- United States

- /

- Software

- /

- NasdaqGS:MGIC

Magic Software Enterprises (NASDAQ:MGIC) Will Pay A Larger Dividend Than Last Year At $0.327

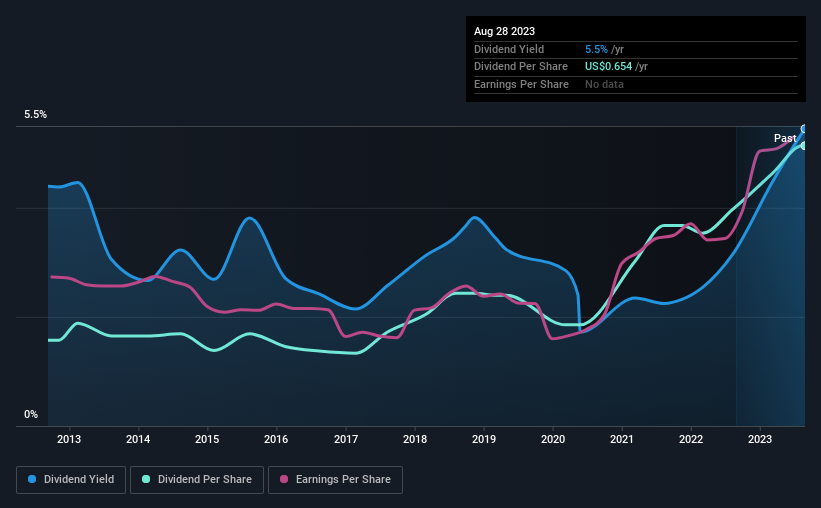

Magic Software Enterprises Ltd.'s (NASDAQ:MGIC) dividend will be increasing from last year's payment of the same period to $0.327 on 13th of September. This makes the dividend yield 5.5%, which is above the industry average.

View our latest analysis for Magic Software Enterprises

Magic Software Enterprises' Payment Has Solid Earnings Coverage

If the payments aren't sustainable, a high yield for a few years won't matter that much. Prior to this announcement, Magic Software Enterprises' dividend made up quite a large proportion of earnings but only 42% of free cash flows. In general, cash flows are more important than earnings, so we are comfortable that the dividend will be sustainable going forward, especially with so much cash left over for reinvestment.

The next year is set to see EPS grow by 8.4%. Assuming the dividend continues along recent trends, we think the payout ratio could be 74% by next year, which is in a pretty sustainable range.

Dividend Volatility

The company has a long dividend track record, but it doesn't look great with cuts in the past. Since 2013, the dividend has gone from $0.20 total annually to $0.654. This means that it has been growing its distributions at 13% per annum over that time. Magic Software Enterprises has grown distributions at a rapid rate despite cutting the dividend at least once in the past. Companies that cut once often cut again, so we would be cautious about buying this stock solely for the dividend income.

The Dividend Looks Likely To Grow

Given that the dividend has been cut in the past, we need to check if earnings are growing and if that might lead to stronger dividends in the future. It's encouraging to see that Magic Software Enterprises has been growing its earnings per share at 17% a year over the past five years. The payout ratio is very much on the higher end, which could mean that the growth rate will slow down in the future, and that could flow through to the dividend as well.

Magic Software Enterprises Looks Like A Great Dividend Stock

In summary, it is always positive to see the dividend being increased, and we are particularly pleased with its overall sustainability. The company is easily earning enough to cover its dividend payments and it is great to see that these earnings are being translated into cash flow. All of these factors considered, we think this has solid potential as a dividend stock.

It's important to note that companies having a consistent dividend policy will generate greater investor confidence than those having an erratic one. Meanwhile, despite the importance of dividend payments, they are not the only factors our readers should know when assessing a company. For example, we've picked out 1 warning sign for Magic Software Enterprises that investors should know about before committing capital to this stock. Looking for more high-yielding dividend ideas? Try our collection of strong dividend payers.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:MGIC

Magic Software Enterprises

Provides proprietary application development, vertical software solutions, business process integration, information technologies (IT) outsourcing software services, and cloud-based services worldwide.

Excellent balance sheet with proven track record.

Similar Companies

Market Insights

Weekly Picks

An Undervalued 3.3Moz Gold Project in Canada

Coca-Cola’s Enduring Moat in a Health-Conscious World: Steady Compounder Poised for 5-10% Annual Returns Through Emerging Market Dominance

Xero: Growth Was Priced In — Execution Is Not

Nu holdings will continue to disrupt the South American banking market

Recently Updated Narratives

From Porcelain to Silicon: Why the World’s Most Famous Toilet Maker is Now an AI Powerhouse

Droneshield is ramping up , 267% revenue increase in 2025

The happiest company on Earth, also perennially misunderstood.

Popular Narratives

Is Ubisoft the Market’s Biggest Pricing Error? Why Forensic Value Points to €33 Per Share

Analyst Commentary Highlights Microsoft AI Momentum and Upward Valuation Amid Growth and Competitive Risks