- United States

- /

- Software

- /

- NasdaqGS:MSFT

Is Microsoft Still a Bargain After Latest AI Partnerships and 22% Rally in 2025?

Reviewed by Bailey Pemberton

- Wondering if Microsoft’s stock is overpriced, a bargain, or somewhere in between? You’re not alone, and today we’ll break down what the numbers actually say about its value.

- After a strong stretch, Microsoft is up 2.7% in just the past week and 21.9% year-to-date, adding fuel to both optimism and curiosity around the stock’s growth prospects.

- Recent headlines have focused on Microsoft’s expanding AI ventures and ongoing cloud partnerships. Both have captured investor attention and contributed to share price volatility. News of new product launches and high-profile collaborations have also helped sustain bullish momentum, even as markets digest shifting tech sector risks.

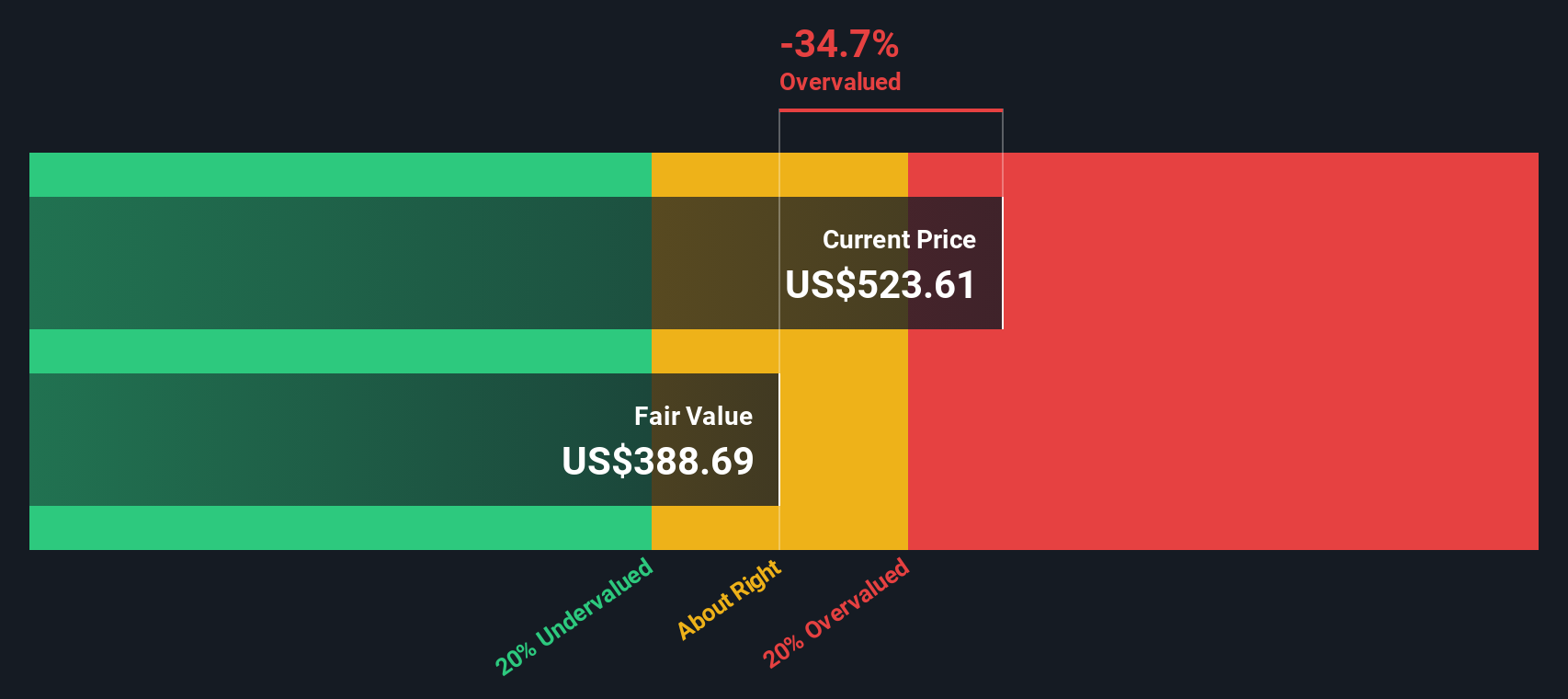

- When we apply our value checks, Microsoft scores 3 out of 6 for undervaluation. We will dive into what this means by looking at several valuation methods. Stick around for a smarter, more complete way to judge value at the end of the article.

Approach 1: Microsoft Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow (DCF) model estimates a company's true value by projecting its future cash flows and discounting them back to today. This gives investors a sense of what the company is really worth based on its ability to generate cash over time.

For Microsoft, the current Free Cash Flow stands at $89.43 Billion, with analysts forecasting continued robust growth. Analysts provide projections for the next five years, and longer-term numbers are extrapolated to paint a more complete picture. By 2030, Microsoft's annual Free Cash Flow is estimated to reach $206.23 Billion, reflecting strong confidence in its business fundamentals and growth trends in cloud and AI.

Using a two-stage Free Cash Flow to Equity model, Microsoft's estimated intrinsic value per share is $608.45. This implies a 16.2% discount compared to where the market currently prices the stock, suggesting there is still value on the table for investors who buy at today's levels.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Microsoft is undervalued by 16.2%. Track this in your watchlist or portfolio, or discover 886 more undervalued stocks based on cash flows.

Approach 2: Microsoft Price vs Earnings

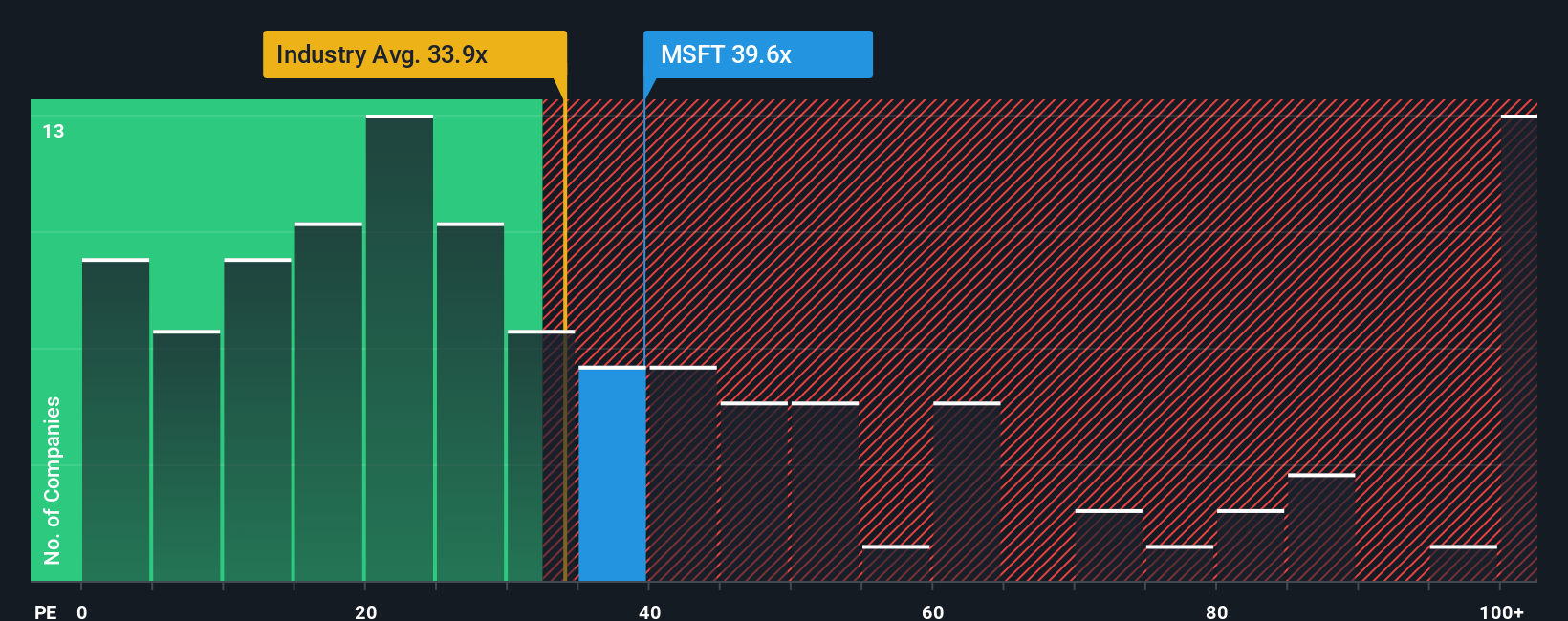

The Price-to-Earnings (PE) ratio is a widely used and reliable valuation metric for profitable companies like Microsoft. It allows investors to gauge how much they are paying for each dollar of the company's earnings, which is particularly helpful when a company generates consistent profits.

Growth expectations and perceived risks both play roles in determining what a "normal" or "fair" PE ratio should be. Companies with higher expected growth, lower risk, or dominant profit margins typically command higher PE multiples because investors are willing to pay a premium for their future prospects and stability.

Currently, Microsoft's PE ratio is 36.1x. This sits above the software industry average of 31.2x and its peer group's average of 35.0x, signaling some premium but not an extreme outlier for a market leader. However, the proprietary "Fair Ratio" calculated by Simply Wall St is 57.5x. This measure goes beyond basic averages by blending Microsoft's robust earnings growth, large market cap, strong profit margins, and sector dynamics into a forecast of what PE ratio is truly justified for the company.

Since the Fair Ratio (57.5x) is substantially higher than Microsoft's current PE (36.1x), the data suggests that the stock trades at a discount relative to its fundamental prospects, rather than being expensive just because it is above the industry average. Comparing to the Fair Ratio provides a more comprehensive signal than peer multiples alone.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1410 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Microsoft Narrative

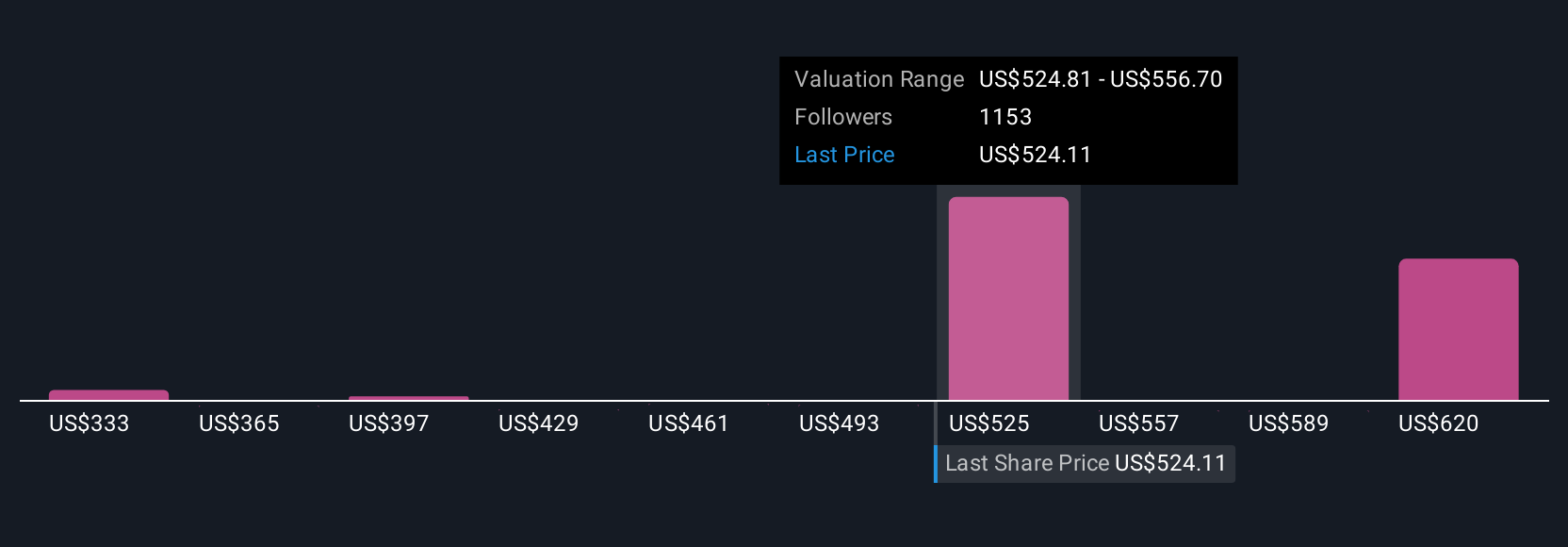

Earlier we mentioned that there is an even better way to understand valuation, so let’s introduce you to Narratives. A Narrative is the story you believe about a company, combining your perspective on its future with numbers like fair value, expected revenue growth, and profit margins, all tied together in a transparent forecast. Rather than being just another “guess,” a Narrative provides a clear link between Microsoft’s business story, your own assumptions, and what you consider to be a fair valuation for the stock.

Narratives are easy to create and follow right in the Simply Wall St Community, making advanced investing insights accessible to millions of users regardless of experience. By comparing the Fair Value from your Narrative to the current share price, you gain a powerful tool to decide when it is time to buy, sell, or just hold. Narratives update dynamically as real-world news, earnings, or company events unfold, so your analysis is always timely and relevant.

For example, investors looking at Microsoft today have created Narratives with Fair Value estimates ranging from $360 to $700, depending on whether they believe Microsoft’s AI investments will accelerate growth or face headwinds from competition and regulation. This means every investor can anchor their decisions to a personalized, data-backed story, not just the headlines or a single valuation metric.

For Microsoft, here are previews of two leading Microsoft Narratives:

Fair Value: $626.65

Undervalued by 18.6%

Forecast Revenue Growth: 15.2%

- Rapid AI and cloud integration, combined with a robust subscription model, are expected to sustain high-margin growth and predictable future earnings.

- Strong demand for cloud, security, and enterprise solutions along with operational efficiency is set to support profit margins, even amid major investments in AI infrastructure.

- Analysts believe new AI and cloud catalysts justify a higher price target, assuming Microsoft maintains double-digit revenue growth and rising earnings through its diverse, recurring business model.

Fair Value: $500.00

Overvalued by 2.0%

Forecast Revenue Growth: 6.8%

- Microsoft faces headwinds from a shrinking PC market, intensifying Mac adoption in the workplace, and a weak competitive position in its gaming division.

- Heavy dependence on its OpenAI partnership poses regulatory and strategic risks, while massive datacenter investment brings significant financial pressure and uncertain returns.

- Recent layoffs and internal challenges threaten morale and innovation, raising questions about Microsoft’s long-term ability to sustain its rapid pace of growth.

Do you think there's more to the story for Microsoft? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:MSFT

Microsoft

Develops and supports software, services, devices, and solutions worldwide.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives