- United States

- /

- Software

- /

- NasdaqGS:MSFT

Is Microsoft’s Recent AI Push Justifying the Stock’s 27% Surge in 2025?

Reviewed by Bailey Pemberton

If you are wondering what to do with Microsoft stock right now, you are not alone. With its share price recently closing at $531.52 and boasting stellar returns over every major timeframe from the past week to the last five years, Microsoft's ride has been remarkable. In just the past week, the stock climbed 2.9%, adding to a 3.9% gain over the last month. Looking longer term, Microsoft is up 27.0% year-to-date, and an astonishing 174.0% over the past five years. These numbers are enough to make even seasoned investors pause and reconsider whether there is still value left in this tech titan or if the best days are already priced in.

Throughout this period of strong performance, Microsoft has continued to make headlines with key strategic moves, such as advancing its artificial intelligence partnerships and expanding its cloud offerings. These initiatives not only support the company’s image as a leader in innovation, but they also influence how investors view Microsoft’s future growth potential and overall risk profile. While such news has not always driven daily price swings, it has helped reinforce market optimism and contributed to shifting perceptions about the company’s valuation.

Speaking of valuation, based on a composite score from six major checks, Microsoft currently earns a value score of 2. This means it ranks as undervalued on two out of six key measures. But how should we interpret that score, and what does it really mean for your investment decision? Let’s break down the main valuation approaches typically used to evaluate Microsoft’s shares and see how they stack up before we dig into an even deeper way of understanding what makes a stock truly worth its price.

Microsoft scores just 2/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Microsoft Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model is a valuation approach that estimates what a company is worth today by projecting its future cash flows and discounting them back to their present value. This gives investors an idea of a business’s intrinsic value based on its expected ability to generate free cash over time.

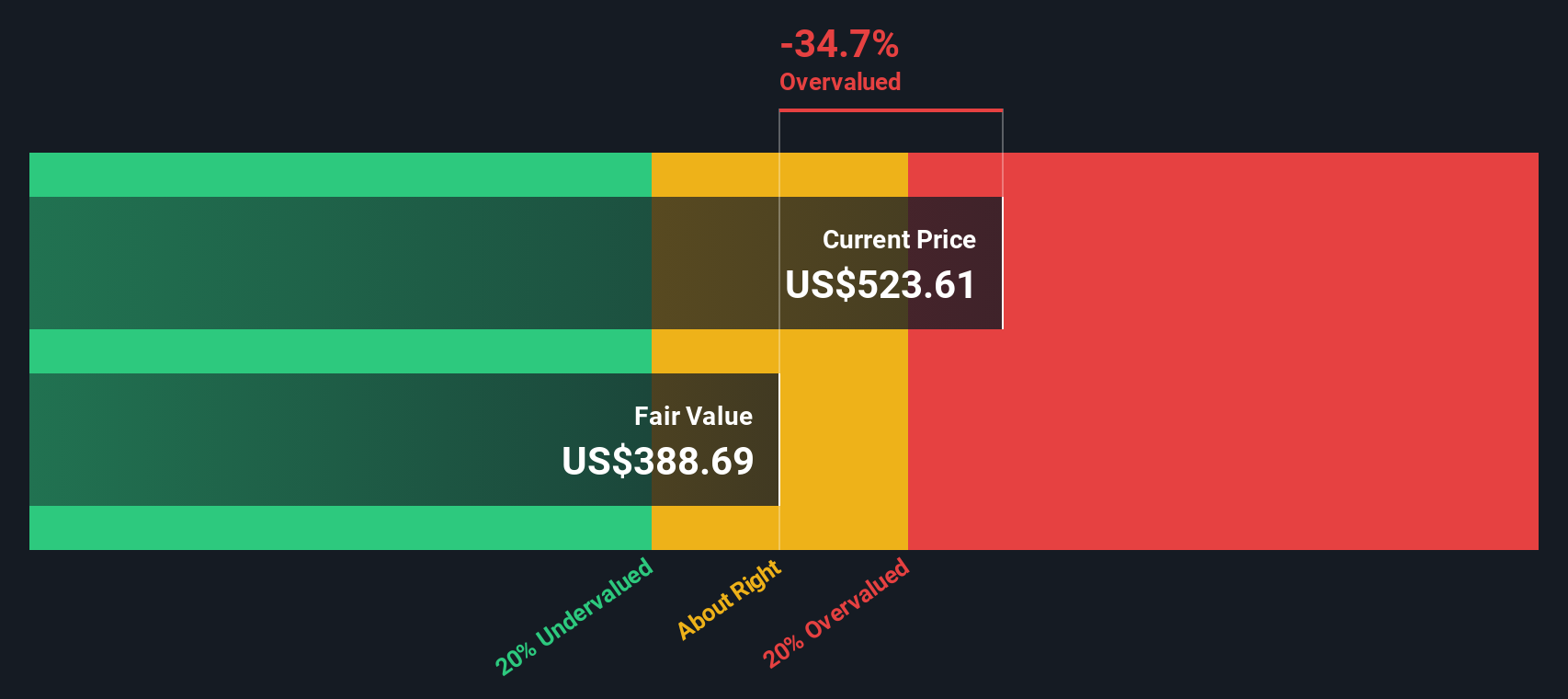

For Microsoft, the DCF model uses a 2 Stage Free Cash Flow to Equity method. Currently, Microsoft’s Free Cash Flow stands at $83.87 Billion. Analysts provide detailed Free Cash Flow estimates up to five years out, with values reaching $176.04 Billion by 2030. Forecasts beyond five years are extrapolated to provide a longer-term outlook, but it is important to keep in mind that certainty drops further out.

Based on these projections, the DCF model calculates an intrinsic fair value of $388.81 per share. With Microsoft’s recent closing share price at $531.52, this suggests the stock is trading at a premium, specifically about 36.7 percent higher than the DCF model’s estimated fair value. This indicates that Microsoft, despite its strong cash flow growth, appears overvalued based on today’s cash flow expectations.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Microsoft may be overvalued by 36.7%. Find undervalued stocks or create your own screener to find better value opportunities.

Approach 2: Microsoft Price vs Earnings (PE)

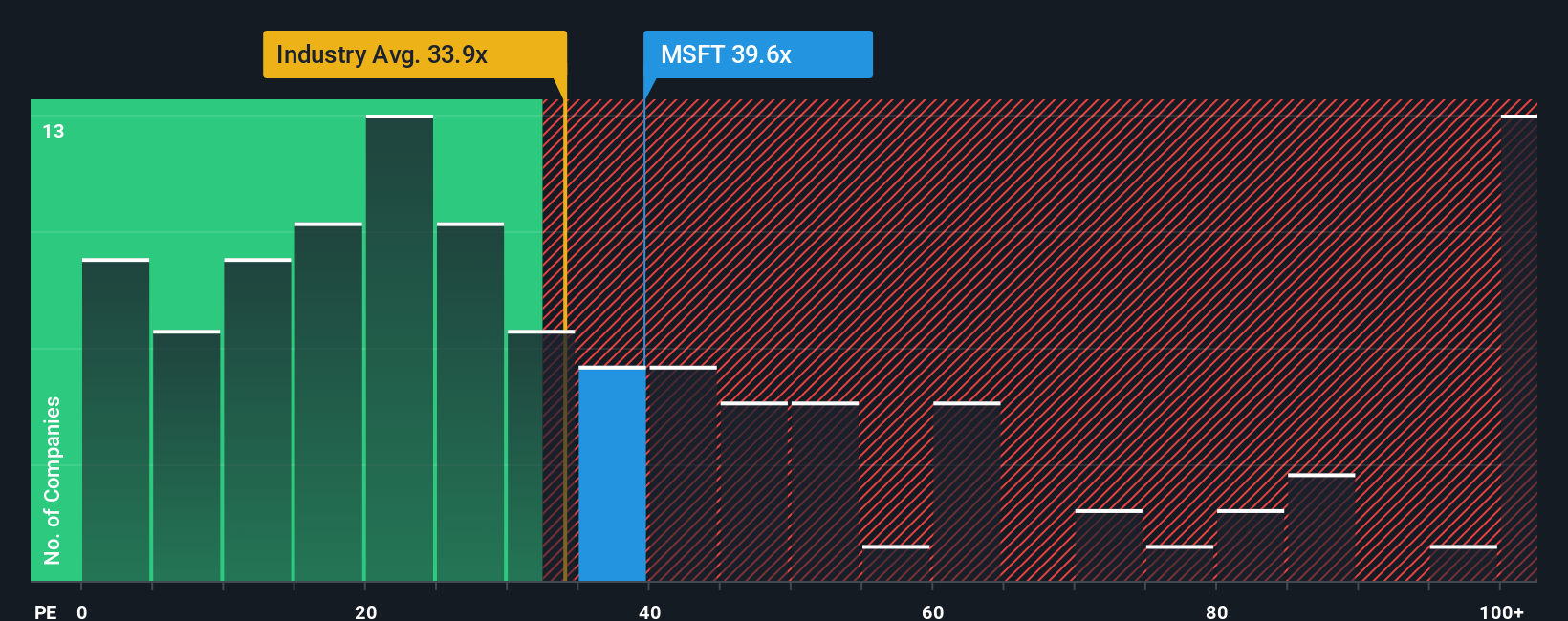

The Price-to-Earnings (PE) ratio is often the go-to valuation metric for profitable companies like Microsoft because it gives a straightforward look at how much investors are willing to pay for each dollar of earnings. This makes it a quick and useful tool for comparing established businesses across similar sectors.

Growth expectations and risk play a big role in what makes for a “fair” PE ratio. Companies expected to grow faster or with more stable earnings generally deserve higher PE multiples, while riskier or slower-growing companies command lower ratios. For Microsoft, the current PE ratio stands at 38.8x. This is in line with the peer average of 39.8x and sits well above the broader software industry average of 33.9x.

While peer and industry multiples are helpful, the “Fair Ratio” created by Simply Wall St goes further by factoring in not just growth and risk, but also Microsoft’s profit margins, market cap, and its industry context. This helps paint a much more tailored picture of what multiple Microsoft actually deserves. According to this measure, Microsoft’s Fair PE Ratio is 56.2x. Since the actual PE is meaningfully lower than the Fair Ratio, it suggests that Microsoft’s current price is not aggressive given its strengths.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Microsoft Narrative

Earlier we mentioned that there's an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is your unique perspective or story about where Microsoft is headed, combined with your own numbers for its future revenue, earnings, and profit margins. Narratives link the company's story, such as its AI strategy, cloud growth, or market risks, to a realistic financial forecast, so you can decide what the stock should actually be worth based on your own assumptions.

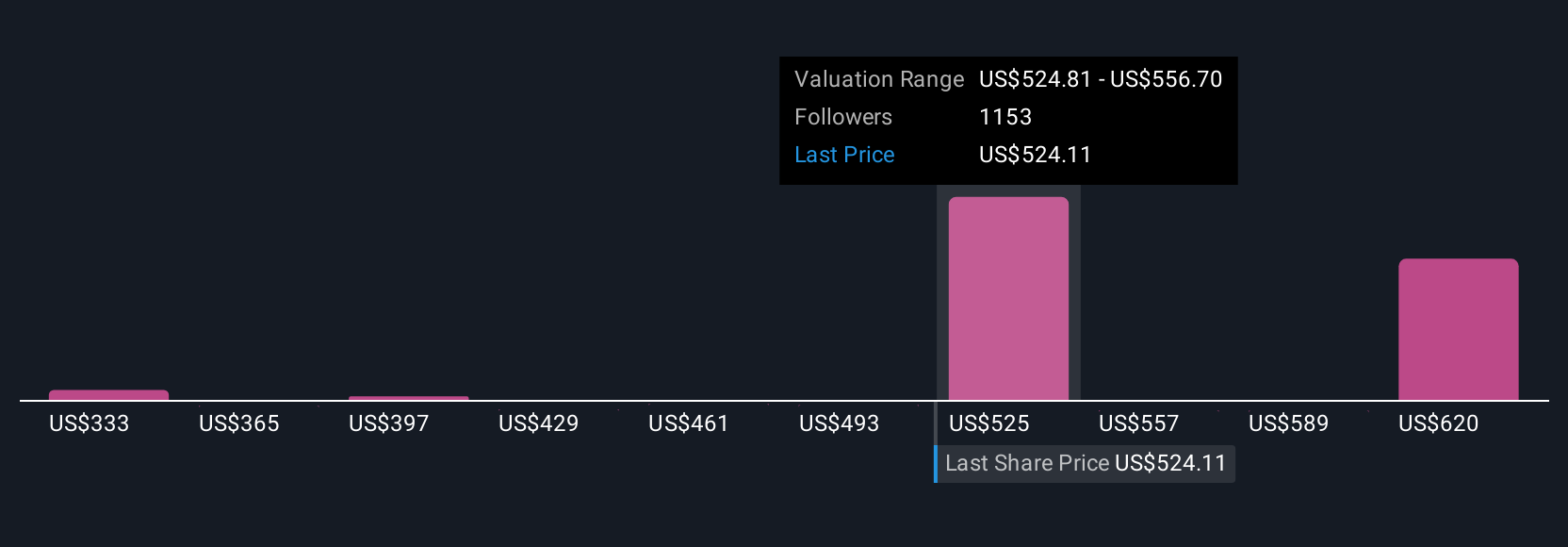

On Simply Wall St's Community page, millions of investors use Narratives as an easy, accessible tool to make sense of all the data and decide whether to buy or sell. Rather than relying just on analyst targets or traditional ratios, you compare your Fair Value (based on your Narrative) to the current share price, giving you a direct and personal view of Microsoft's opportunity or risk. Narratives are dynamic and update instantly as new earnings or news emerges, helping you stay ahead of the curve.

For example, one Narrative for Microsoft might see the company as a dominant AI leader justified in trading at a Fair Value of $700 per share. Another Narrative could view it as overextended, assigning just $333 as Fair Value. Your Narrative can reflect whichever story and numbers you believe in.

For Microsoft, however, we'll make it really easy for you with previews of two leading Microsoft Narratives:

Fair Value: $621.03

Current price is 14.4% above this fair value

Projected Revenue Growth Rate: 14.8%

- Rapid integration of AI and cloud solutions, alongside a robust subscription model, is propelling Microsoft toward sustainable high-margin growth and greater earnings predictability.

- Solid momentum across Azure, cybersecurity, and enterprise software points to recurring, high-quality revenues and margins, supported by a large contracted backlog.

- Risks include potential margin pressures from large AI investments, customer concentration in cloud, and the need to deliver on ambitious future earnings targets.

Fair Value: $333.48

Current price is 59.4% above this fair value

Projected Revenue Growth Rate: 9.5%

- Microsoft is well positioned in AI and cloud but faces a prolonged runway to realizing cash flow benefits from its recent investments, with the market currently ahead of fundamentals.

- Growth in core segments like cloud and productivity remains strong but may begin to mature, while rivals and regulatory threats could challenge future margin expansion.

- Even with robust prospects, the stock is priced at a significant premium to intrinsic value, suggesting it will need to “grow into” its valuation over several years.

Do you think there's more to the story for Microsoft? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:MSFT

Microsoft

Develops and supports software, services, devices, and solutions worldwide.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives