- United States

- /

- Software

- /

- NasdaqGS:MSFT

Does Microsoft's In-House AI Push and New Partnerships Redefine the Bull Case for MSFT?

Reviewed by Simply Wall St

- In recent days, Microsoft introduced its first proprietary AI models and was named as a key collaborator in multiple technology announcements spanning healthcare, automotive, and energy sectors.

- These developments indicate Microsoft's accelerated push toward in-house AI innovation while simultaneously deepening its influence across diverse industry applications.

- We'll examine how Microsoft's unveiling of proprietary AI models and expansion of cross-industry AI partnerships could influence its investment narrative.

Explore 24 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

Microsoft Investment Narrative Recap

For a shareholder to be confident in Microsoft, they need to believe the company can translate its ongoing AI investments and multi-sector partnerships into sustained revenue and margin growth, while managing the considerable costs and risks tied to AI infrastructure. The recent introduction of Microsoft’s own AI models and expanded collaborations across healthcare, automotive, and energy highlight the drive for product innovation and cross-industry adoption, though the immediate impact on the most important short-term catalyst, enterprise AI uptake, appears incremental rather than transformational. However, the growing need for significant AI-related capital expenditure remains the core risk to near-term profitability, especially if end-market demand slows.

Among recent developments, Microsoft’s launch of in-house AI models like MAI-Voice-1 and MAI-1 Preview stands out for its relevance, it marks a move toward reducing reliance on external partners and could boost internal efficiency, but also brings new competition and the challenge of scaling proprietary technologies. This effort ties directly to the company’s bid to defend or expand operating margins through software optimization, an important consideration as its AI roadmap matures and cost structures shift. But even as AI partnerships multiply, investors should remain mindful that, if revenue growth does not accelerate to match ballooning infrastructure spend...

Read the full narrative on Microsoft (it's free!)

Microsoft's narrative projects $425.0 billion revenue and $158.4 billion earnings by 2028. This requires 14.7% yearly revenue growth and a $56.6 billion earnings increase from $101.8 billion.

Uncover how Microsoft's forecasts yield a $613.89 fair value, a 20% upside to its current price.

Exploring Other Perspectives

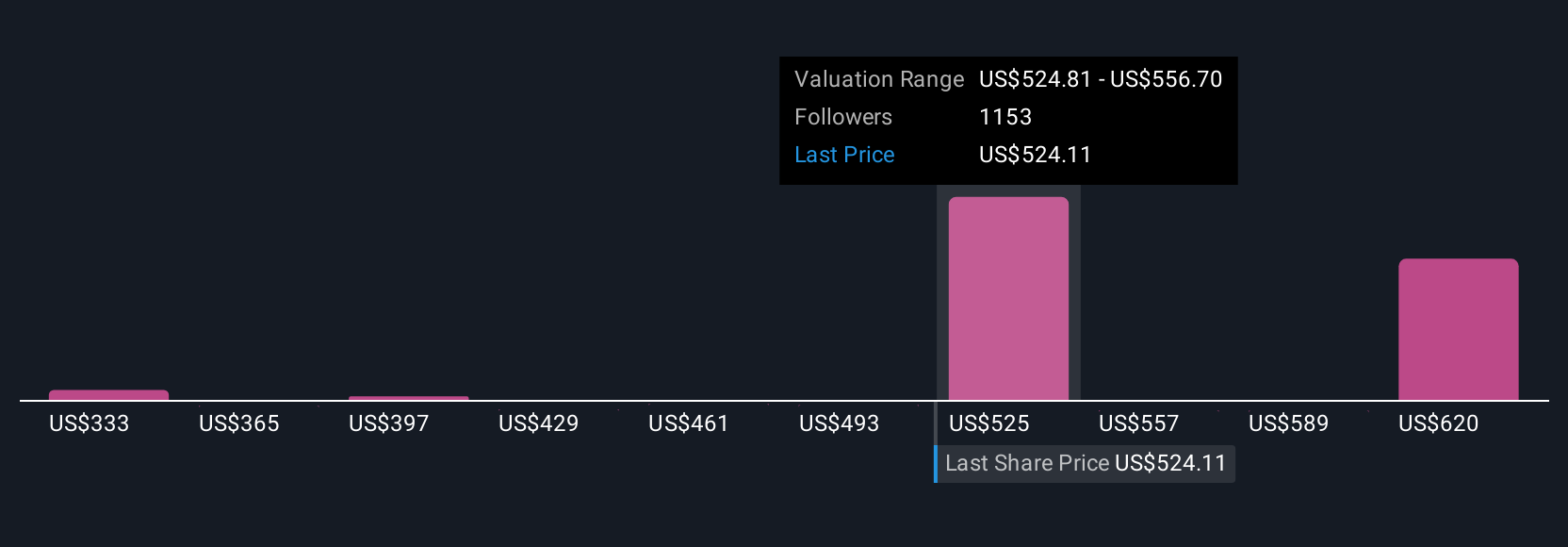

Fair value targets from 154 Simply Wall St Community members for Microsoft range from US$335.64 to US$613.89. While many see upside, the varied outlook underlines ongoing risks related to substantial AI spending and the need for future growth to justify premium valuations, consider how this could affect Microsoft’s ability to sustain its current performance, and explore the wide mix of community opinions.

Explore 154 other fair value estimates on Microsoft - why the stock might be worth as much as 20% more than the current price!

Build Your Own Microsoft Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Microsoft research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Microsoft research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Microsoft's overall financial health at a glance.

Interested In Other Possibilities?

Our top stock finds are flying under the radar-for now. Get in early:

- We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:MSFT

Microsoft

Develops and supports software, services, devices, and solutions worldwide.

Flawless balance sheet with solid track record and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Automotive Electronics Manufacturer Consistent and Stable

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion