- United States

- /

- IT

- /

- NasdaqGM:MDB

Introducing MongoDB (NASDAQ:MDB), The Stock That Soared 871% In The Last Three Years

Investing can be hard but the potential fo an individual stock to pay off big time inspires us. But when you hold the right stock for the right time period, the rewards can be truly huge. One such superstar is MongoDB, Inc. (NASDAQ:MDB), which saw its share price soar 871% in three years. It's also up 18% in about a month. But this could be related to good market conditions -- stocks in its market are up 13% in the last month.

We love happy stories like this one. The company should be really proud of that performance!

See our latest analysis for MongoDB

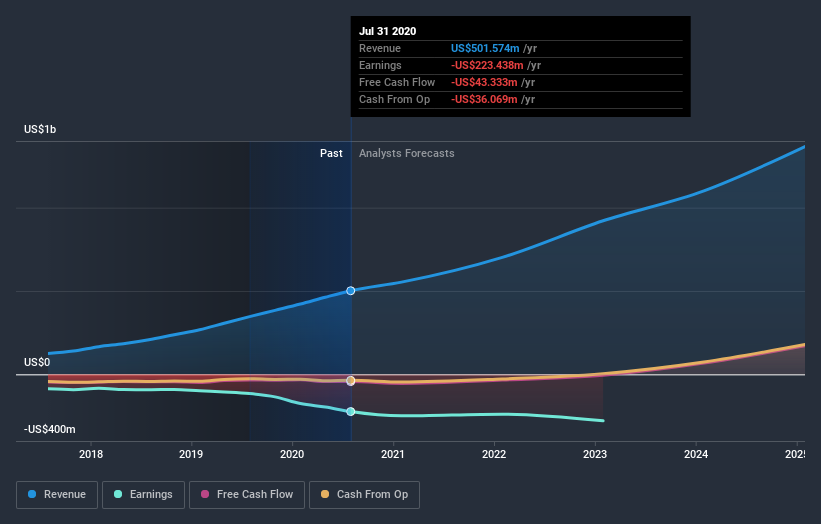

MongoDB isn't currently profitable, so most analysts would look to revenue growth to get an idea of how fast the underlying business is growing. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. Some companies are willing to postpone profitability to grow revenue faster, but in that case one does expect good top-line growth.

MongoDB's revenue trended up 45% each year over three years. That's well above most pre-profit companies. In light of this attractive revenue growth, it seems somewhat appropriate that the share price has been rocketing, boasting a gain of 113% per year, over the same period. Despite the strong run, top performers like MongoDB have been known to go on winning for decades. In fact, it might be time to put it on your watchlist, if you're not already familiar with the stock.

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

MongoDB is a well known stock, with plenty of analyst coverage, suggesting some visibility into future growth. So we recommend checking out this free report showing consensus forecasts

A Different Perspective

Pleasingly, MongoDB's total shareholder return last year was 82%. But the three year TSR of 113% per year is even better. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Take risks, for example - MongoDB has 4 warning signs (and 1 which is concerning) we think you should know about.

We will like MongoDB better if we see some big insider buys. While we wait, check out this free list of growing companies with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

If you’re looking to trade MongoDB, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About NasdaqGM:MDB

Flawless balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives