- United States

- /

- Software

- /

- NasdaqGS:MSFT

Assessing Microsoft (MSFT) Valuation As Copilot Checkout Expands AI Commerce Ambitions

Reviewed by Simply Wall St

Why Copilot Checkout matters for Microsoft stock

Microsoft (MSFT) just rolled out agentic AI tools for retailers, headlined by Copilot Checkout, which keeps shoppers inside the Copilot experience while completing purchases through partners including PayPal, Shopify, and Stripe.

For investors, this moves Microsoft deeper into AI-powered commerce. It ties the company’s cloud and Copilot ecosystem more directly to transaction flows, retailer workflows, and potential usage based revenue streams across retail and adjacent sectors.

See our latest analysis for Microsoft.

Microsoft’s recent string of AI related announcements, from Copilot Checkout in retail to new partnerships in robotics, data engineering and industry specific agents, comes as the stock sits at US$479.28 with a modest year to date share price return of 1.34% and a 1 year total shareholder return of 15.73%. The 3 year total shareholder return of about 2.1x suggests earlier momentum has eased in recent months.

If Copilot Checkout has you thinking more broadly about AI in your portfolio, this is a good moment to scan other potential opportunities in high growth tech and AI stocks.

With Microsoft delivering 15.73% total return over the past year and trading at US$479.28, recent AI headlines and a 20% intrinsic discount estimate raise the real question: is there still a mispricing here, or has the market already baked in the next leg of growth?

Most Popular Narrative: 14.1% Overvalued

According to PicaCoder, the fair value of Microsoft at US$420 sits below the last close of US$479.28, which sets up a more cautious story around Copilot driven enthusiasm.

Microsoft is currently digging away the foundation that makes it different. It is trapped in a perfect storm, losing the AI tech war to Google, burning cash on infrastructure without guaranteed ROI, cannibalizing its own seat-based revenue, and antagonizing users with a buggy, bloatware-filled operating system. The ship is massive, and momentum will carry it forward for years. But if Microsoft continues to sell an inferior, job-destroying AI while forcing users to endure a degrading Windows experience, it will eventually find that its enterprise fortress is built on sand. When the user base leaves, the necessity for the Azure infrastructure that supports them leaves with it.

Curious how that US$420 number is built. The narrative leans heavily on a richer profit margin today, a punchy future earnings multiple, and a discount rate that keeps the bar high. Want to see which assumptions do the heavy lifting in that calculation, and how they square with Microsoft’s current AI push and capital spend.

Result: Fair Value of $420.0 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, the narrative could crack if Copilot adoption delivers stickier enterprise usage than feared, or if Microsoft’s US$293.8b revenue and US$104.9b net income trends hold up.

Find out about the key risks to this Microsoft narrative.

Another Angle on Microsoft’s Value

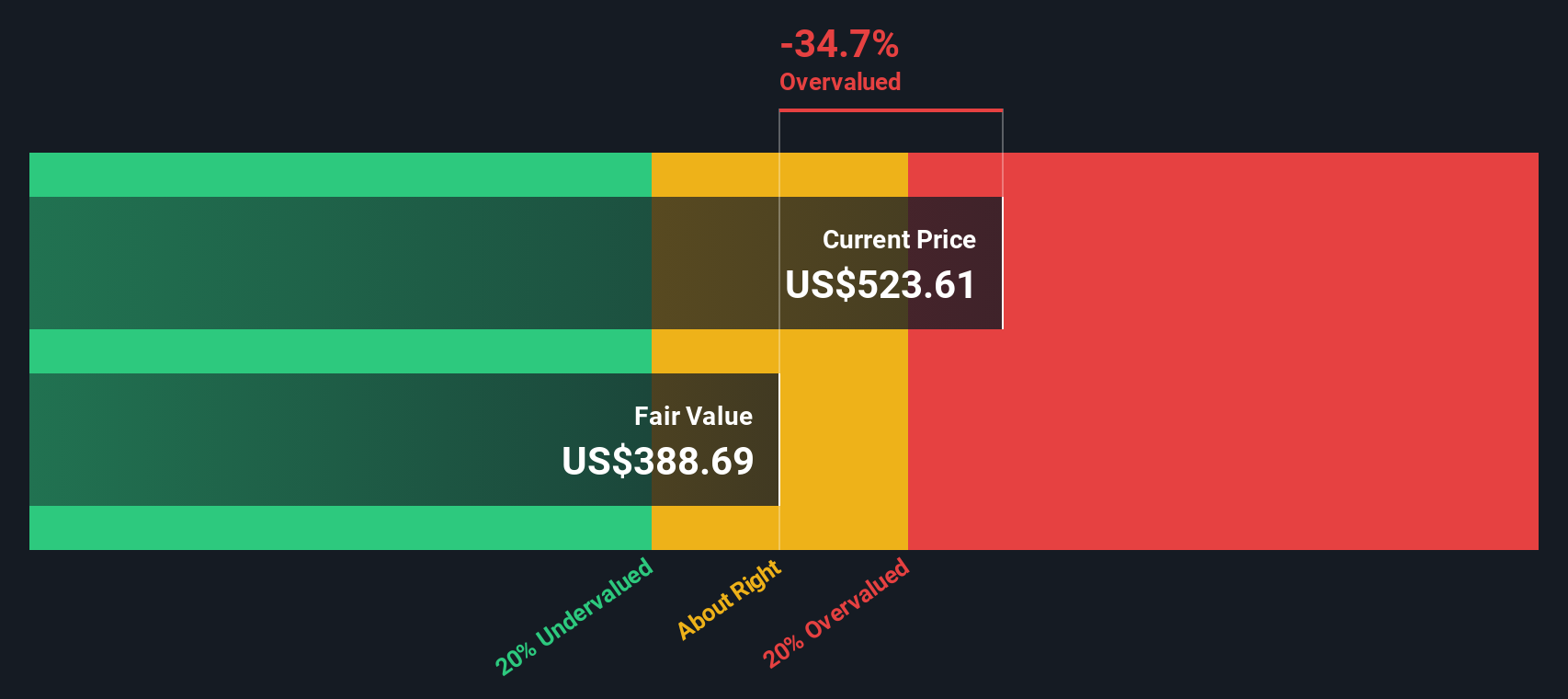

The user narrative suggests Microsoft is 14.1% overvalued at US$420, but our DCF model indicates a different perspective. With a fair value estimate of US$602.67 and the current price at US$479.28, it identifies Microsoft as trading at a 20.5% discount instead. Which interpretation aligns better with your risk tolerance?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Microsoft for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 881 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Microsoft Narrative

If you see the numbers differently or prefer to work from your own assumptions, you can build a custom narrative in just a few minutes with Do it your way.

A great starting point for your Microsoft research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

If you only stop at Microsoft, you risk missing other useful ideas, so put the Simply Wall St Screener to work across a few different angles.

- Spot income potential by screening for these 12 dividend stocks with yields > 3% that might suit a portfolio focused on regular cash returns.

- Hunt for mispriced opportunities with these 881 undervalued stocks based on cash flows to see which companies currently trade below their estimated cash flow value.

- Position early in structural tech themes by checking out these 30 healthcare AI stocks that sit at the intersection of medicine and machine learning.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:MSFT

Microsoft

Develops and supports software, services, devices, and solutions worldwide.

Flawless balance sheet with solid track record and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

The "Sleeping Giant" Stumbles, Then Wakes Up

Swiped Left by Wall Street: The BMBL Rebound Trade

Duolingo (DUOL): Why A 20% Drop Might Be The Entry Point We've Been Waiting For

Recently Updated Narratives

Apple Inc. (AAPL) — Durable Compounder With Services-Led Earnings Upside

Mota-Engil's Intrinsic and Historical Valuation

Ferrari's Intrinsic and Historical Valuation

Popular Narratives

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

The "Sleeping Giant" Stumbles, Then Wakes Up