- United States

- /

- Software

- /

- NasdaqGS:MNDY

Will monday.com's (MNDY) Shift in Lead Generation Reshape Its Growth Narrative?

Reviewed by Sasha Jovanovic

- Carillon Tower Advisers highlighted monday.com in its third-quarter 2025 investor letter, noting that the company delivered better than expected quarterly results but issued cautious guidance due to a temporary change in inbound lead-generation and ongoing macroeconomic pressures affecting its customer base.

- Despite operational outperformance, increased hedge fund holdings in monday.com reflected continued investor interest even as management warned of near-term headwinds impacting its outlook.

- We'll take a look at how management's cautious guidance amid changing lead-generation trends could affect monday.com's broader investment narrative.

The latest GPUs need a type of rare earth metal called Dysprosium and there are only 37 companies in the world exploring or producing it. Find the list for free.

monday.com Investment Narrative Recap

To be a monday.com shareholder, you need to believe in sustained demand for cloud-based productivity tools and the company’s ability to expand its multi-product platform, especially in AI automation and upmarket enterprise segments. While management’s cautious guidance tied to a temporary dip in inbound lead generation shapes short-term sentiment, it does not appear to materially disrupt the most important catalyst, AI-driven product innovation, or mitigate mounting risks around slower SMB customer growth and operating leverage from ramped investment.

The most relevant recent announcement is the company’s launch of AI-powered products such as monday agents and monday campaigns at Elevate 2025, reinforcing efforts to drive cross-sell and customer value amid evolving demand patterns. This suite of AI tools could help offset softer SMB momentum, underlining management’s emphasis on balancing product-led growth while confronting near-term lead-generation uncertainty.

On the other hand, investors should be mindful of how sustained softness in SMB additions, especially from search-driven channels, can ...

Read the full narrative on monday.com (it's free!)

monday.com's narrative projects $2.0 billion revenue and $157.5 million earnings by 2028. This requires 22.9% yearly revenue growth and a $117.5 million earnings increase from $40.0 million today.

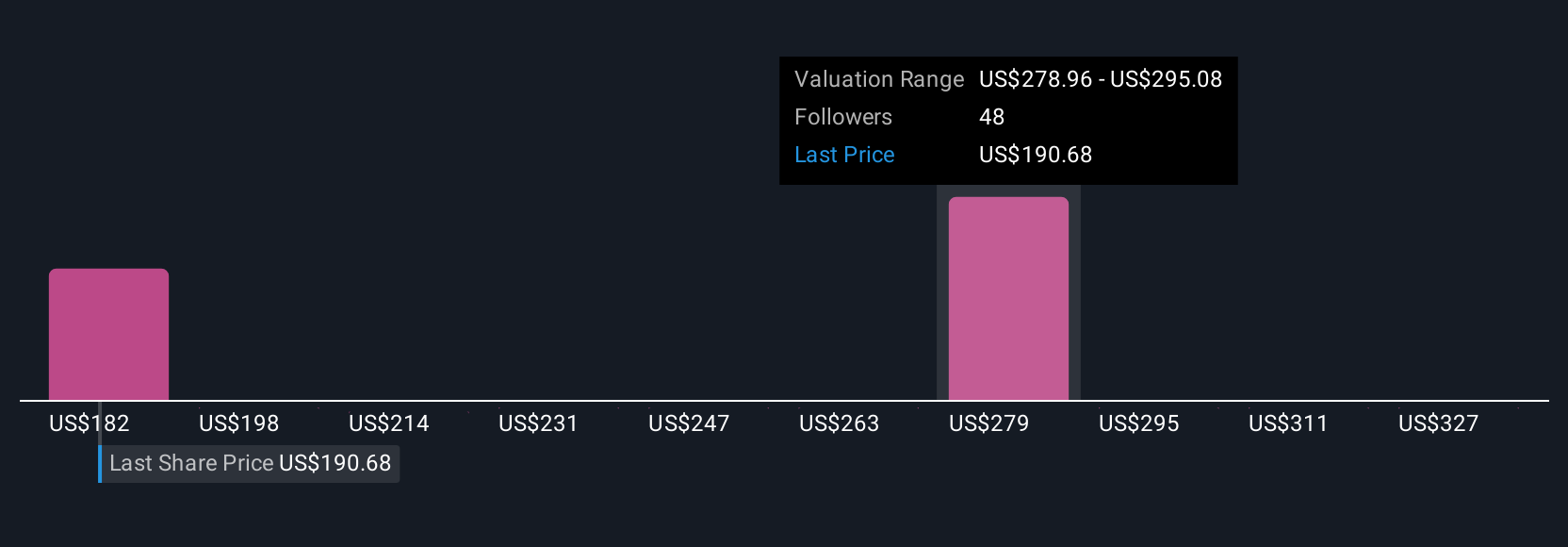

Uncover how monday.com's forecasts yield a $266.33 fair value, a 30% upside to its current price.

Exploring Other Perspectives

Fifteen members of the Simply Wall St Community have fair value estimates for monday.com ranging from US$170.20 to US$343.44. Many point to the company’s exposure to performance marketing risks and evolving customer acquisition costs as critical variables that could affect future revenue momentum, so exploring multiple opinions is essential.

Explore 15 other fair value estimates on monday.com - why the stock might be worth 17% less than the current price!

Build Your Own monday.com Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your monday.com research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free monday.com research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate monday.com's overall financial health at a glance.

Ready For A Different Approach?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- These 16 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:MNDY

monday.com

Develops software applications in the United States, Europe, the Middle East, Africa, the United Kingdom, and internationally.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives