- United States

- /

- Software

- /

- NasdaqGS:MGIC

Magic Software Enterprises (NasdaqGS:MGIC): Exploring Valuation as Shares Extend Strong Year-To-Date Gains

Reviewed by Simply Wall St

Magic Software Enterprises (MGIC) shares have edged higher recently, catching the eye of investors tracking the company’s steady trajectory this year. The moves come as the stock builds on momentum from earlier in the year and this has prompted questions about its valuation.

See our latest analysis for Magic Software Enterprises.

Momentum continues to build for Magic Software Enterprises, with shares driving higher and extending significant gains this year. The stock’s nearly 80% year-to-date share price return and an impressive 110% total return over the past 12 months reflect a renewed sense of growth potential and changing risk perceptions among investors.

If you’re weighing up similar opportunities, now is a great time to broaden your investing horizons and discover fast growing stocks with high insider ownership

With the recent surge in price, investors now face a key question: is Magic Software Enterprises still offering hidden value, or has the market already factored in its future growth potential?

Most Popular Narrative: 18% Overvalued

Compared to the last close price of $21.32, the narrative’s fair value of $18.00 implies analysts see the stock trading above what they view as its justified level. Investors are left to decide whether robust future growth can back up the current premium.

Market expectations appear elevated due to the company's above-industry-average recent revenue growth from cloud, DevOps, and AI services, with continued expansion into digital transformation projects. This implies assumed sustained double-digit top-line growth rates despite a potentially maturing overall enterprise IT spending environment. The company is seen as particularly well suited to benefit from accelerating enterprise adoption of cloud computing, supported by a shift in both new and legacy customers towards cloud solutions. This has likely led to optimism around durable, high-growth recurring revenue streams and future margin expansion.

Curious what daring financial projections justify this premium? The narrative leans on aggressive top-line expansion and margin improvements, supported by sweeping tech trends and bolder management bets. Dig into the full narrative for a look at the assumptions behind this price.

Result: Fair Value of $18.00 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent competitive pressures or slower than expected adoption of new services could quickly challenge the current optimism reflected in analyst forecasts.

Find out about the key risks to this Magic Software Enterprises narrative.

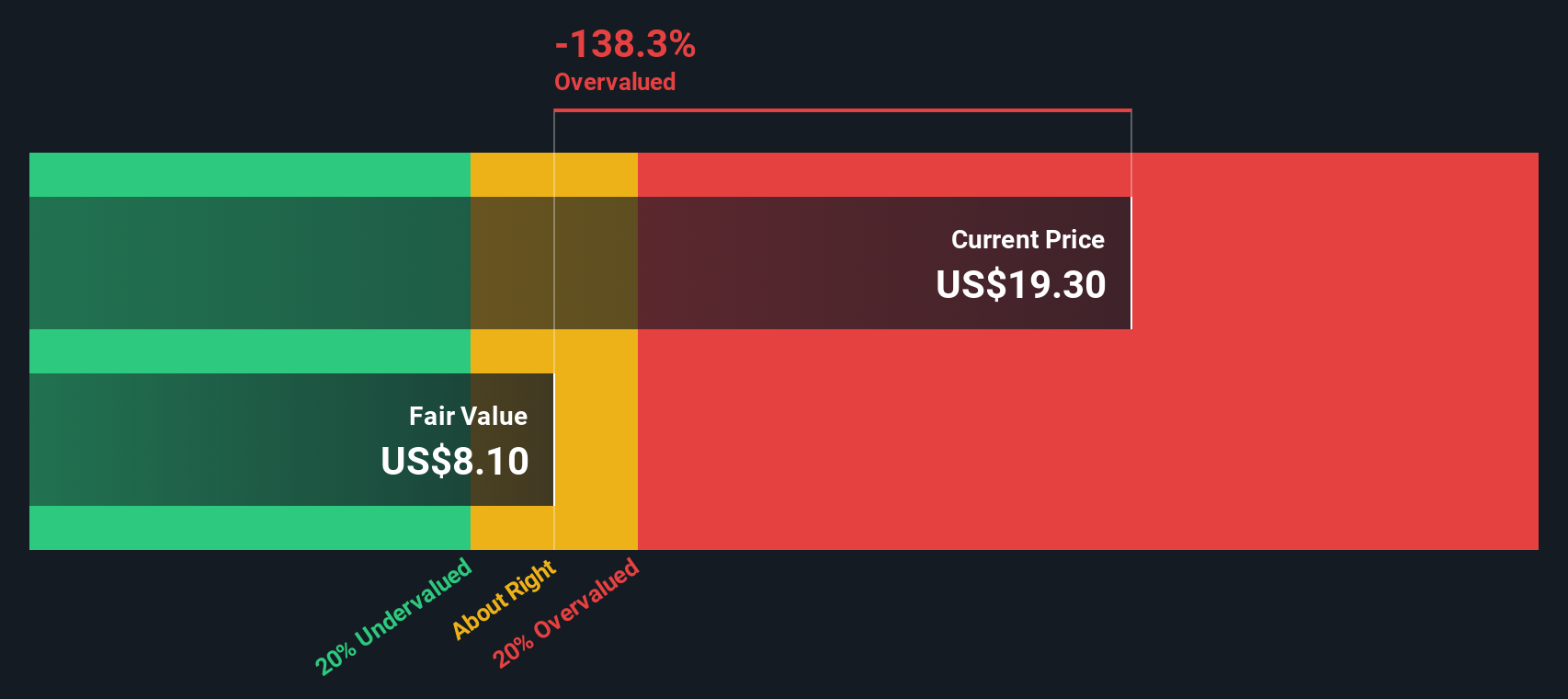

Another View: Our DCF Model Suggests a Deeper Discount

While analysts using market multiples judge Magic Software Enterprises to be moderately overvalued, our SWS DCF model presents a different perspective. The model estimates fair value at just $8.31 per share, indicating the current price might be factoring in much more optimism than fundamentals support. How much weight should investors give to future assumptions compared to present realities?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Magic Software Enterprises Narrative

If you see things differently or want your own hands-on look at the numbers, you can easily craft your own narrative and interpretation in just a few minutes: Do it your way

A great starting point for your Magic Software Enterprises research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Smart investors never settle for just one opportunity. Expand your reach and stay ahead by tracking tomorrow’s winners with these hand-picked stock ideas:

- Uncover market gems by reviewing these 836 undervalued stocks based on cash flows stocks. These companies may offer strong potential when others are overlooking their true worth.

- Boost your income potential by checking out these 20 dividend stocks with yields > 3% that offer robust yields above 3% for steadier portfolio growth.

- Capitalize on the AI boom and spot innovation leaders through these 25 AI penny stocks, placing yourself on the right side of the future.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:MGIC

Magic Software Enterprises

Provides proprietary application development, vertical software solutions, business process integration, information technologies (IT) outsourcing software services, and cloud-based services worldwide.

Excellent balance sheet with proven track record.

Similar Companies

Market Insights

Weekly Picks

The "Sleeping Giant" Stumbles, Then Wakes Up

Swiped Left by Wall Street: The BMBL Rebound Trade

Duolingo (DUOL): Why A 20% Drop Might Be The Entry Point We've Been Waiting For

Recently Updated Narratives

A Quality Compounder Marked Down on Overblown Fears

Etsy Stock: Defending Differentiation in a World of Infinite Marketplaces

Align Technology Stock: Premium Orthodontics in a Cost-Sensitive World

Popular Narratives

SFM: Multi-Year Growth Plan Will Drive Renewed Momentum Despite Near-Term Challenges

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

Trending Discussion