- United States

- /

- IT

- /

- NasdaqGM:MDB

Should Analyst Optimism Outweigh Mixed Earnings Signals for MongoDB (MDB) Investors?

Reviewed by Sasha Jovanovic

- MongoDB recently saw its stock dip 1.65% despite broader market gains, with its next earnings report scheduled for December 1, 2025, expected to show an EPS decline of 31.9% alongside an 11.68% increase in revenue.

- Analysts have continued to express confidence in MongoDB’s outlook, highlighting the company's enterprise momentum and supportive analyst consensus even as projected earnings face pressure.

- We’ll examine how strong analyst sentiment and mixed earnings expectations may influence MongoDB’s investment narrative going forward.

Outshine the giants: these 25 early-stage AI stocks could fund your retirement.

MongoDB Investment Narrative Recap

To be a MongoDB shareholder, you need confidence in the sustained demand for flexible, cloud-first database platforms powering enterprise digital transformation, despite near-term earnings volatility or margin pressure from competition. While the latest 1.65% stock dip and softer earnings outlook may trigger nerves ahead of the December 1 report, the short term catalyst remains continued growth in the Atlas (cloud) business, and this recent news does not appear to materially shift that focus or the largest risks around competition and margin sustainability.

Among recent updates, MongoDB’s Q2 results and raised guidance stand out as especially relevant, demonstrating ongoing revenue expansion and enterprise adoption that underpin bullish analyst consensus, even as earnings headwinds draw scrutiny. This context frames the market’s reaction to headline numbers as investors weigh growth momentum versus competitive risks.

By contrast, investors should be aware that as large enterprise customer gains mature, future growth rates could be at risk if...

Read the full narrative on MongoDB (it's free!)

MongoDB's outlook estimates $3.5 billion in revenue and $5.0 million in earnings by 2028. This projection is based on annual revenue growth of 16.8% and an $83.6 million increase in earnings from the current $-78.6 million.

Uncover how MongoDB's forecasts yield a $369.91 fair value, a 13% upside to its current price.

Exploring Other Perspectives

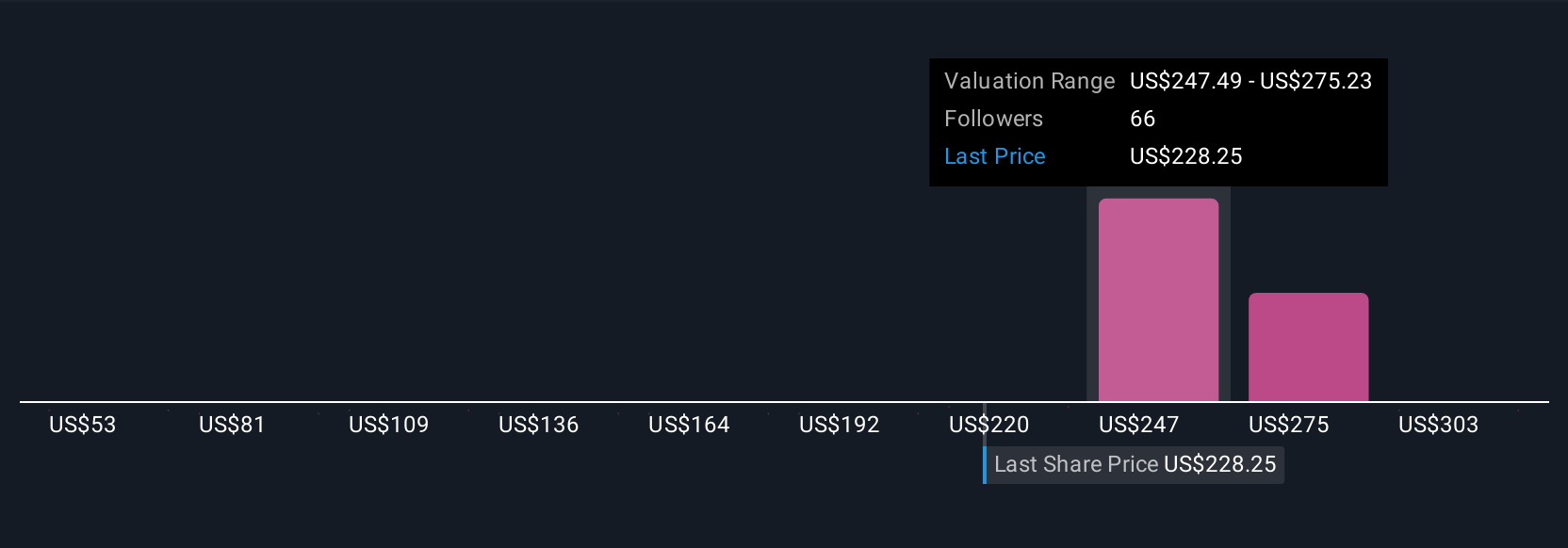

Analysis from 11 members of the Simply Wall St Community values MongoDB between US$130.20 and US$394.78 per share. With such a broad spread and ongoing competitive pressure keeping margins in focus, you can see why market participants weigh these risks differently when forming their own outlook.

Explore 11 other fair value estimates on MongoDB - why the stock might be worth as much as 21% more than the current price!

Build Your Own MongoDB Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your MongoDB research is our analysis highlighting 2 key rewards that could impact your investment decision.

- Our free MongoDB research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate MongoDB's overall financial health at a glance.

Seeking Other Investments?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:MDB

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

CEO: We are winners in the long term in the AI world

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

Near zero debt, Japan centric focus provides future growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.