- United States

- /

- Software

- /

- NasdaqGS:MSFT

Microsoft (NasdaqGS:MSFT) Enhances Data Security with Kyndryl's New Services for AI Readiness

Reviewed by Simply Wall St

Microsoft (NasdaqGS:MSFT) experienced a 1.80% increase in its share price over the past week, which aligns with a broader market upswing where major indices, including the Nasdaq Composite, have seen significant gains. This market surge has been spurred by investor optimism surrounding earnings reports and potential tariff relaxations. Recent announcements, such as Kyndryl's launch of a data security service utilizing Microsoft Purview, may have further supported Microsoft’s market position by enhancing its offerings in the critical area of data security. However, given the overall positive market trend, Microsoft's price movement likely reflects broader market momentum rather than being greatly influenced by specific events.

Buy, Hold or Sell Microsoft? View our complete analysis and fair value estimate and you decide.

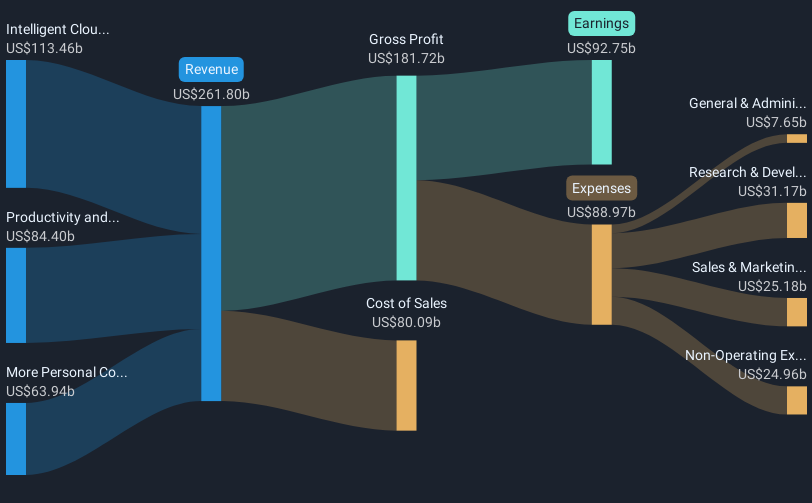

The introduction covers recent developments that may bolster Microsoft's market position, particularly through new data security services. These announcements, along with the overall market upswing, could support revenue and earnings forecasts by generating renewed enterprise interest and potentially expanding Microsoft's customer base. The integration of Copilot in Microsoft 365 and notable advancements in AI are expected to drive revenue growth and efficiency. However, the actual impact of these factors on earnings and revenues will depend on successful execution and overcoming capacity constraints.

Over a five-year period, Microsoft's shares have generated a total return of 118.26%, reflecting a robust upward trajectory. This contrasts with its one-year performance, where it underperformed compared to the broader US market and the Software industry. The shares' current market price of US$366.82 reflects a discount relative to the consensus analyst price target of US$493.34, indicating potential room for appreciation. If Microsoft's strategic initiatives translate into sustained revenue and earnings growth, the distance to the price target might narrow, aligning the market valuation more closely with future projections.

Assess Microsoft's future earnings estimates with our detailed growth reports.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:MSFT

Microsoft

Develops and supports software, services, devices, and solutions worldwide.

Flawless balance sheet with solid track record and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion