- United States

- /

- Software

- /

- NasdaqCM:MARA

Could MARA Holdings' (MARA) New Gas Supply Deal Hint at a Shift Beyond Crypto Mining?

Reviewed by Sasha Jovanovic

- Earlier this month, MPLX LP and MARA Holdings, Inc. announced the signing of a letter of intent for MPLX to supply natural gas to MARA's planned gas-fired power generation facilities and data center campuses in West Texas, with initial capacity slated at 400 MW and potential scaling to 1.5 GW.

- This partnership reflects MARA's push to evolve beyond crypto-mining by focusing on vertically integrated digital infrastructure and energy-efficient data center operations.

- We'll explore how the new MPLX partnership, centered on long-term energy access, reshapes MARA Holdings' investment outlook and diversification plans.

AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

MARA Holdings Investment Narrative Recap

To own MARA Holdings, I believe you have to trust in their transformation from a pure bitcoin miner to an energy-efficient digital infrastructure player. The recent MPLX partnership underpins this vision, helping address energy access and vertical integration, but near-term business drivers are still mainly linked to bitcoin price volatility and execution risks in shifting to new revenue streams; the announcement itself may not change the most critical short-term catalysts or the ongoing exposure to crypto cycles in a material way.

The most relevant recent announcement is MARA Holdings’ Q3 earnings, which showed strong sales growth and a positive earnings turnaround compared to the previous year. While this financial surge highlights operational progress, its sustainability remains tied to bitcoin economics and the company's pace in expanding non-mining infrastructure, both still closely tied to those core market catalysts.

But while the ongoing transition is promising, investors should also watch for the potential impact of elevated capital expenditures if bitcoin prices...

Read the full narrative on MARA Holdings (it's free!)

MARA Holdings' outlook anticipates $1.1 billion in revenue and $31.5 million in earnings by 2028. This scenario is based on a projected 12.4% annual revenue growth rate, but reflects a sharp drop in earnings, down $647.3 million from the current $678.8 million.

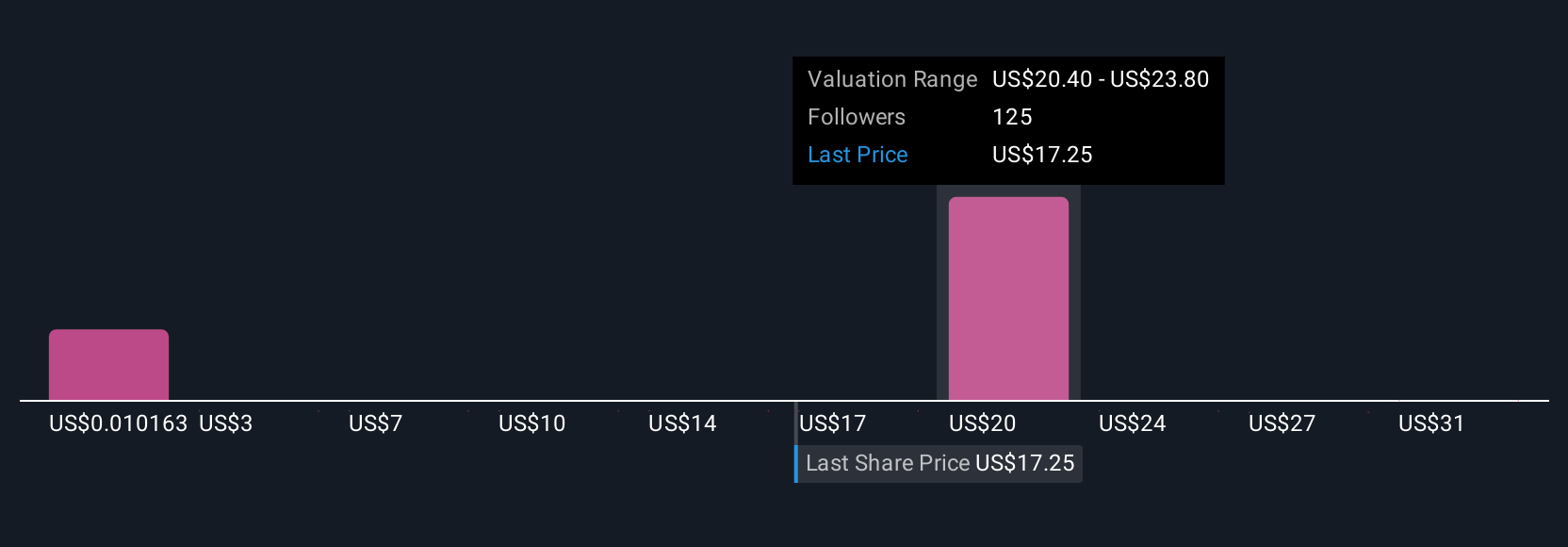

Uncover how MARA Holdings' forecasts yield a $24.14 fair value, a 101% upside to its current price.

Exploring Other Perspectives

Retail investors in the Simply Wall St Community value MARA Holdings between US$18 and US$37.17 across nine independent fair value models. Despite this range, many remain concerned that ongoing heavy capital investments could pressure net margins if mining economics deteriorate, which could shape future performance outcomes for shareholders.

Explore 9 other fair value estimates on MARA Holdings - why the stock might be worth over 3x more than the current price!

Build Your Own MARA Holdings Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your MARA Holdings research is our analysis highlighting 3 key rewards and 6 important warning signs that could impact your investment decision.

- Our free MARA Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate MARA Holdings' overall financial health at a glance.

Interested In Other Possibilities?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- Find companies with promising cash flow potential yet trading below their fair value.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:MARA

MARA Holdings

Operates as a digital asset technology company in the United States and Europe.

Medium-low risk and good value.

Similar Companies

Market Insights

Community Narratives