions worldwide.

Flawless balance sheet with solid track record and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion