- United States

- /

- Software

- /

- NasdaqCM:MARA

MARA Holdings (MARA) Reports US$238 Million Q2 Sales and US$808 Million Net Income

Reviewed by Simply Wall St

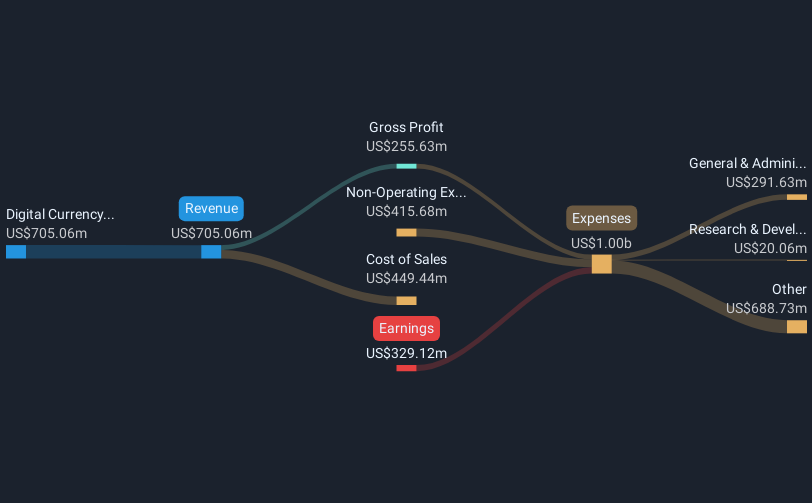

MARA Holdings (MARA) recently reported strong second-quarter results, with a significant turnaround in net income and impressive sales growth, contributing to its stock price increase of 24% over the last quarter. The company also made headlines with its appointment of Nir Rikovitch as Chief Product Officer and a new lead underwriter for a $950 million fixed-income offering. These company-specific developments added weight to its broader share price movement, which aligns with the overall market's positive trajectory fueled by optimism about corporate earnings despite some macroeconomic uncertainties and mixed performances among tech giants.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

The recent strategic developments at MARA Holdings, including the appointment of Nir Rikovitch and the new $950 million fixed-income offering, may reinforce the narrative surrounding MARA’s expansion into AI and energy solutions. These initiatives could further improve cost-efficiency and diversify revenue streams. However, they also introduce complexities that could impact execution, as the shift into these emerging markets brings with it a blend of opportunities and risks, particularly concerning technological adoption and geopolitical challenges.

In terms of long-term performance, MARA's shares have seen a total return of 401.81% over the past five years, highlighting significant growth despite recent short-term fluctuations. Over the past year, however, MARA's performance lagged behind the US Software industry, which experienced returns of 31%. This contrast underscores the challenges the company faces in maintaining pace with industry and market trends.

The current price of US$16.61 is below the analyst consensus price target of US$23.13, indicating a potential undervaluation based on future expectations. If MARA's ongoing projects in AI and energy drive the expected growth in revenue and earnings, the gap between current pricing and the consensus target could narrow. However, the company remains unprofitable, with analysts not forecasting profitability within the next three years, suggesting uncertainty in achieving these projections. The impact of current developments on revenue and earnings remains to be seen, as they could enhance or challenge the company's financial performance depending on execution success.

Assess MARA Holdings' future earnings estimates with our detailed growth reports.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:MARA

MARA Holdings

Operates as a digital asset technology company in the United States.

Fair value low.

Similar Companies

Market Insights

Community Narratives