- United States

- /

- Software

- /

- NasdaqGS:MSFT

Assessing Microsoft (MSFT) Valuation As Maia 200 Chip Launch And AI Earnings Expectations Draw Focus

Microsoft (MSFT) has put its in house Maia 200 AI chip into production just as investors focus on upcoming earnings, with cloud capacity, Copilot usage, and AI related spending at the forefront.

See our latest analysis for Microsoft.

The Maia 200 news arrives as Microsoft’s share price shows mixed momentum, with a 5.73% 7 day share price return but a 1.46% 30 day decline and an 11.26% 90 day pullback. At the same time, the 3 year total shareholder return of 98.57% and 5 year total shareholder return of 109.11% reflect a much stronger long run picture. Recent partnerships in areas like embedded payments, healthcare imaging, and robotics have kept Microsoft in the AI and cloud spotlight, and the latest 2.19% 1 day share price return to US$480.58 suggests investors are reacting to the chip launch and upcoming earnings as a fresh update on growth potential and execution risk.

If Maia 200 and Copilot have you watching big tech more closely, it could be a good moment to see how other high growth tech and AI stocks stack up on growth, risk, and AI exposure.

With Maia 200, strong AI partnerships, and a recent share price pullback, Microsoft appears both profitable and still in a growth phase. So is this AI heavyweight trading at a discount, or has the market already reflected the next stage of its growth potential in the current price?

Most Popular Narrative: 19.9% Undervalued

Compared with Microsoft’s last close at $480.58, the most followed narrative pegs fair value at $600, which frames Maia 200 and Copilot within a broader long term story.

Microsoft isn’t just “Windows and Word” anymore. It is a cloud, AI, enterprise, gaming, cybersecurity, and productivity behemoth. Its diversified revenue streams reduce dependence on any single business line.

Curious how a business mix like this gets to a higher fair value? According to oscargarcia, the key ingredients are compounding revenue, expanding profits, and a premium earnings multiple. The exact assumptions behind those numbers are where the narrative gets interesting.

Result: Fair Value of $600 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, regulatory pressure on big tech and any cloud pricing battles with rivals could quickly challenge assumptions behind that 19.9% undervalued narrative.

Find out about the key risks to this Microsoft narrative.

Another View: Premium Price Tag

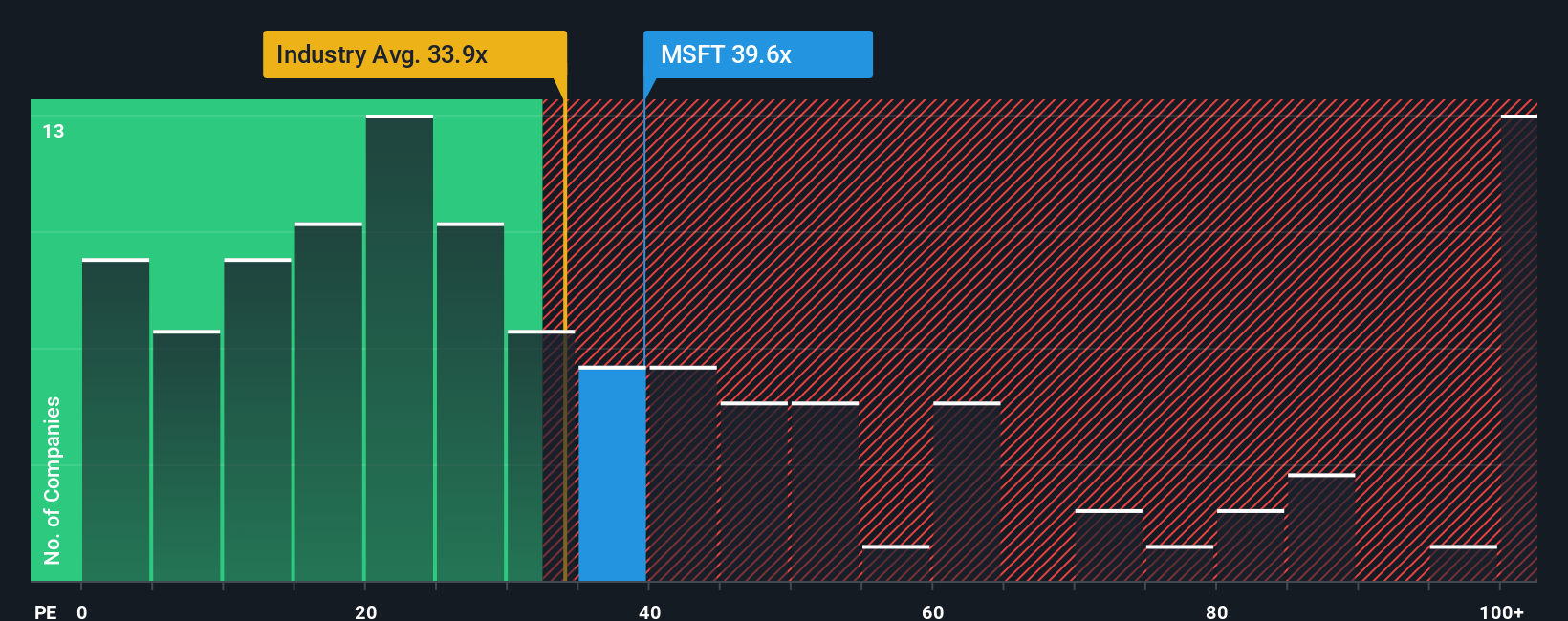

While the user narrative and intrinsic estimates point to Microsoft trading below fair value, its current P/E of 34x sits above both the US Software industry average of 30.4x and the peer average of 32x. Our fair ratio of 51.4x suggests the market could move higher over time. Is that gap a cushion or extra risk if expectations cool?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Microsoft Narrative

If you see the numbers differently, or prefer to test your own assumptions, you can build a complete Microsoft story in minutes by starting with Do it your way.

A great starting point for your Microsoft research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

If you stop with just one stock, you could miss out on opportunities that better fit your goals, risk comfort, or preferred themes across sectors and megatrends.

- Spot early stage potential by reviewing these 3511 penny stocks with strong financials that combine smaller market caps with stronger financial profiles than many investors expect.

- Tap into the AI build out by scanning these 24 AI penny stocks that tie revenue directly to machine learning, automation, and data driven services.

- Hunt for price and cash flow mismatches using these 876 undervalued stocks based on cash flows, where current market quotes sit below modeled cash flow based estimates.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:MSFT

Microsoft

Develops and supports software, services, devices, and solutions worldwide.

Flawless balance sheet with solid track record and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

The Future of Social Sharing Is Private and People Are Ready

EU#3 - From Philips Management Buyout to Europe’s Biggest Company

Booking Holdings: Why Ground-Level Travel Trends Still Favor the Platform Giants

A fully integrated LNG business seems to be ignored by the market.

Recently Updated Narratives

Czechoslovak Group - is it really so hot?

Is Ubisoft the Market’s Biggest Pricing Error? Why Forensic Value Points to €33 Per Share

Hotel101 Global: A Scalable Hospitality Platform Built to Compound

Popular Narratives

Undervalued Key Player in Magnets/Rare Earth

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The "Easy Money" Is Gone: Why Alphabet Is Now a "Show Me" Story

Trending Discussion