- United States

- /

- Software

- /

- NasdaqGS:MSFT

Is Microsoft Fairly Priced After Its Latest AI and Cloud Announcements?

Reviewed by Bailey Pemberton

Thinking about what to do with your Microsoft shares, or just trying to figure out whether now is the moment to get involved? You’re in good company. Over the past year, Microsoft’s stock has navigated a fascinating path and recently finished at $516.79. With a 23.5% return so far this year and a remarkable 152.7% gain over five years, investors who stuck with the company have been well rewarded. Even in the last seven days, the stock saw a modest 0.6% uptick, while the past month has been more or less flat.

A lot of this momentum is fueled by Microsoft’s strategic moves into artificial intelligence and cloud computing. Big announcements from the company regularly turn heads on Wall Street. For example, the company's recent partnerships and high-profile tech investments are shaping how investors view its future potential, pushing risk perceptions lower and growth expectations even higher. At the same time, the tech giant’s stability and cash flow are helping to anchor its valuation, even as many other big names see their multiples come down during periods of broader market uncertainty.

So, what does all this mean for Microsoft's valuation right now? Based on six key valuation checks, Microsoft currently earns a value score of 3, signaling that it appears undervalued in three separate ways. But that is just a starting point. In the next section, we’ll unpack what’s behind that score by breaking down the main valuation approaches, then explore an angle on valuation that even experienced investors sometimes overlook.

Why Microsoft is lagging behind its peers

Approach 1: Microsoft Discounted Cash Flow (DCF) Analysis

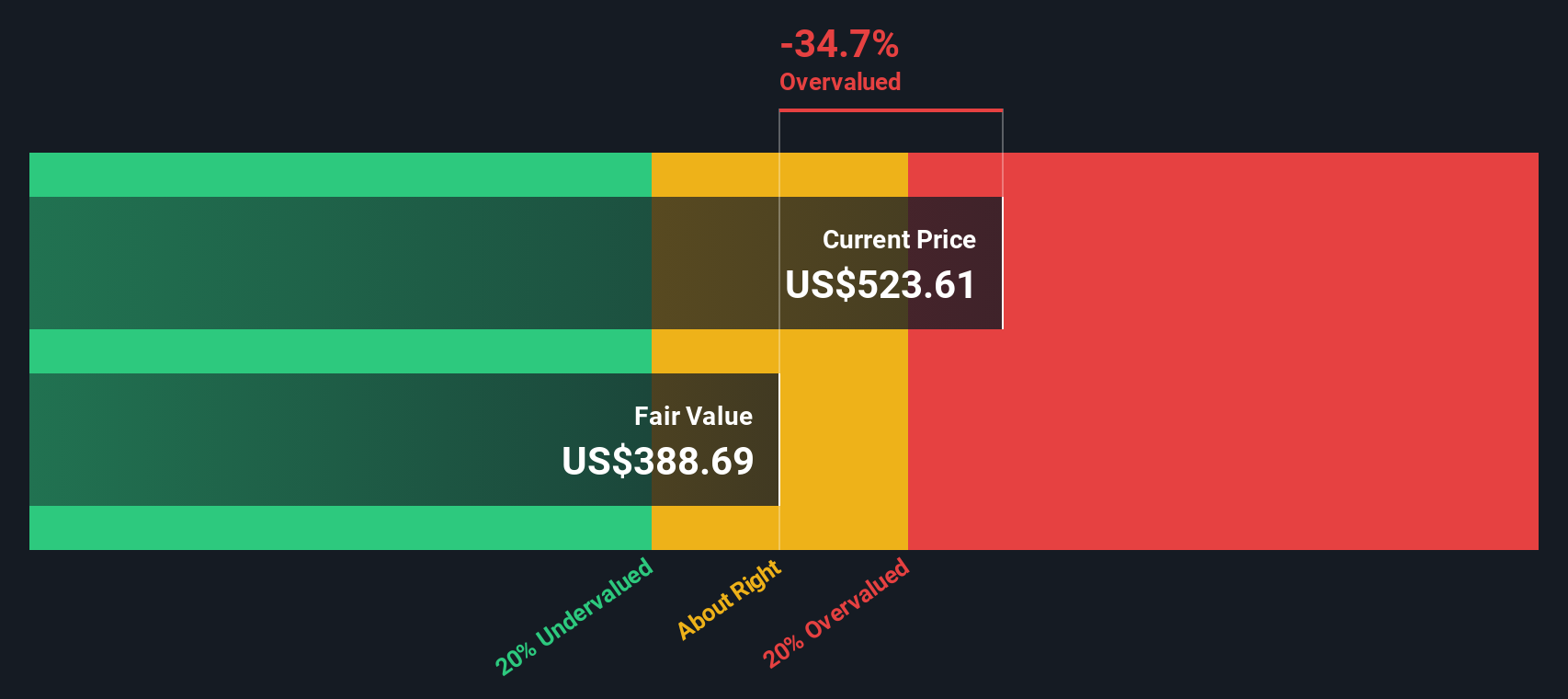

The Discounted Cash Flow (DCF) model projects Microsoft's expected free cash flows into the future and then discounts those amounts back to today's value. This approach provides an estimate of what the company is intrinsically worth based on its potential to generate future cash.

Currently, Microsoft's Free Cash Flow (FCF) over the past year is $83.87 billion. Analyst estimates indicate steady growth over the next five years, with FCF projected to reach $199.48 billion by 2030. Projections beyond 2028 are based on Simply Wall St's extrapolation, as analyst coverage decreases. Yearly FCF figures show a steady increase, supported by strong analyst consensus in the near term and robust long-term growth forecasts.

Based on these projections, the DCF analysis estimates Microsoft's intrinsic value at $502.47 per share. With the recent share price at $516.79, the DCF model suggests the stock is about 2.8% overvalued compared to its estimated fair value.

Given the small difference, this model indicates the current price is very close to intrinsic value.

Result: ABOUT RIGHT

Simply Wall St performs a valuation analysis on every stock in the world every day (check out Microsoft's valuation analysis). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes.

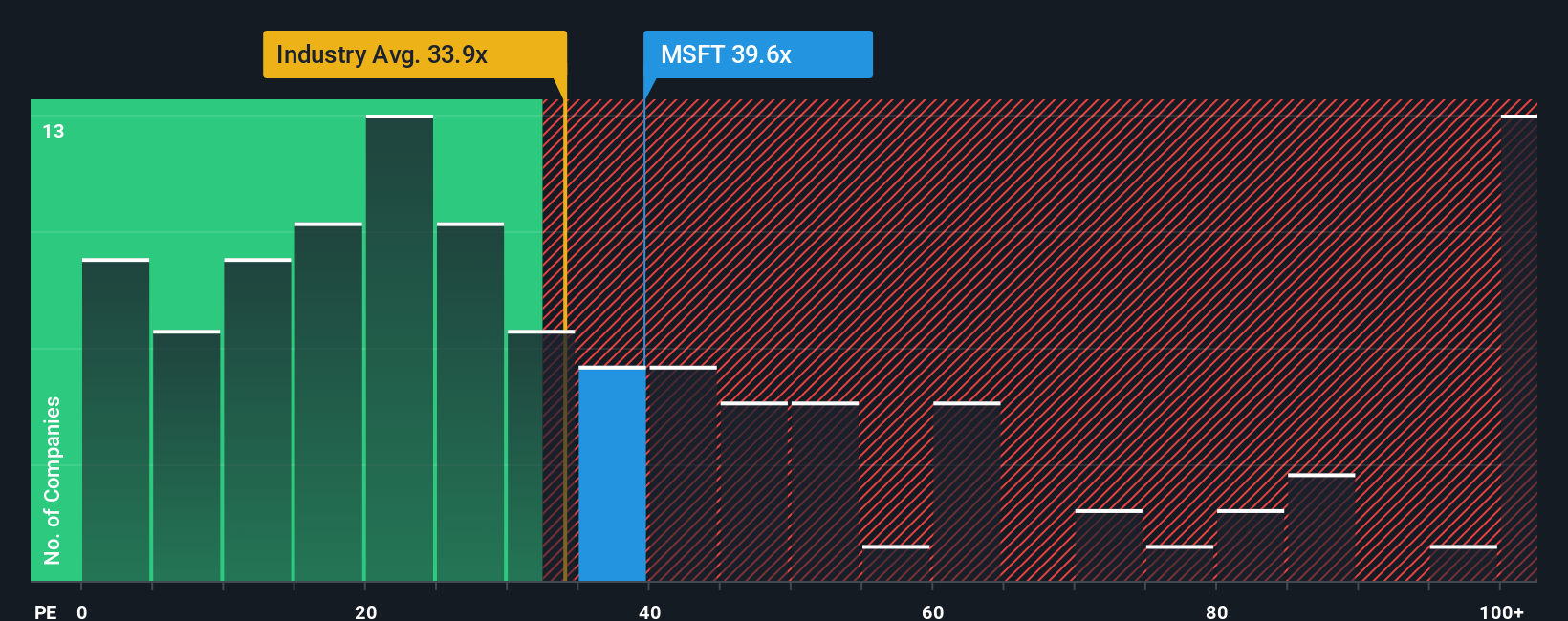

Approach 2: Microsoft Price vs Earnings

The price-to-earnings (PE) ratio is widely regarded as an effective valuation measure for profitable companies like Microsoft because it directly compares a company's current share price to its per-share earnings. This gives investors a clear sense of how much they are paying for each dollar of profit generated by the business.

What qualifies as a “normal” PE ratio can vary depending on growth expectations and perceived risks. Higher growth and lower risk usually justify a higher PE, while companies with slower growth or more uncertainty tend to trade at lower multiples. For Microsoft, the current PE ratio stands at 37.7x. This is just under the Software industry average of 35.3x, and also slightly lower than the peer group average of 38.8x.

Simply Wall St uses a proprietary “Fair Ratio” model that takes into account a company’s growth outlook, profit margins, industry, risk profile and size. For Microsoft, the Fair Ratio is 56.1x. Given its earnings growth, scale and financial strength, the stock could reasonably be valued at a higher PE than both industry and peer averages. This approach provides a more nuanced view than simple comparison, as it tailors expectations to Microsoft’s unique strengths and outlook.

With Microsoft’s actual PE ratio at 37.7x and a Fair Ratio of 56.1x, the stock appears undervalued using this method.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Microsoft Narrative

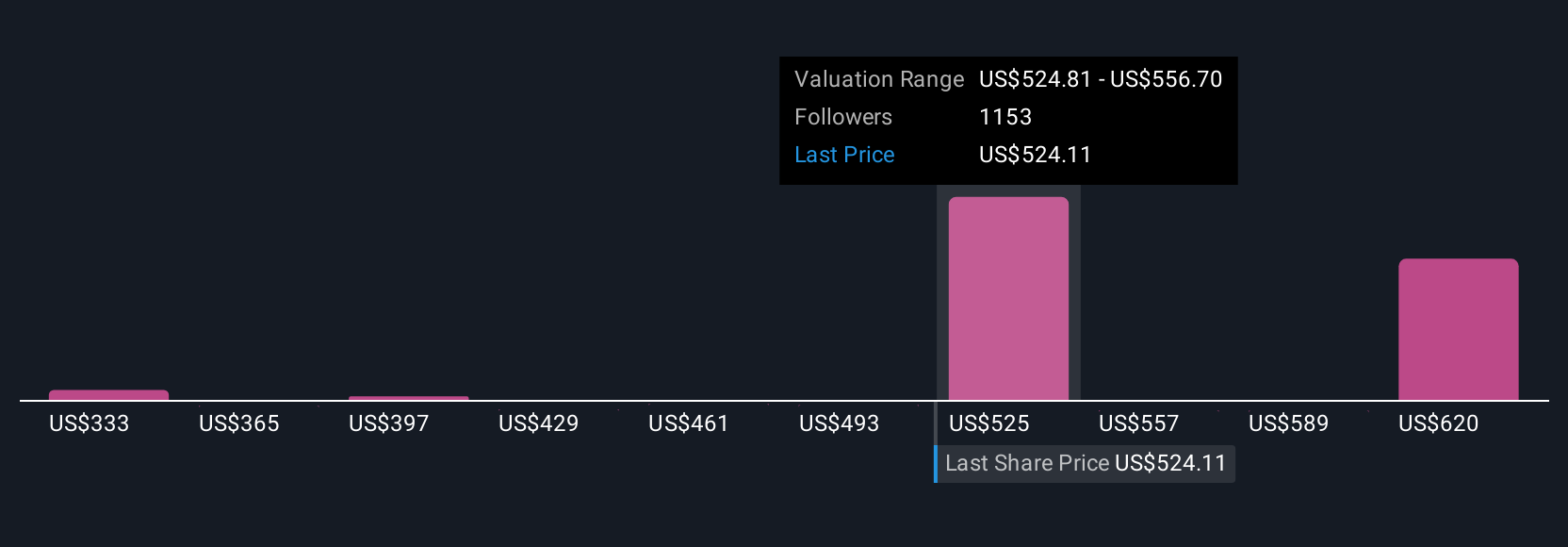

Earlier we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives. A Narrative lets you attach your own story and reasoning to a company's numbers. It is your way to connect what you believe about Microsoft's future with your estimates for revenue, profit margins, and fair value.

Instead of relying only on models like DCF or the PE ratio, a Narrative ties together your outlook for Microsoft's business, your financial forecasts, and what you think a share should be worth. This approach makes it easier to see at a glance whether Microsoft’s current share price lines up with your expectations, or if it is time to revisit your assumptions.

Narratives are straightforward to create and track on Simply Wall St’s Community page, a free space used by millions of investors. As new information like earnings releases or breaking news comes in, Narratives update automatically, so you are always basing decisions on the latest data and sentiment, not yesterday’s story.

This makes Narratives a powerful tool for deciding if and when to buy or sell. By comparing what you see as fair value to the real-time market price, you get immediate, contextual insight for your next move.

For example, among users tracking Microsoft, one Narrative expects a fair value of $700 per share by 2028, reflecting strong AI-fueled growth, while another sees a more cautious $360, factoring in growing competition and regulatory risks. Your perspective matters, and Narratives let your investment story be seen.

For Microsoft, however, we will make it really easy for you with previews of two leading Microsoft Narratives:

Fair Value: $620.74

17% undervalued (based on last close)

Forecast Revenue Growth: 14.78%

- AI and cloud services, supported by an entrenched subscription model, are expected to drive high-margin and visible earnings growth.

- Strong enterprise cloud demand and integrated cybersecurity boost recurring revenues. Software-driven efficiency aims to protect margins despite heavy CapEx.

- Main risks include rising investment costs, margin pressures from rapid scaling, and challenges if key AI and cloud contract customers shift or slow spending.

Fair Value: $333.48

55% overvalued (based on last close)

Forecast Revenue Growth: 9.5%

- Microsoft’s leadership in productivity and cloud will keep driving growth, but market expectations for AI benefits may be ahead of near-term fundamentals.

- Profit margins are projected to rise as new AI and cloud services are monetized. Slower growth in core segments and cloud competition could temper results.

- Risks include regulatory scrutiny on acquisitions, an already high profit base, and the challenge of achieving further growth given market saturation and strong rivals in both productivity and AI.

Do you think there's more to the story for Microsoft? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:MSFT

Microsoft

Develops and supports software, services, devices, and solutions worldwide.

Flawless balance sheet with solid track record and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion