- United States

- /

- Software

- /

- NasdaqGS:MNDY

monday.com (MNDY) Is Down 7.6% After Tech Pullback Despite Strong AI and CRM Advances – What's Changed

Reviewed by Sasha Jovanovic

- Shares of monday.com recently fell amid a broad technology sector pullback, as investor concerns over high valuations and artificial intelligence disruption weighed on sentiment despite the company posting a strong quarter.

- monday.com’s continued rollout of advanced AI features and its milestone of surpassing US$100 million in annual recurring revenue for its CRM offering highlight significant momentum in both innovation and product adoption.

- We’ll explore how market caution around artificial intelligence shapes monday.com’s investment narrative following its recently reported robust results.

Outshine the giants: these 25 early-stage AI stocks could fund your retirement.

monday.com Investment Narrative Recap

Investors in monday.com need to be confident in the company’s ability to drive sustained growth through continuous product innovation and enterprise expansion, despite recurring sector volatility. The recent tech sector pullback has weighed on shares, but the core catalyst, ongoing enterprise and CRM momentum, remains intact; the biggest near-term risk continues to be acquisition challenges in the SMB segment due to search algorithm changes, which the latest news does not materially impact.

The announcement that monday.com’s CRM platform surpassed US$100 million in annual recurring revenue stands out, reinforcing its cross-sell strategy and upmarket ambitions. In the context of future growth drivers, this milestone underscores platform adoption, which is central to maintaining momentum as questions on valuation and AI competition circulate.

Yet, as the near-term outlook brightens with strong product traction, investors should not overlook the implications of recent softness in SMB customer additions…

Read the full narrative on monday.com (it's free!)

monday.com's narrative projects $2.0 billion revenue and $157.5 million earnings by 2028. This requires 22.9% yearly revenue growth and a $117.5 million earnings increase from $40.0 million today.

Uncover how monday.com's forecasts yield a $266.33 fair value, a 40% upside to its current price.

Exploring Other Perspectives

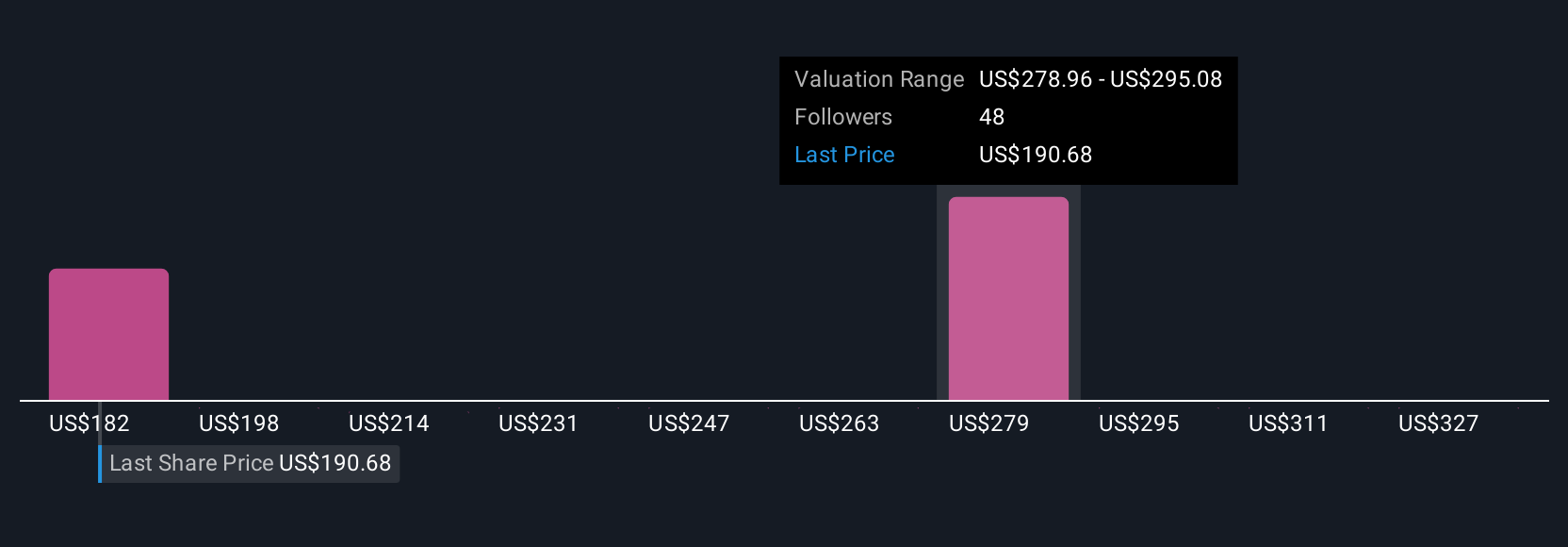

Fifteen member-generated fair value estimates for monday.com from the Simply Wall St Community span from US$170.20 to US$343.44 per share, showing significant opinion differences. With ongoing pressure in SMB segment additions highlighted as a key risk, readers should consider how a range of viewpoints could influence expectations about the company’s next phase.

Explore 15 other fair value estimates on monday.com - why the stock might be worth 10% less than the current price!

Build Your Own monday.com Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your monday.com research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free monday.com research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate monday.com's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 35 best rare earth metal stocks of the very few that mine this essential strategic resource.

- We've found 16 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:MNDY

monday.com

Develops software applications in the United States, Europe, the Middle East, Africa, the United Kingdom, and internationally.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Dentsply Sirona Stock: Dental Technology Built for Cycles, Not Headlines

Etsy Stock: Defending Differentiation in a World of Infinite Marketplaces

Align Technology Stock: Premium Orthodontics in a Cost-Sensitive World

Popular Narratives

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion