- United States

- /

- IT

- /

- NasdaqGM:MDB

Is MongoDB (NASDAQ:MDB) Using Debt Sensibly?

David Iben put it well when he said, 'Volatility is not a risk we care about. What we care about is avoiding the permanent loss of capital.' So it might be obvious that you need to consider debt, when you think about how risky any given stock is, because too much debt can sink a company. As with many other companies MongoDB, Inc. (NASDAQ:MDB) makes use of debt. But should shareholders be worried about its use of debt?

When Is Debt A Problem?

Debt is a tool to help businesses grow, but if a business is incapable of paying off its lenders, then it exists at their mercy. Ultimately, if the company can't fulfill its legal obligations to repay debt, shareholders could walk away with nothing. However, a more frequent (but still costly) occurrence is where a company must issue shares at bargain-basement prices, permanently diluting shareholders, just to shore up its balance sheet. Having said that, the most common situation is where a company manages its debt reasonably well - and to its own advantage. When we examine debt levels, we first consider both cash and debt levels, together.

Check out our latest analysis for MongoDB

What Is MongoDB's Net Debt?

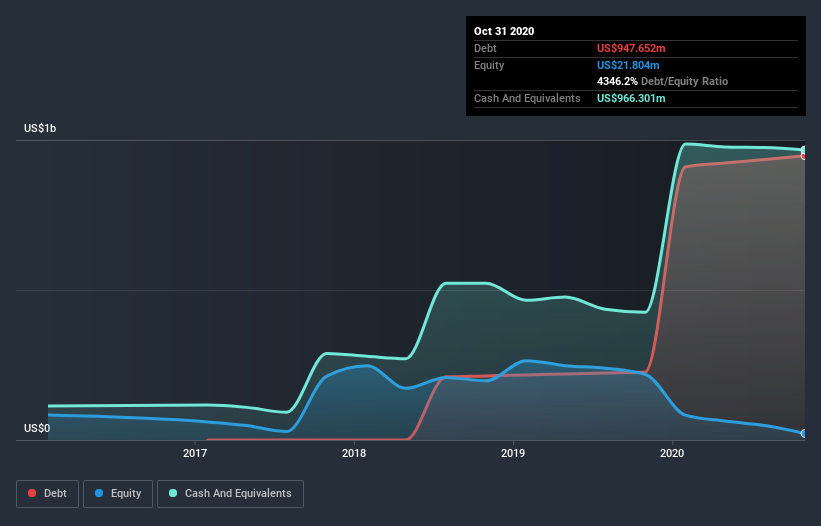

As you can see below, at the end of October 2020, MongoDB had US$947.7m of debt, up from US$226.7m a year ago. Click the image for more detail. But it also has US$966.3m in cash to offset that, meaning it has US$18.6m net cash.

How Healthy Is MongoDB's Balance Sheet?

Zooming in on the latest balance sheet data, we can see that MongoDB had liabilities of US$271.5m due within 12 months and liabilities of US$1.06b due beyond that. On the other hand, it had cash of US$966.3m and US$91.8m worth of receivables due within a year. So it has liabilities totalling US$276.0m more than its cash and near-term receivables, combined.

This state of affairs indicates that MongoDB's balance sheet looks quite solid, as its total liabilities are just about equal to its liquid assets. So while it's hard to imagine that the US$22.8b company is struggling for cash, we still think it's worth monitoring its balance sheet. Despite its noteworthy liabilities, MongoDB boasts net cash, so it's fair to say it does not have a heavy debt load! When analysing debt levels, the balance sheet is the obvious place to start. But ultimately the future profitability of the business will decide if MongoDB can strengthen its balance sheet over time. So if you're focused on the future you can check out this free report showing analyst profit forecasts.

Over 12 months, MongoDB reported revenue of US$543m, which is a gain of 41%, although it did not report any earnings before interest and tax. Shareholders probably have their fingers crossed that it can grow its way to profits.

So How Risky Is MongoDB?

By their very nature companies that are losing money are more risky than those with a long history of profitability. And we do note that MongoDB had an earnings before interest and tax (EBIT) loss, over the last year. And over the same period it saw negative free cash outflow of US$45m and booked a US$254m accounting loss. While this does make the company a bit risky, it's important to remember it has net cash of US$18.6m. That means it could keep spending at its current rate for more than two years. With very solid revenue growth in the last year, MongoDB may be on a path to profitability. By investing before those profits, shareholders take on more risk in the hope of bigger rewards. When analysing debt levels, the balance sheet is the obvious place to start. However, not all investment risk resides within the balance sheet - far from it. Consider for instance, the ever-present spectre of investment risk. We've identified 5 warning signs with MongoDB (at least 1 which is significant) , and understanding them should be part of your investment process.

If you're interested in investing in businesses that can grow profits without the burden of debt, then check out this free list of growing businesses that have net cash on the balance sheet.

When trading MongoDB or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NasdaqGM:MDB

MongoDB

Provides general purpose database platform worldwide.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Weekly Picks

Is this the AI replacing marketing professionals?

Pro Medicus: The Market Is Confusing a Lumpy Quarter With a Broken Business

The Rising Deal Risk That Helped Sink Netflix’s $72 Billion Bid for Warner Bros. Discovery

The Infrastructure AI Cannot Be Built Without

Recently Updated Narratives

Realty Income - A Fundamental and Historical Valuation

A Structured Counter‑Analysis of "The Leaking Dreadnought"

Alphabet Inc. (GOOG): The Gemini Era – Consolidating AI Dominance in 2026.

Popular Narratives

Is Ubisoft the Market’s Biggest Pricing Error? Why Forensic Value Points to €33 Per Share

Nu holdings will continue to disrupt the South American banking market