- United States

- /

- Software

- /

- NasdaqGS:MSFT

How Investors Are Reacting To Microsoft (MSFT) Surging AI Demand and Expanding Cloud Infrastructure

Reviewed by Sasha Jovanovic

- Microsoft recently reported strong quarterly earnings growth, fueled by accelerated demand for Azure and AI-powered cloud services, alongside expanding enterprise adoption of its AI solutions and infrastructure.

- This performance was further supported by significant investments in new AI data centers, continued momentum around major partnerships, and a robust backlog, underscoring the company's rapidly growing presence in the enterprise AI ecosystem.

- We'll examine how Microsoft's large-scale AI infrastructure investments and customer adoption momentum shape the company's investment narrative going forward.

Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

Microsoft Investment Narrative Recap

To be a Microsoft shareholder today, one needs confidence in the company's ability to translate accelerated AI and cloud adoption into sustained revenue and earnings growth, while managing the risks that come with substantial capital expenditures and shifting customer dynamics. The latest earnings and client partnership announcements reaffirm the company's leadership in enterprise AI and Azure momentum, but the most important short-term catalyst remains continued robust customer demand for Azure and cloud-based AI workloads; the biggest risk is margin pressure from heavy infrastructure investment. Recent news around Microsoft's expanded collaborations and new features for Azure and Entra reinforce customer adoption, though these developments do not materially impact the most significant near-term opportunities or threats.

Among recent announcements, Preservica's integration of Active Digital Preservation™ within Microsoft 365 Archive is an example of partners extending Microsoft's platform capabilities for enterprise customers. This underscores rising demand for long-term, compliant data management solutions, which supports Microsoft's positioning in regulated industries and complements its broader AI and cloud catalysts.

By contrast, some investors may underestimate the risk that ongoing massive capital expenditures could pressure Microsoft's cash flow and profitability if AI revenue growth expectations are not met...

Read the full narrative on Microsoft (it's free!)

Microsoft's narrative projects $425.0 billion revenue and $158.4 billion earnings by 2028. This requires 14.7% yearly revenue growth and a $56.6 billion earnings increase from $101.8 billion today.

Uncover how Microsoft's forecasts yield a $626.65 fair value, a 23% upside to its current price.

Exploring Other Perspectives

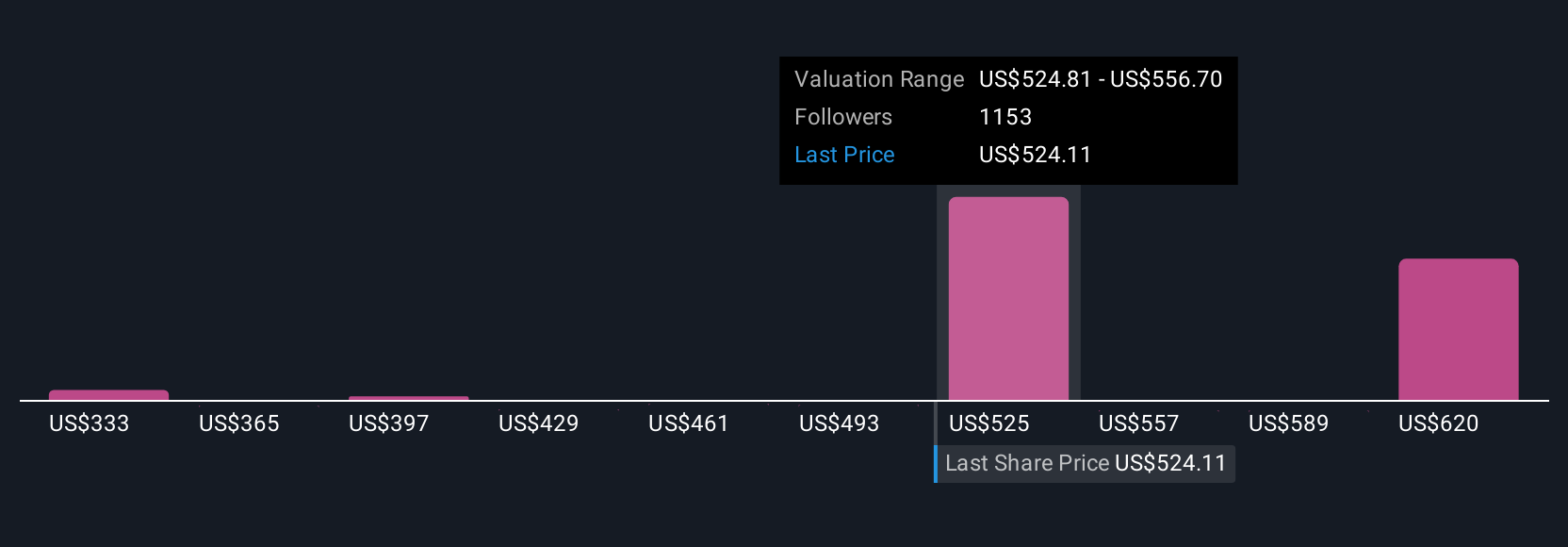

129 community fair value estimates for Microsoft range from US$360 to US$626.65 per share, with views from the Simply Wall St Community. With heavy AI infrastructure investments shaping margin trends, see why opinions about future profitability and risk diverge sharply.

Explore 129 other fair value estimates on Microsoft - why the stock might be worth 29% less than the current price!

Build Your Own Microsoft Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Microsoft research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Microsoft research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Microsoft's overall financial health at a glance.

Ready For A Different Approach?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- Outshine the giants: these 25 early-stage AI stocks could fund your retirement.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- We've found 16 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:MSFT

Microsoft

Develops and supports software, services, devices, and solutions worldwide.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives