- United States

- /

- Software

- /

- NasdaqGS:MSFT

Is Microsoft (MSFT) Still Attractive After Recent Share Price Pullback And AI Cloud Focus?

Reviewed by Bailey Pemberton

- If you are wondering whether Microsoft is still worth its current share price, you are not alone, especially with so much attention on big tech valuations right now.

- The stock closed at US$456.66, with returns of 8.3% over 1 year, 101.6% over 3 years and 111.5% over 5 years, even though it has seen a 4.5% decline over 7 days, a 4.1% decline over 30 days and a 3.4% decline year to date.

- Recent headlines have continued to focus on Microsoft as a key player in large cap software and cloud computing. This reinforces its role as a core holding in many technology focused portfolios. Broader sector news around regulation, artificial intelligence partnerships and cloud spending trends has also been closely watched by investors as they interpret the latest price moves.

- Microsoft currently has a valuation score of 4/6, which means it screens as undervalued on four of six checks. Next, we will look at what different valuation approaches say about that score and why many investors find an even richer view of value by going one step further at the end of this article.

Approach 1: Microsoft Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow, or DCF, model estimates what a company could be worth by projecting its future cash flows and then discounting them back to today using a required return. It is essentially asking what those future dollars are worth in present terms.

For Microsoft, the model used is a 2 Stage Free Cash Flow to Equity approach based on cash flow projections. The latest twelve month free cash flow is about US$89.4b. Analyst and extrapolated estimates then project free cash flow reaching about US$369.8b in 2035, with interim years such as 2026 at US$75.1b and 2030 at US$206.2b. These later year figures are extrapolated beyond the initial analyst horizon.

Aggregating and discounting those projected cash flows results in an estimated intrinsic value of US$600.16 per share, compared with the current share price of US$456.66. That gap equates to an implied 23.9% discount, which suggests the shares screen as undervalued on this DCF view.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Microsoft is undervalued by 23.9%. Track this in your watchlist or portfolio, or discover 868 more undervalued stocks based on cash flows.

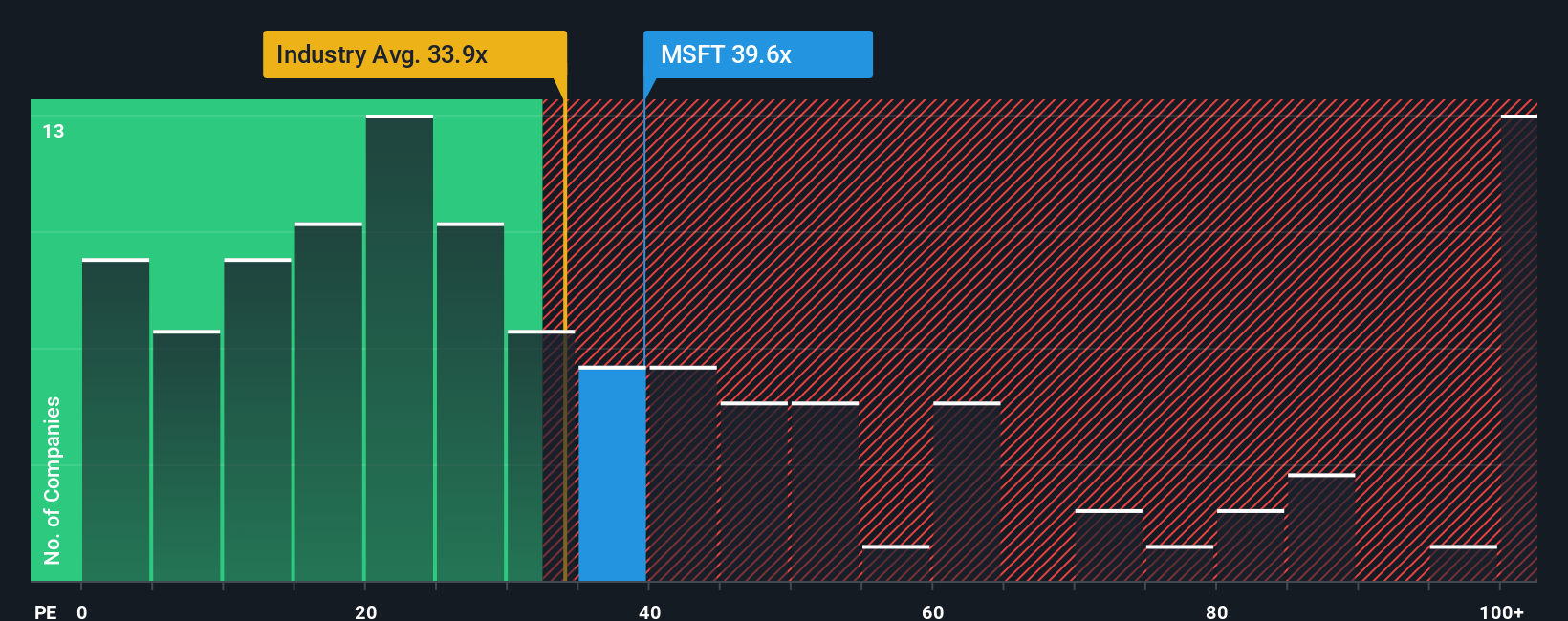

Approach 2: Microsoft Price vs Earnings

For a profitable business like Microsoft, the P/E ratio is a useful shorthand for how much investors are currently paying for each dollar of earnings. It ties the share price directly to the bottom line, which is often what drives long term returns.

What counts as a “normal” P/E depends on how the market views a company’s growth prospects and risk. Higher expected growth or lower perceived risk can support a higher P/E, while slower growth or higher risk tends to justify a lower one.

Microsoft currently trades on a P/E of 32.35x. That is very close to the peer average of 32.07x and modestly above the broader Software industry average of 31.77x. Simply Wall St’s proprietary “Fair Ratio” for Microsoft is 51.15x. This Fair Ratio is an internally derived P/E that reflects factors such as earnings growth, profit margins, industry, market cap and company specific risks.

Because the Fair Ratio blends these fundamentals, it can be more tailored than a simple comparison with peers or the sector, which may have very different growth profiles or risk levels. Comparing Microsoft’s current 32.35x P/E to the Fair Ratio of 51.15x indicates that the shares appear undervalued on this metric.

Result: UNDERVALUED

P/E ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1440 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Microsoft Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives, which let you attach a clear story about Microsoft to your own numbers for fair value, future revenue, earnings and margins. You can then link that story to a forecast and finally to a fair value that you can compare to today’s price.

On Simply Wall St’s Community page, Narratives are an easy tool used by millions of investors. You set your assumptions, see a fair value, and then quickly check whether your view suggests Microsoft is cheap or expensive compared to the current market price, with those Narratives updating automatically as new earnings, news or other data come in.

For example, one Microsoft Narrative on the platform currently sets fair value around US$360.00, reflecting a cautious view on factors like AI spending and margins. Another puts fair value closer to US$622.51, based on expectations of stronger AI and cloud driven earnings. This shows how two investors can look at the same company, apply different stories and assumptions, and end up with very different but clearly explained conclusions about what the stock is worth.

For Microsoft however we will make it really easy for you with previews of two leading Microsoft Narratives:

These give you a quick sense of how different investors are currently framing the same stock using the same underlying data, but with very different conclusions about what feels reasonable on price.

Fair value: US$622.51

Implied discount vs last close: about 26.6% below this fair value

Revenue growth assumption: 15.28% a year

- Focuses on AI and cloud as long run growth engines, with Azure, Copilot and security subscriptions tied to a large contracted backlog and recurring revenue.

- Assumes margins can stay healthy as software efficiencies and scale help offset heavy AI and data center spending.

- Leans on analyst consensus that earnings and free cash flow can continue to build, which in this view supports a higher fair value than today’s share price.

Fair value: US$420.00

Implied premium vs last close: about 8.7% above this fair value

Revenue trend assumption: revenue growth rate slightly below zero

- Argues that AI enthusiasm has pushed the share price ahead of business fundamentals, with concerns about shrinking PC volumes, Xbox’s position and weakening Windows and consumer sentiment.

- Highlights heavy AI and data center spending as a risk to returns, with questions about whether commoditised models and pricing pressure can justify the capital outlay.

- Flags internal and customer related pressures, from layoffs and morale to the risk that AI tools could reduce paid seats over time and chip away at the core subscription base.

Taken together, these Narratives show how the same facts can support either a more optimistic or more cautious view on Microsoft, depending on what you believe about AI demand, capital spending and the resilience of the core franchises. That is why many investors find it useful to read both sides, then build their own version using assumptions they are comfortable with.

Curious how numbers become stories that shape markets? Explore Community Narratives

Do you think there's more to the story for Microsoft? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:MSFT

Microsoft

Develops and supports software, services, devices, and solutions worldwide.

Flawless balance sheet with solid track record and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

Ferrari's Intrinsic and Historical Valuation

Investment Thesis: Costco Wholesale (COST)

Undervalued Key Player in Magnets/Rare Earth

Recently Updated Narratives

The silent giant behind virtually every advanced chip powering AI, smartphones, and modern infrastructure.

Booking Holdings: Why Ground-Level Travel Trends Still Favor the Platform Giants

Looking to be second time lucky with a game-changing new product

Popular Narratives

The "Sleeping Giant" Stumbles, Then Wakes Up

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026