- United States

- /

- IT

- /

- NasdaqGM:MDB

Why MongoDB (MDB) Is Up 9.2% After Voyage AI Acquisition and New AI Solution Launch — And What's Next

Reviewed by Simply Wall St

- In recent weeks, MongoDB announced the acquisition of Voyage AI and released Voyage 3.5, strengthening its AI capabilities and expanding enterprise data protection partnerships. These developments highlight MongoDB’s intent to enhance embedding accuracy, storage efficiency, and enterprise integration, positioning itself for greater adoption in the evolving data management sector.

- With MongoDB enhancing its AI solutions and ecosystem partnerships, we will explore how these innovations could shape its broader investment outlook.

MongoDB Investment Narrative Recap

For MongoDB shareholders, the core thesis centers on the company’s ability to drive long-term growth by winning new workloads and expanding its Atlas platform, especially as businesses shift toward building custom applications and AI solutions. While the recent acquisition of Voyage AI and related AI advancements underscore MongoDB’s focus on future growth opportunities, these initiatives are not expected to materially impact the most pressing short term risk: headwinds from a declining non-Atlas business and seasonality in Atlas consumption, both of which could weigh on near-term revenue stability.

Among the recent announcements, MongoDB’s partnership expansions, such as deeper data protection integrations with Rubrik and Cohesity, stand out for their direct relevance to boosting Atlas’s enterprise adoption. These moves support a key catalyst: maintaining steady Atlas consumption growth, which remains vital for offsetting non-Atlas revenue declines and sustaining overall growth targets.

However, despite the company’s positive product momentum, investors should be aware that high uncertainty still surrounds...

Read the full narrative on MongoDB (it's free!)

MongoDB's narrative projects $3.3 billion revenue and $205.5 million earnings by 2028. This requires 15.6% yearly revenue growth and a $291.6 million earnings increase from -$86.1 million currently.

Uncover how MongoDB's forecasts yield a $266.38 fair value, a 20% upside to its current price.

Exploring Other Perspectives

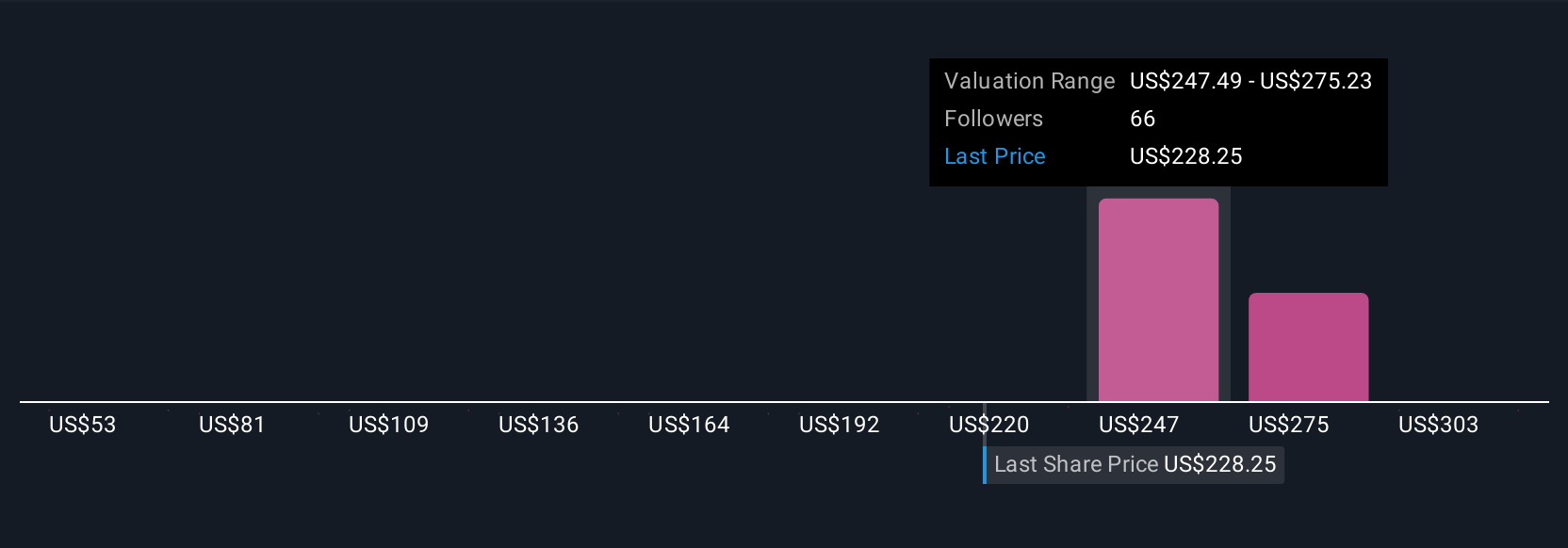

Six members of the Simply Wall St Community estimate MongoDB’s fair value between US$53 and US$294 per share. While opinions on valuation vary significantly, ongoing risks around a declining non-Atlas business remain a key issue with implications for revenue patterns and growth.

Build Your Own MongoDB Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your MongoDB research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free MongoDB research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate MongoDB's overall financial health at a glance.

No Opportunity In MongoDB?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 26 best rare earth metal stocks of the very few that mine this essential strategic resource.

- AI is about to change healthcare. These 26 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Outshine the giants: these 19 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:MDB

Flawless balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives