- United States

- /

- Software

- /

- NasdaqGS:MSFT

Microsoft (MSFT): Evaluating Valuation as Investor Focus Intensifies Ahead of Earnings and AI Growth Prospects

Reviewed by Simply Wall St

Microsoft (MSFT) is catching Wall Street’s attention ahead of its earnings, with the spotlight on AI and cloud infrastructure growth, particularly in Azure. The market is watching to see how recent investments and product rollouts will appear in these results.

See our latest analysis for Microsoft.

Microsoft’s share price return of 25% year-to-date has outpaced most of the S&P 500, powered by steady enthusiasm for its leadership in AI and cloud computing. With a fresh string of strategic collaborations and robust product rollouts, positive momentum is building. This narrative is further reflected in the company’s impressive 23% total return over the past year and 170% over five years.

If Microsoft’s run in tech innovation has your attention, this could be an ideal time to explore the fast-moving world of See the full list for free..

The anticipation now centers on whether Microsoft's current valuation truly reflects its accelerating AI and cloud momentum, or if investors are overlooking further growth potential. Investors are asking if there is real upside left for buyers, or if the market has already priced in the company’s next phase.

Most Popular Narrative: 45% Overvalued

According to Broke_Joe, the most popular narrative pegs Microsoft’s fair value well below its latest closing price, challenging the market’s optimism. The stage is set to explore the bullish expectations fueling ambitious projections behind this valuation call.

Overall, Microsoft remains one of the most compelling large-cap investments, offering a rare blend of profitability, structural growth drivers (AI, cloud, SaaS), pricing power, and resilience. The company is on track to surpass a $5 trillion market cap within five years, assuming continued execution and supportive market conditions.

What if rapid revenue acceleration and expanding profit margins are the secret weapons powering this sky-high valuation? There is a bold earnings outlook here and aggressive margin assumptions. Ready to see which growth levers the narrative says will take Microsoft to the next level? The answer is just a click away.

Result: Fair Value of $360 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, delayed AI monetization or new regulatory hurdles could quickly disrupt the optimistic path forecast for Microsoft's continued growth and profitability.

Find out about the key risks to this Microsoft narrative.

Another View: Looking Beyond the Fair Value Debate

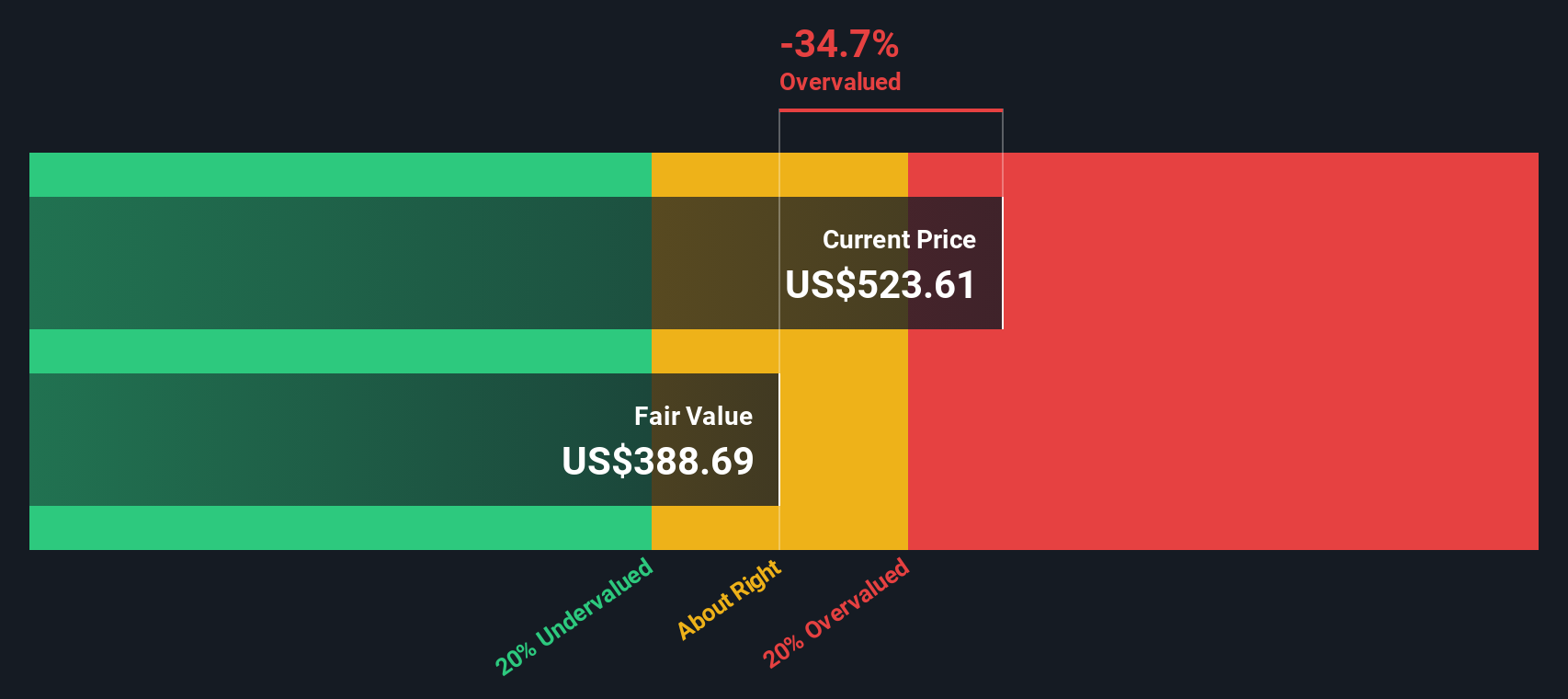

Taking a closer look at Microsoft’s valuation through the lens of a different method, our DCF model produces a fair value estimate of $388.70, which is noticeably below the current share price. While this view calls the stock overvalued, does it fully capture Microsoft’s AI-driven prospects or is it overemphasizing risk?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Microsoft Narrative

If you see things differently or want a hands-on approach to uncovering Microsoft’s true potential, crafting your own analysis takes just a few minutes. Why not Do it your way.

A great starting point for your Microsoft research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Smart investors never stop at just one opportunity. Broaden your horizons and seize your edge by pursuing dynamic companies and themes that promise exciting potential beyond Microsoft.

- Capitalize on income potential by tapping into these 17 dividend stocks with yields > 3%, offering reliable yields above 3% for those who value steady returns.

- Spot future tech leaders and outpace the market trend with these 27 AI penny stocks, where artificial intelligence continues to shape tomorrow’s winning portfolios.

- Outsmart the crowd by digging into these 881 undervalued stocks based on cash flows that trade below their true worth. This can unlock compelling value opportunities other investors may be missing.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:MSFT

Microsoft

Develops and supports software, services, devices, and solutions worldwide.

Flawless balance sheet with solid track record and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion