- United States

- /

- IT

- /

- NasdaqGM:MDB

Is MongoDB Still Attractive After Strong 2025 Gains and Recent Growth Trends?

Reviewed by Bailey Pemberton

Thinking about what to do with MongoDB stock right now? You are not alone. The company’s share price has certainly kept investors on their toes this year, up 31.3% year to date and boasting a one-year gain of 21.0%. That kind of performance can make anyone wonder if there is more room for growth, or if the stock is looking a little stretched. Over the past week MongoDB nudged up 0.9%, despite being down slightly for the past month at -1.1%. Looking at the three- and five-year timelines, returns are 69.2% and 24.0% respectively.

These moves have come as the broader tech sector has shifted, with investors rethinking how software companies like MongoDB fit into the growth versus value debate. Current market discussions frequently focus on AI, data storage, and cloud infrastructure, all areas where MongoDB has played an influential role. While risk sentiment has slightly ebbed and flowed, it is clear the long-term thesis for this stock continues to evolve.

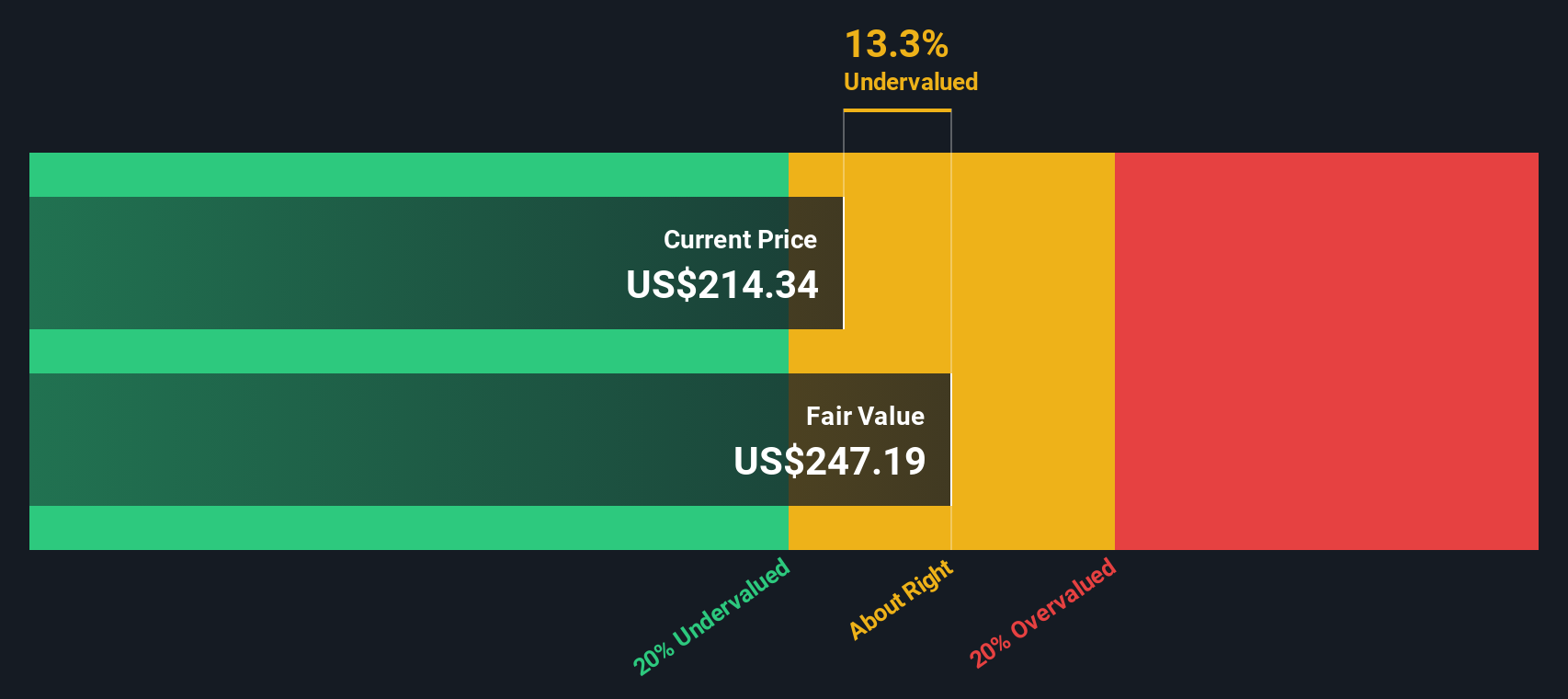

But here is the key question: with such strong returns, is MongoDB undervalued or already priced for perfection? According to six commonly used valuation checks, MongoDB is considered undervalued in zero out of six, giving it a value score of 0. Before you make your next move, let’s break down how these valuation methods come together. Stay tuned for an approach that may give an even fuller picture of what the stock is really worth.

MongoDB scores just 0/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: MongoDB Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model works by estimating a company’s future cash flows and discounting those amounts back to today’s dollars. This approach helps investors evaluate what a business might truly be worth, based on its ability to generate cash in the years ahead.

For MongoDB, DCF analysis focuses first on its latest Free Cash Flow, which stands at $254 million over the last twelve months. Analyst estimates provide annual Free Cash Flow projections for the next five years, showing substantial growth. By 2030, MongoDB is forecasted to generate $858 million in Free Cash Flow, all in USD. Since analysts only look out five years, projections beyond that are modeled based on expected growth trends from Simply Wall St.

The result of this analysis is a DCF fair value of $213.55 per share. However, based on where the stock currently trades, DCF implies MongoDB is 50.4% overvalued. In simple terms, the underlying cash flow prospects do not appear to justify today’s valuation according to this model.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests MongoDB may be overvalued by 50.4%. Find undervalued stocks or create your own screener to find better value opportunities.

Approach 2: MongoDB Price vs Sales

For companies like MongoDB that are still reaching consistent profitability, the Price-to-Sales (P/S) ratio is often the preferred valuation metric. This multiple helps investors gauge how much they are paying for each dollar of a company’s revenue, which is especially relevant for high-growth software businesses where upcoming sales growth is a key driver of value.

In theory, higher growth and potential profitability place upward pressure on a reasonable P/S ratio, while increased risks or lower expected growth require a more cautious approach. Benchmarks are useful in providing initial context: MongoDB’s current P/S ratio stands at 11.78x, which is notably above the IT industry average of 2.38x and the peer average of 7.30x. This suggests MongoDB trades at a premium compared to both its direct competitors and the wider sector.

However, simply comparing these multiples can miss important context. That is where the Simply Wall St Fair Ratio comes in, a proprietary metric designed to reflect what the preferred multiple should be, taking into consideration MongoDB’s growth rate, industry, profit margins, market cap, and specific risks. The Fair Ratio for MongoDB is 10.69x, which is only modestly lower than its current P/S ratio and provides a more nuanced benchmark than peers or industry averages alone. Because MongoDB's actual multiple and Fair Ratio are so close, the stock appears to be valued about right by this metric.

Result: ABOUT RIGHT

PS ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your MongoDB Narrative

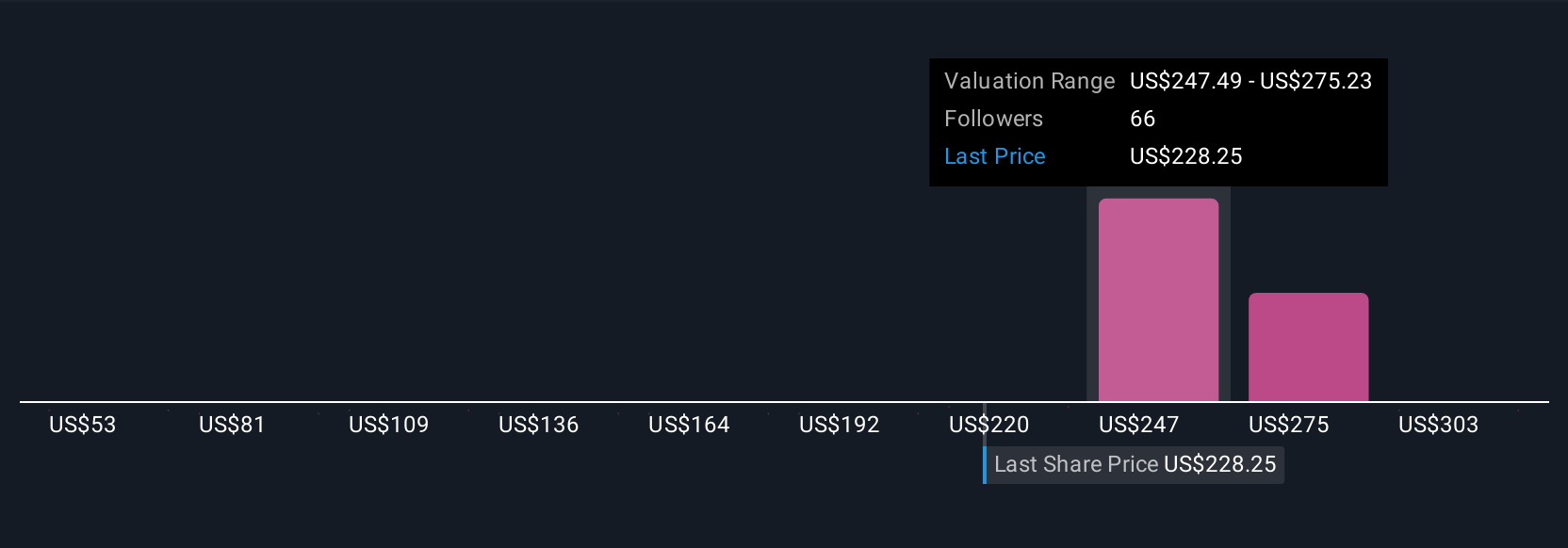

Earlier we mentioned there is an even better way to understand valuation, so let’s introduce you to Narratives. A Narrative is an investor’s story, their unique perspective about a company, that connects what they believe about the business to a specific set of financial forecasts and a resulting fair value estimate.

In other words, Narratives make it easy to express your own view of how MongoDB will perform. You can capture your assumptions for future revenue, earnings, and margins, and instantly see what that means for the stock’s fair value. By linking a company’s story directly to numbers, Narratives bridge the gap between investment opinions and hard analysis. This powerful feature is easy to access on Simply Wall St’s Community page, where millions of investors create and share their views.

With Narratives, you can quickly see how your fair value compares to MongoDB’s current price and decide whether it looks like a buy, hold, or sell. No spreadsheets or advanced models are required. Narratives update automatically when new data or news arrives, helping your investment thesis stay current even as the market evolves.

For example, right now some investors’ Narratives for MongoDB point to a bullish fair value as high as $425 per share, while others are more conservative, seeing fair value closer to $222, depending on their forecasts for growth and profitability.

Do you think there's more to the story for MongoDB? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:MDB

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives