- United States

- /

- Software

- /

- NasdaqCM:MARA

Is MARA's Shift Toward AI and European Data Centers Reshaping the Investment Case for MARA Holdings (MARA)?

Reviewed by Sasha Jovanovic

- Earlier this month, MARA Holdings reported unaudited production of 736 Bitcoin for September 2025 and continued to attract attention for its expansion into AI infrastructure, European data centers, and energy operations.

- This ongoing pivot positions MARA Holdings at the intersection of cryptocurrency mining and AI-driven compute, fueling interest as the company adapts its business model to capitalize on the rising demand for energy-efficient, high-performance data centers globally.

- We’ll examine how MARA’s move into GDPR-compliant AI data centers shapes its diversified investment narrative and long-term prospects.

Find companies with promising cash flow potential yet trading below their fair value.

MARA Holdings Investment Narrative Recap

To believe in MARA Holdings as a shareholder, you must back the company's transition from pure Bitcoin mining to a diversified digital infrastructure model, betting on secular growth in AI-driven demand for high-performance, energy-efficient data centers. The recent report of 736 Bitcoin produced in September confirms operational consistency, but does not materially alter the most important near-term catalyst, successful AI infrastructure monetization, or mitigate the key risk of persistent revenue sensitivity to Bitcoin price volatility.

Among recent developments, MARA’s establishment of a European headquarters in Paris stands out as most relevant. This major move expands its physical and regulatory footprint into the European energy market, directly aligning with its broader plan to capture international demand for sovereign, GDPR-compliant AI data centers, an area widely seen as essential for unlocking new revenue streams and reducing reliance on the cyclical Bitcoin business.

But while the company’s push into regulated markets is promising, investors should be aware that new regulatory environments can introduce…

Read the full narrative on MARA Holdings (it's free!)

MARA Holdings' outlook suggests revenue of $1.1 billion and earnings of $31.5 million by 2028. This is based on an assumed annual revenue growth rate of 12.4%, but reflects a significant earnings decrease of $647.3 million from the current earnings of $678.8 million.

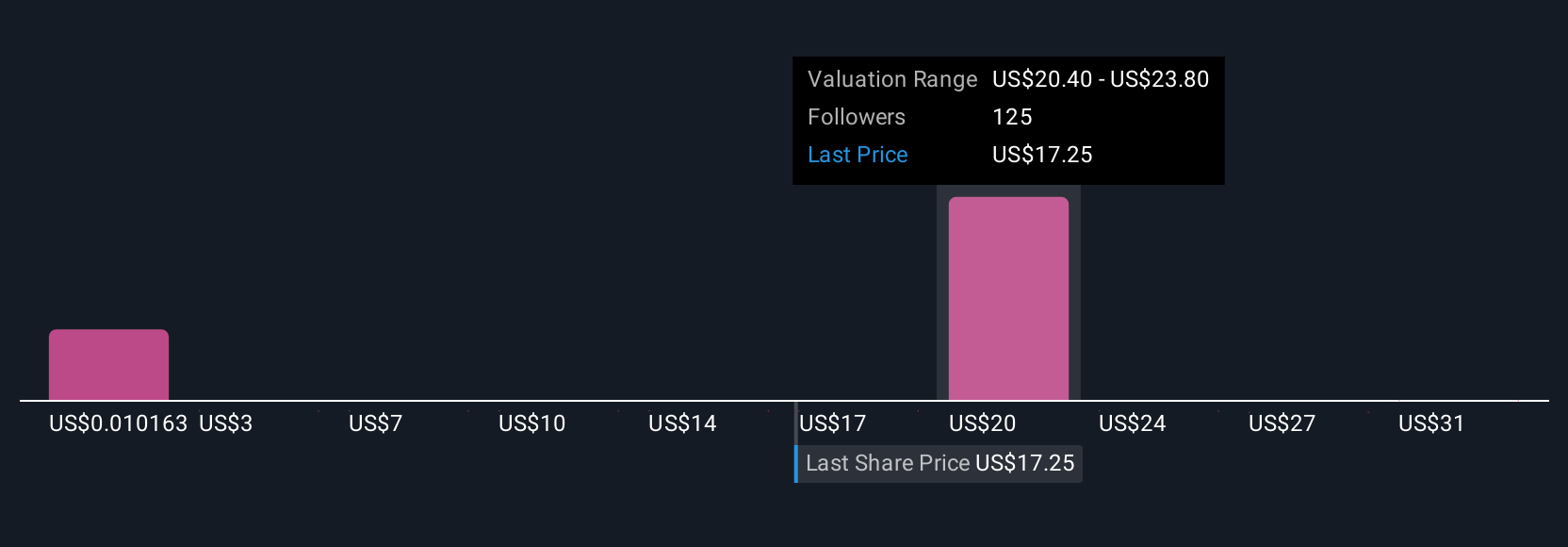

Uncover how MARA Holdings' forecasts yield a $23.32 fair value, a 25% upside to its current price.

Exploring Other Perspectives

Eleven fair value estimates from the Simply Wall St Community range between US$17.45 and US$74.31 per share. While opinions differ sharply, one recurring catalyst is MARA Holdings’ ambition to create new revenue streams through expanded AI infrastructure, underscoring just how much future performance may depend on successful execution in this area.

Explore 11 other fair value estimates on MARA Holdings - why the stock might be worth over 3x more than the current price!

Build Your Own MARA Holdings Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your MARA Holdings research is our analysis highlighting 3 key rewards and 4 important warning signs that could impact your investment decision.

- Our free MARA Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate MARA Holdings' overall financial health at a glance.

Interested In Other Possibilities?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:MARA

MARA Holdings

Operates as a digital asset technology company in the United States and Europe.

Medium-low risk with proven track record.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success