- United States

- /

- IT

- /

- NasdaqGM:MDB

MongoDB (MDB) Valuation Check After Recent Share Price Pullback And Mixed Fair Value Signals

Reviewed by Simply Wall St

With no single headline event driving attention, MongoDB (MDB) is drawing interest as investors look at its recent share performance alongside the company’s current fundamentals and business profile.

See our latest analysis for MongoDB.

At a share price of $386.89, MongoDB has recently seen a 1 day share price return of a 5.91% decline and a 30 day share price return of an 8.21% decline, although its 90 day share price return of 21.46% and 1 year total shareholder return of 56.03% point to longer term momentum that is still positive.

If you are comparing MongoDB with other software names, it could be a useful time to widen your view to high growth tech and AI stocks and see what else fits your thesis.

So with a recent pullback, a 1 year total return of 56.03% and revenue and net income growth both in double digits, is MongoDB still priced attractively, or is the market already assuming plenty of future growth?

Most Popular Narrative: 12.1% Undervalued

The most followed narrative puts MongoDB’s fair value at about $440, above the recent close of $386.89, and builds that view on revenue scale, profitability and AI centric demand.

Ongoing product innovation including integrated capabilities like search, vector search, and embeddings increases platform stickiness and wallet share, enabling deeper penetration of current accounts and higher net revenue retention, which can drive both top-line and operating margin improvement over time.

Curious what kind of revenue path and margin uplift underpin that fair value? The narrative leans on robust growth, improving profitability, and a punchy future earnings multiple. Want the full picture behind those assumptions?

Result: Fair Value of $440.10 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, this upbeat narrative still hinges on Atlas sustaining its current traction and MongoDB maintaining clear differentiation, while cloud and open source rivals push harder into similar workloads.

Find out about the key risks to this MongoDB narrative.

Another Angle on Valuation

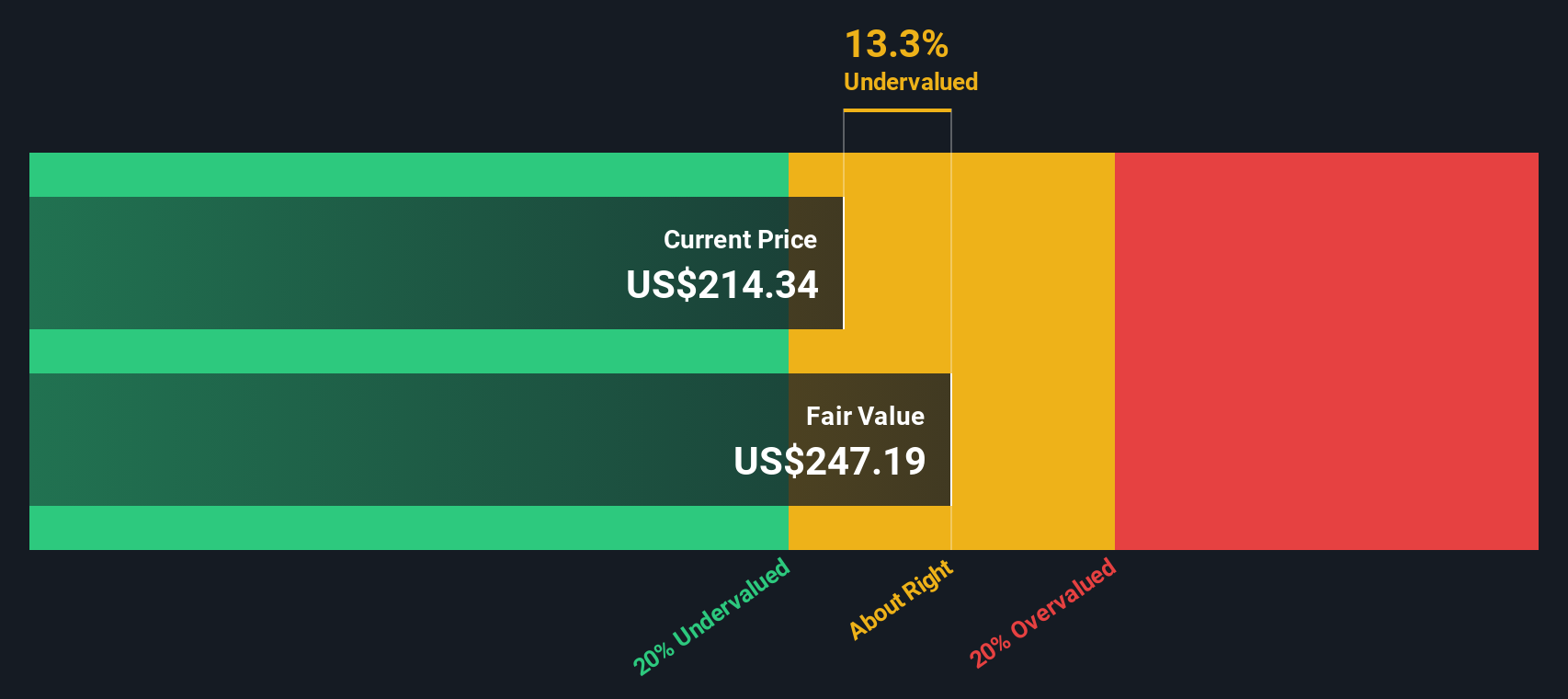

That 12.1% undervalued narrative sits against a very different signal from our DCF model, which puts fair value closer to $237.63. With the current price at $386.89, the stock screens as expensive on this view. Which set of assumptions do you find more realistic?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own MongoDB Narrative

If you see the data differently or prefer to test your own assumptions, you can build a custom MongoDB view in just a few minutes, starting with Do it your way.

A great starting point for your MongoDB research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Ready for more investment ideas?

If MongoDB has your attention, do not stop here. The screener can surface other opportunities that fit your style, so you are not leaving potential ideas on the table.

- Target income-focused ideas by checking out these 12 dividend stocks with yields > 3% that might suit a portfolio looking for regular cash returns.

- Hunt for potential growth stories with these 24 AI penny stocks that are tied to artificial intelligence themes you already follow.

- Zero in on value opportunities by scanning these 872 undervalued stocks based on cash flows that could align with a price conscious approach.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:MDB

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Weekly Picks

Ferrari's Intrinsic and Historical Valuation

Investment Thesis: Costco Wholesale (COST)

Undervalued Key Player in Magnets/Rare Earth

Recently Updated Narratives

The silent giant behind virtually every advanced chip powering AI, smartphones, and modern infrastructure.

Booking Holdings: Why Ground-Level Travel Trends Still Favor the Platform Giants

Looking to be second time lucky with a game-changing new product

Popular Narratives

The "Sleeping Giant" Stumbles, Then Wakes Up

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026