- United States

- /

- Software

- /

- NasdaqGS:MSFT

How New AI and Security Partnerships at Microsoft (MSFT) Are Reshaping Its Cloud Investment Thesis

Reviewed by Sasha Jovanovic

- Recent announcements from Microsoft’s clients and partners highlighted new integrations and product launches across Azure Marketplace, Microsoft Security Store, and Teams, underscoring the growing adoption of artificial intelligence, cybersecurity, and workflow automation solutions in the Microsoft ecosystem over the past two weeks.

- Several new collaborations and product integrations are enabling enterprises to streamline cloud security, automate compliance, and deploy sophisticated AI agents, reinforcing Microsoft's expanding role as a platform of choice in enterprise digital transformation initiatives.

- We’ll assess how Microsoft’s deepening enterprise AI and security partnerships could strengthen the company’s long-term cloud and recurring revenue outlook.

We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Microsoft Investment Narrative Recap

To be a Microsoft shareholder today, you need to believe that the company’s lead in enterprise AI, cloud, and integrated cybersecurity will drive steady recurring revenue, even as heavy capital investment puts pressure on near-term margins. Recent news spotlighting product launches and deepening security partnerships further expands Microsoft’s ecosystem, but does not appear to materially shift the main near-term catalyst, accelerated adoption of Azure-based AI and security solutions, or the primary risk of ongoing CapEx outpacing anticipated growth.

Among the announcements, the partnership with ReversingLabs to enhance Microsoft Sentinel’s threat detection is especially relevant, as it highlights Microsoft’s focus on expanding and monetizing cloud security offerings. This aligns directly with the company’s ambitions to grow high-margin, sticky security revenue as more organizations move critical workloads to Azure, a core catalyst for long-term earnings stability.

Yet, while the business model appears resilient, investors should be aware that if capital expenditures keep rising and AI-driven revenue growth slows...

Read the full narrative on Microsoft (it's free!)

Microsoft's narrative projects $425.0 billion revenue and $158.4 billion earnings by 2028. This requires 14.7% yearly revenue growth and a $56.6 billion earnings increase from $101.8 billion today.

Uncover how Microsoft's forecasts yield a $613.89 fair value, a 16% upside to its current price.

Exploring Other Perspectives

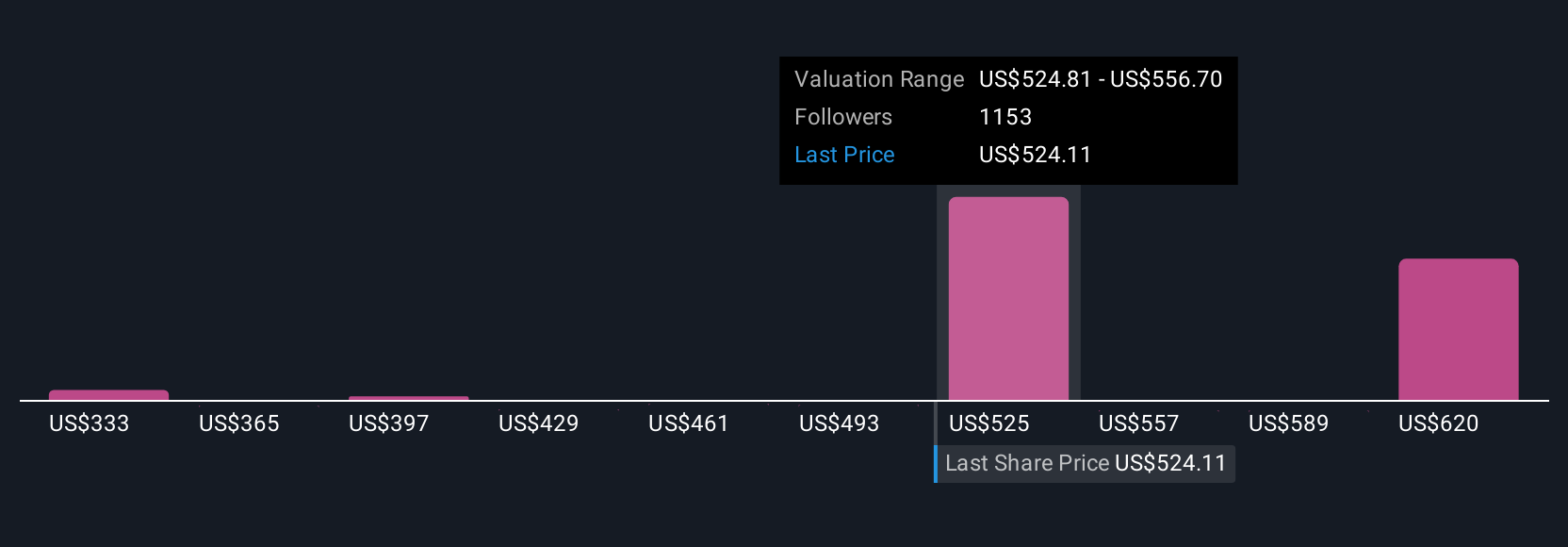

Simply Wall St Community members provided 156 fair value estimates for Microsoft, ranging from US$335.64 to US$613.89 per share. This breadth of outlooks underscores how capex pressures and margin dynamics remain points of ongoing debate for the company’s future trajectory, see how your view stacks up across varied community insights.

Explore 156 other fair value estimates on Microsoft - why the stock might be worth 37% less than the current price!

Build Your Own Microsoft Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Microsoft research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Microsoft research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Microsoft's overall financial health at a glance.

Seeking Other Investments?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:MSFT

Microsoft

Develops and supports software, services, devices, and solutions worldwide.

Flawless balance sheet with solid track record and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Q3 Outlook modestly optimistic

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

MicroVision will explode future revenue by 380.37% with a vision towards success

Trending Discussion